|

|

|

|

|||||

|

|

Healthcare information technology (IT) continues to garner substantial investor attention in 2025 as digital transformation in the U.S. health system accelerates. Providers and payers are investing in technology that supports telehealth access, streamlines administrative workflows and improves chronic disease management.

These shifts are driven by persistent labor shortages, cost containment pressures, and the imperative to deliver value-based care amid rising demand for personalized services and data-driven decision-making. The adoption of remote patient monitoring, predictive analytics, and coordinated care platforms is reshaping the delivery landscape, making Healthcare IT not just a growth theme but a strategic priority across delivery networks and health plans.

Per a report from Grand View Research, the global healthcare IT market size was estimated at $663 billion in 2023 and is projected to reach $1,834.3 billion by 2030, at a CAGR of 15.8% from 2024 to 2030. It also stated that North America dominated the global healthcare IT market with a revenue share of more than 40% in 2023, and where growth is primarily driven by the United States.

Investors seeking exposure to this structural shift have leaned toward companies that combine scalable technology with recurring revenue models and expanding addressable markets. In 2025, several Healthcare IT names have outpaced broader indices, powered by fundamentals, contract growth and product expansion. Among these, three U.S.-listed stocks — Hims & Hers Health, Inc. HIMS, Biotricity, Inc. BTCY and Privia Health Group, Inc. PRVA — have delivered year-to-date share price gains exceeding 20%, driven by distinct subsector dynamics in telehealth, biometric monitoring and physician-enablement technology.

This article examines why these stocks have performed well in 2025, the catalysts that could sustain their momentum, and the risks investors should consider as the U.S. healthcare IT cycle evolves.

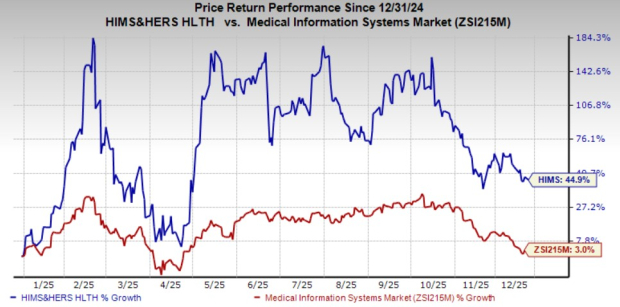

Hims & Hers, which has gained 44.9% so far in 2025, operates a consumer-focused telehealth and digital care platform offering personalized treatment plans, prescription services, and wellness solutions across mental health, dermatology, sexual health, weight management and preventive care. The company’s subscriber model and integrated digital care suite position it at the forefront of online healthcare delivery.

In 2025, HIMS demonstrated strong execution, posting revenues of nearly $600 million in the third quarter (up approximately 49% year over year), while its subscriber base expanded about 21% to roughly 2.5 million. The company maintained its full-year revenue outlook of $2.335-$2.355 billion. These results reflect strong demand for personalized digital care and broader service adoption. HIMS also announced a $250 million share repurchase program, signaling confidence in long-term value creation and capital allocation discipline.

HIMS is expanding beyond core telehealth into adjacent services and specialties, leveraging its platform to deepen engagement and increase lifetime value per subscriber. Strategic initiatives include international expansion investments and an $870 million convertible note offering to fund AI, diagnostics integration and growth into new care categories. These efforts could fuel long-term revenues and operating leverage.

HIMS operates in a competitive digital health landscape with regulatory scrutiny and margin volatility tied to product mix and service costs. Investors should monitor subscriber growth trends, average revenue per user, and margin trajectory in upcoming earnings releases.

The company currently carries a Zacks Rank #3 (Hold). However, its Zacks Style Score of ‘B’ looks favorable. Sales and earnings estimates for 2026 suggest 17.6% and 22.3% growth, respectively, from the year-ago level.

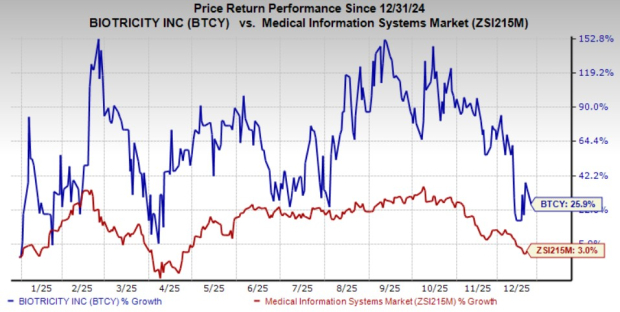

Biotricity develops remote patient monitoring solutions and biometric data platforms that support chronic disease management, particularly in cardiac care. Its Technology-as-a-Service (TaaS) model combines hardware and cloud-based software to deliver continuous diagnostic insights, enabling clinicians to make timely, data-driven decisions outside traditional care settings. The stock has risen 25.9% year to date.

In 2025, Biotricity gained market attention as one of the Financial Times’ fastest-growing companies in the Americas, recognized for exceptional growth over a multi-year period —highlighting momentum in demand for smart remote monitoring solutions. While the stock has a small market cap and notable volatility, it has outpaced broader healthcare tech benchmarks due to its structural tailwinds and product expansion narratives.

The company is advancing toward scalable profitability and expanding its product footprint. Recent operational updates show improved gross margins and progress toward reduced net losses while broadening clinical applications into adjacent care fields, such as sleep and pulmonology. Continued penetration of diagnostic tools and potential regulatory approvals could further solidify its recurring revenue base.

BTCY’s small-cap status pose liquidity and volatility risks. Key metrics to monitor include recurring technology fee revenue growth, margin expansion, and progress toward consistent profitability alongside adoption rates from healthcare providers.

The company currently carries a Zacks Rank of 3. However, its Zacks Style Score of ‘B’ looks favorable. Sales and earnings estimates for fiscal 2026 suggest 14.5% and 41.8% growth, respectively, from the year-ago level.

Privia Health Group is a physician-enablement technology company that partners with practices and health systems to deliver population health, practice management, and value-based care solutions. Its platform integrates clinical workflows, analytics, and administrative tools to enhance provider efficiency and patient outcomes.

In 2025, PRVA delivered double-digit revenue growth, with third-quarter revenues up 32.5% to $580.4 million, and operating income surging nearly 150%, underscoring operational leverage and efficiency gains. Privia also expanded geographically through acquisitions and raised full-year guidance to the mid-to-high end across key metrics. This resulted in 22.9% growth for this stock so far this year.

Privia’s emphasis on value-based care and integration with accountable care organizations (ACOs) positions it well amid shifting reimbursement models that reward preventive and coordinated care. Analysts maintain a strong buy view, with price targets implying further upside, reflecting confidence in Privia’s growth trajectory and expanding provider network.

As a company with exposure to Medicare Advantage and shared savings programs, Privia’s earnings and growth can be sensitive to policy shifts and reimbursement trends. Monitoring provider sign-ups, shared savings performance, and adjusted EBITDA conversion to free cash flow will be critical.

The company currently carries a Zacks Rank #3. However, its Zacks Style Score of ‘B’ looks favorable. Sales and earnings estimates for 2026 suggest 9.7% and 142.9% growth, respectively, from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite