|

|

|

|

|||||

|

|

Pfizer PFE expects a significant negative impact on revenues from the loss of exclusivity (“LOE”) of several of its key products in the 2026-2030 period. These include Eliquis, Vyndaqel, Ibrance, Xeljanz and Xtandi, all of which face patent expirations.

However, the company has strengthened its R&D pipeline through M&A deals, successful data readouts and pivotal program starts in 2025, which, it believes, will position it for sustainable growth in the post-LOE period.

Pfizer has particularly advanced its oncology pipeline with several candidates entering late-stage development. Key oncology candidates in late-stage development include vepdegestrant (a small-molecule PROTAC for ER+/HER2- metastatic breast cancer), atirmociclib (a CDK4 inhibitor for 1st line HR+/HER2- metastatic breast cancer) and sigvotatug vedotin (an antibody-drug-conjugate or ADC for metastatic non-small cell lung cancer).

Sasanlimab for the treatment of BCG-naive high-risk non-muscle invasive bladder cancer is under review in the United States and the EU. This year, it in-licensed exclusive global ex-China rights to develop, manufacture and commercialize PF-08634404, a dual PD-1 and VEGF inhibitor, from China’s 3SBio. Dual PD-1/VEGF inhibitors have been designed to overcome the limitations of single-target cancer therapies like Merck’s MRK blockbuster PD-L1 inhibitor, Keytruda and have the potential to become the new standard of care oncology treatments.

By 2030, Pfizer expects to have eight or more blockbuster oncology medicines in its portfolio.

In non-oncology areas, an mRNA flu/COVID combination vaccine and osivelotor for sickle cell disease are in late-stage development.

Pfizer is also working on expanding the labels of approved products like Padcev, Adcetris, Litfulo, Nurtec, Velsipity and Elrexfio, among others. Last month, Pfizer's key drug, Padcev, was approved by the FDA in combination with MRK’s Keytruda for patients with muscle-invasive bladder cancer who are ineligible for cisplatin-containing chemotherapy.

Importantly, Pfizer is strengthening its presence in the obesity market, currently dominated by Eli Lilly and Novo Nordisk. The $10 billion Metsera acquisition in November added four novel clinical-stage incretin and amylin programs for obesity, which are expected to generate billions of dollars in peak sales. Earlier this month, Pfizer in-licensed exclusive global rights to develop YP05002, an oral small molecule GLP-1 receptor agonist (GLP-1 RA) for treating obesity from Chinese biotech YaoPharma. With the Metsera acquisition, the YaoPharma deal and other Pfizer programs that include a GIPR antagonist candidate, Pfizer believes it has a robust and diverse obesity portfolio.

Despite near-term revenue pressure from upcoming patent expirations, Pfizer’s expanding late-stage pipeline, led by oncology and supported by growing investments in obesity, vaccines, and rare diseases, positions it for sustainable long-term growth.

Pfizer is one of the largest drugmakers of cancer medicines. Other large players in the oncology space are AstraZeneca AZN, Merck, J&J JNJ and Bristol-Myers.

For AstraZeneca, oncology sales now comprise around 43% of total revenues. Sales in its oncology segment rose 16% in the first nine months of 2025. AstraZeneca’s strong oncology performance was driven by medicines such as Tagrisso, Lynparza, Imfinzi, Calquence and Enhertu (in partnership with Daiichi Sankyo).

Merck’s key oncology medicines are PD-LI inhibitor, Keytruda and PARP inhibitor, Lynparza, which it markets in partnership with AstraZeneca. Keytruda, approved for several types of cancer, alone accounts for more than 50% of Merck’s pharmaceutical sales. Keytruda recorded sales of $23.3 billion in the first nine months of 2025, up 8% year over year.

Bristol-Myers’ key cancer drug is PD-LI inhibitor, Opdivo, which accounts for around 20% of its total revenues. Opdivo’s sales rose 8% to $7.54 billion in the nine months of 2025.

J&J’s oncology sales now comprise around 27% of its total revenues. Its oncology sales rose 20.6% on an operational basis in the first nine months to $18.52 billion. While J&J’s older cancer drugs, multiple myeloma treatment Darzalex and prostate cancer drug, Erleada, are key contributors to its top-line growth, new drugs such as Carvykti, Tecvayli, Talvey and Rybrevant, plus Lazcluze, hold the key for long-term growth.

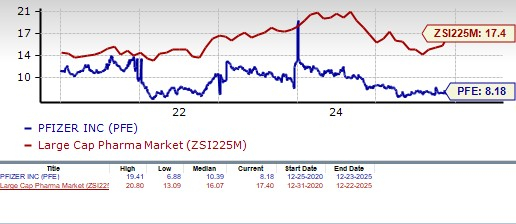

Pfizer’s stock has declined 7% in the past year against an increase of 16.0% for the industry.

From a valuation standpoint, Pfizer appears attractive relative to the industry and is trading below its 5-year mean. Going by the price/earnings ratio, the company’s shares currently trade at 8.18 forward earnings, lower than 17.40 for the industry and the stock’s 5-year mean of 10.39.

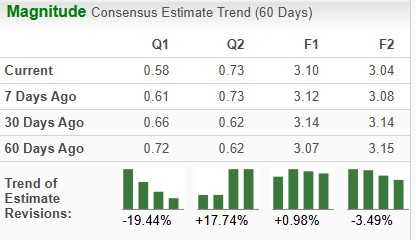

The Zacks Consensus Estimate for 2025 earnings has risen from $3.07 per share to $3.10 per share, while that for 2026 has declined from $3.15 per share to $3.04 per share over the past 60 days.

Pfizer has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 57 min | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

MRK

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite