|

|

|

|

|||||

|

|

Shares of Green Thumb Industries GTBIF soared nearly 35% in the past month, all thanks to an executive order signed by President Trump directing federal agencies to reschedule marijuana at the federal level.

Although this order was officially announced last Thursday, investor positioning had been building well before the announcement. Several third-party reports over the past several weeks had increasingly pointed to imminent action from the White House, prompting shares of several U.S.-listed cannabis operators, including Green Thumb, to rally ahead of the formal order.

The executive order directs federal agencies to expedite the reclassification of marijuana from Schedule I to Schedule III under the Controlled Substances Act. This move formally acknowledges the medical value of cannabis at the federal level and represents one of the most meaningful regulatory developments for the U.S. cannabis industry in years.

For operators like Green Thumb, rescheduling holds the potential to materially improve long-term profitability. Most notably, it could eliminate the application of IRS Code 280E, which currently prevents cannabis companies from deducting ordinary business expenses and significantly inflates effective tax rates. Any relief on this front would improve net income visibility and cash flow generation over time.

Reclassification may also support broader medical research efforts and enhance the legitimacy of cannabis-based therapies, potentially expanding adoption within regulated healthcare channels. These developments could benefit scaled, profitable operators with established consumer packaged goods (CPG) and medical portfolios, including Green Thumb.

That said, the executive order does not outline a specific implementation timeline or address federal legalization of adult-use cannabis. While these limitations introduce some uncertainty, the directive signals a clear shift in federal policy and marks an important step toward longer-term regulatory normalization for the industry.

However, an investment decision cannot be based on this development alone. A closer look at GTBIF’s broader fundamentals should provide a better context on how to play the stock following this regulatory shift.

What sets Green Thumb apart from many peers is its vertically integrated model — cultivating, processing and selling cannabis through its own retail and wholesale operations. However, with 100% of the company’s revenues tied to U.S. markets, it remains highly exposed to domestic regulatory risks, particularly the lack of federal legalization, which continues to restrict access to capital and interstate commerce.

Green Thumb’s third-quarter 2025 revenues rose nearly 2% year over year to more than $291 million. The quarter benefited from continued strength in the company’s CPG portfolio and incremental contributions from newer adult-use markets, including Minnesota. However, pricing pressure across existing retail markets partially offset these gains. Comparable store sales (open at least 12 months) declined 7% during the quarter, reflecting heightened competition and softer consumer demand.

Profitability metrics were mixed. Gross margin declined 200 basis points year over year to 49.4%, primarily due to continued price compression across key markets. However, EPS (excluding one-time gains) remained flat year over year at 4 cents, underscoring Green Thumb’s operational resilience amid a challenging pricing environment.

Looking ahead, we expect Green Thumb to remain under pressure due to persistent pricing compression in maturing markets. While the company continues to prioritize cash flow and prudent cost management, margin expansion could remain elusive without a rebound in retail pricing dynamics. Management expects fourth-quarter 2025 revenues to be sequentially flat to up low single digits.

Green Thumb operates in an increasingly competitive U.S. cannabis market, where price compression and oversupply are weighing on most operators. The company faces stiff competition from peers like Canopy Growth CGC and Cresco Labs CRLBF, both of which are also pursuing similar expansion and cost-control initiatives.

What further differentiates the competitive landscape is geographic exposure. Canopy Growth and Cresco Labs have been expanding their presence outside the United States, targeting the growing cannabis markets in Europe and other regions. This diversification provides them with additional growth avenues and some insulation from U.S.-specific risks. In contrast, Green Thumb remains fully reliant on the fragmented and crowded domestic market.

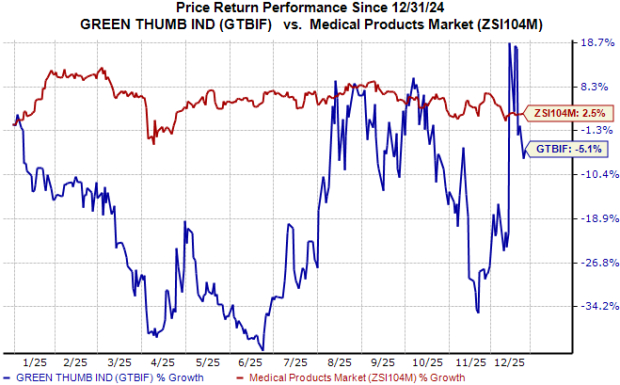

Shares of Green Thumb have underperformed the industry year to date, as shown in the chart below.

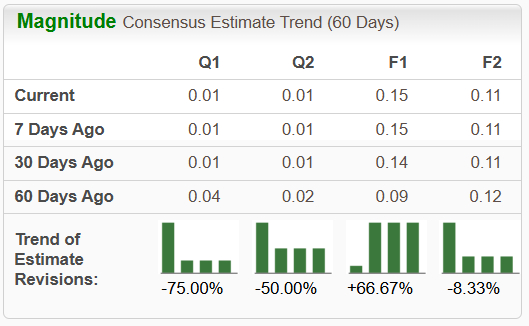

Movements in EPS estimates for 2025 and 2026 have been mixed over the past 60 days.

While marijuana reclassification represents a meaningful policy milestone, it does not fundamentally alter the near-term operating outlook for cannabis companies focused on adult-use markets. The current regulatory focus remains on the medical component of cannabis, leaving uncertainty around broader legalization, interstate commerce and banking reform. As a result, we expect the financial uplift from reclassification to be gradual rather than immediate.

Although a stable revenue stream and the ability to generate free cash flow offer some support for GTBIF stock, the company’s significant exposure to the U.S. market, along with pricing pressures, continues to strain its financial profile. While existing shareholders may choose to maintain exposure in anticipation of longer-term reform, prospective investors are advised to wait for clearer evidence that regulatory progress is translating into sustainable earnings growth. Until then, a cautious approach toward this Zacks Rank #3 (Hold) stock remains warranted.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite