|

|

|

|

|||||

|

|

Vistra Corp. VST has been trading below its 50-day simple moving average (SMA), signaling a short-term bearish trend. The stock closed at $161.67 as of Dec. 23, 2025, down 26.5% from its 52-week high of $219.82.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of an uptrend or downtrend.

As of Dec. 31, 2024, Vistra’s total generation capacity stood at 40,657 MW, and nearly 59% of it comes from its natural gas generating assets. The market capitalization of this utility is $54.77 billion, and the average trading volume in the last three months was 4.64 million.

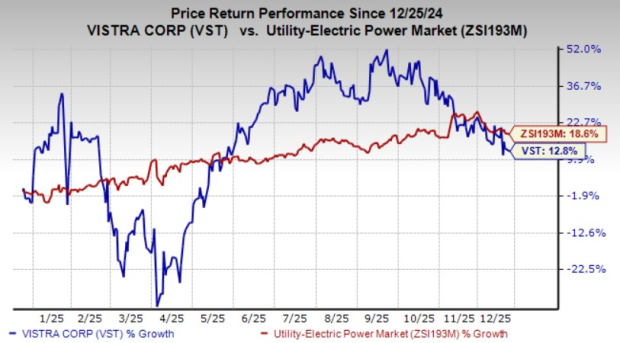

In the past 12 months, VST shares have gained 12.8% compared with the Zacks Utility – Electric Power industry’s rally of 18.6%.

The company is going to benefit from strong residential and commercial demand in Texas, the Midwest and the Northeast. VST’s high nuclear fleet availability has helped the company reliably meet growing power needs and generate long-term value for its stakeholders.

Another company, Constellation Energy Corporation CEG, also produces a substantial volume of clean energy from its nuclear generation assets. CEG’s shares have gained 46.1% in the past year.

Given the weakness in VST's share price, will it be a correct choice to add this utility stock to your portfolio? Let us delve deeper and find out the factors that can help investors decide whether it is a good entry point to add VST stock to their portfolio.

Vistra runs a fully integrated business that combines power generation, retail electricity sales, and energy storage, backed by strong risk management. This model helps the company balance supply and demand, limit exposure to commodity price fluctuations and produce stable cash flows with more consistent earnings.

Vistra’s diversified, multi-fuel generation portfolio supports long-term growth. Its balanced mix of natural gas, nuclear, coal, and growing renewable and battery storage assets allows the company to adapt to changes in the U.S. energy market, maintain grid reliability, optimize costs and benefit during periods of fuel price volatility or extreme weather.

Rising demand for clean electricity in Vistra’s markets, driven by the growth of AI data centers and increasing electrification in the Permian Basin, is creating new opportunities. Vistra’s ability to supply large amounts of low- and zero-emission power from solar, nuclear, natural gas and other sources has been a key factor behind its strong performance.

Vistra already has a strong and well-defined capital expenditure plan focused on expanding zero-carbon nuclear output, growing solar and battery storage capacity,and optimizing its natural gas fleet to meet peak demand. Falling interest rates directly enhance Vistra’s financial profile by reducing borrowing costs and interest expense.

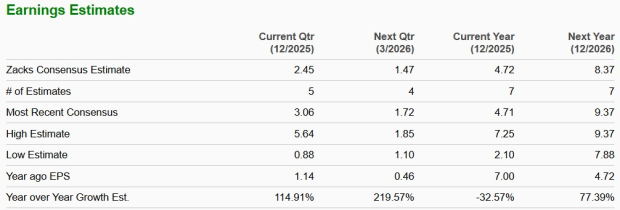

The Zacks Consensus Estimate for VST’s 2025 earnings per share indicates a year-over-year decline of 32.57%, while the estimate for 2026 earnings per share implies an increase of 77.39%.

Duke Energy Corporation DUK is another company operating in the same industry and is investing heavily to enhance its clean energy generation capabilities. The Zacks Consensus Estimate for Duke Energy’s 2025 and 2026 earnings per share indicates year-over-year growth of 7.12% and 6.1%, respectively.

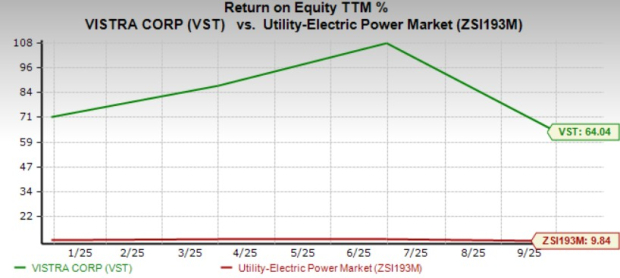

ROE, a profitability measure, reflects how effectively a company is utilizing its shareholders’ funds in its operations to generate income.

VST’s trailing 12-month return on equity (“ROE”) is 64.04%, way ahead of its industry average of 9.84%. VST’s better ROE than its industry indicates that the company is utilizing its funds more efficiently than its industry peers to generate returns.

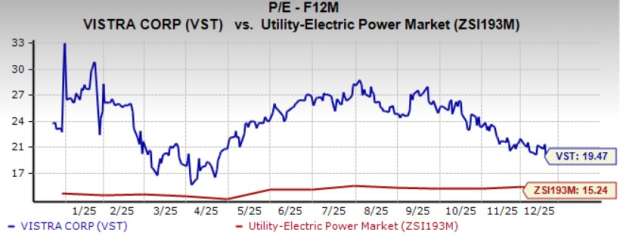

Vistra is currently trading at a premium valuation compared with the industry. Its forward 12-month price-to-earnings (P/E) ratio is 19.47X compared with the industry average of 15.24X.

Vistra continues to increase its shareholders' value through the share repurchase program and dividend payments.

VST’s board of directors has also approved a quarterly dividend of 22.7 cents for the fourth quarter of 2025. Management is targeting a dividend payment of $300 million annually. VST has raised dividends 17 times in the past five years.

Vistra’s board of directors has approved an additional $1 billion for share repurchases. As of Oct. 31, 2025, $2.2 billion remained under the current authorization, which the company expects to fully utilize by the end of 2027.

Vistra is strongly positioned to capitalize on rising clean electricity demand across its service territories. Its multi-fuel-based electricity production and focus on clean energy production allow it to benefit from the changing energy landscape. The company is also expanding its portfolio with additional clean energy assets.

Given that VST shares are trading at a premium valuation compared with the industry and VST is trading below the 50-Day SMA, it will be a good choice for the existing investors to hold their positions in the Zacks Rank #3 (Hold) stock. It will be appropriate for the new investors to keep monitoring the stock and wait for a favorable entry point before making investments.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 15 hours |

Dell Earnings, Inflation and Consumer-Confidence Data: Still to Come This Week

VST

The Wall Street Journal

|

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite