|

|

|

|

|||||

|

|

Plug Power Inc. PLUG and Ballard Power Systems Inc. BLDP are both prominent names operating in the clean energy market. As rivals, these companies are engaged in providing hydrogen fuel cell solutions for transportation, stationary power and alternative energy markets in the United States and internationally.

While Plug Power has been enjoying growth opportunities in the green hydrogen market, Ballard Power is benefiting from growing needs for eco-friendly energy storage solutions across transportation and material handling markets. But which one has the better upside potential? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

Plug Power’s results have been showing signs of improvement of late. After witnessing growth of 11% and 21% in the first and second quarter, respectively, PLUG’s revenues increased 2% year over year in third-quarter 2025. Revenues were driven by impressive demand for its electrolyzer product line, volume increase in hydrogen fuel sales and other businesses. In the third quarter, revenues from this product line surged approximately 12.9% on a year-over-year basis.

This strong growth was supported by increased demand for the company’s GenEco proton exchange membrane (PEM) electrolyzers across the industrial and energy sectors throughout the world. PLUG has a robust pipeline of electrolyzer projects and is working to mobilize more than 230 MW of its GenEco electrolyzers across North America, Europe and Australia. With strong expertise in providing and installing electrolyzers, Plug Power is poised to benefit from increasing demand for renewable fuels and green ammonia across the world.

Plug Power remains focused on scaling its business and investing in hydrogen plants, given the long-term growth potential of the green hydrogen market. PLUG intends to capitalize on the opportunity with increased green hydrogen production at its plant in Georgia, as well as its joint venture with Olin Corp. OLN in Louisiana.

PLUG also launched Project Quantum Leap to improve its margin, cash flow and reduce the cash burn rate. As part of the project, it is expected to benefit from sales growth, pricing actions, inventory and capex management, and increased leverage of its hydrogen production platform.

However, the major issue plaguing Plug Power is its inability to generate positive gross margins and cash inflows. It recorded a gross margin of negative 67.9% in third-quarter 2025 after reporting a gross margin of negative 31% in the second quarter. Meanwhile, its operating cash outflow totaled $387.2 million in the first nine months of the year.

The company is experiencing a significant decline in the number of hydrogen site installations, which has reduced to four from eleven year over year in the first nine months of 2025. This has been hurting its revenues related to the sales of hydrogen infrastructure. In addition, fewer liquefier projects and a slower rate of progress on the existing ventures have been affecting revenues from the sales of cryogenic storage equipment and liquefiers.

BLDP is benefiting from solid order intakes for its PEM fuel cell products from bus, rail and material handling customers in North America and Europe. The company’s third-quarter revenues surged 120% on a year-over-year basis to $32.5 million. Exiting the quarter, its healthy order backlog of $132.8 million also holds positive. With growing demand for green hydrogen and fuel cells across the stationary power and heavy-duty mobility sectors, Ballard Power remains well-positioned to capitalize on the opportunities across the sectors.

Ballard Power remains committed to launching new products and upgrading existing ones as part of its portfolio enhancement strategy. For instance, it is receiving positive response from bus OEMs for its recently unveiled ninth-generation fuel cell engine, FCMove-SC. This engine has been developed to improve its customers’ total cost of ownership and lower BLDP’s manufacturing expenses.

The company also remains focused on effectively managing its operating costs and expenses, which is likely to boost its margins and profitability moving ahead. In the third quarter of 2025, it successfully reduced total operating expenses by 36% on a year-over-year basis through its restructuring actions.

BLDP’s strong liquidity position adds to its strength. It exited the third quarter with cash and cash equivalents of $525.7 million, with no bank debt and near-term financing obligations. This implies that the company has sufficient cash to meet its current debt. As Ballard Power continues to boost its cash flow, it expects to enhance its gross margins with pricing initiatives, product cost reductions and growing sales of the FCmove-SC engine.

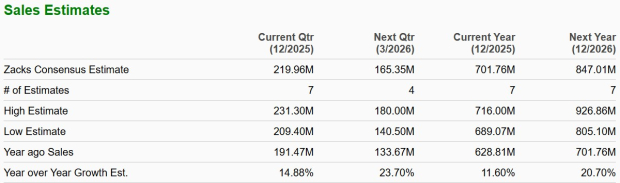

The Zacks Consensus Estimate for PLUG’s 2025 sales is $701.8 million, implying year-over-year growth of 11.6%. The consensus estimate for its bottom line is pegged at a loss of 80 cents per share.

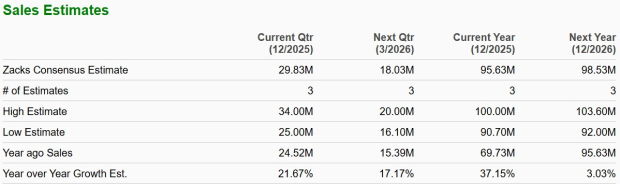

The Zacks Consensus Estimate for BLDP’s 2025 sales is approximately $95.6 million, indicating an increase of 37.2% year over year. The Zacks Consensus Estimate for its bottom line is pegged at a loss of 32 cents per share.

In the past six months, shares of Plug Power have gained 88.1%, while Ballard Power stock has soared 90.7%.

From a valuation standpoint, both PLUG and BLDP are trading at a negative forward price-to-earnings ratio.

PLUG’s strong foothold in the green hydrogen market, innovative product portfolio and the Quantum Leap project are likely to be beneficial in the long run. However, the ongoing challenges, including lower sales of hydrogen infrastructure and negative gross margins and cash outflows, are likely to continue impacting the company’s performance in the near term.

In contrast, Ballard Power’s solid momentum in the fuel cell market, along with its product innovation efforts and healthy liquidity position, bodes well for strong growth in the quarters ahead. Additionally, the company’s strong sales estimates and price performance instill investor confidence. Given these factors, BLDP seems a better pick for investors than PLUG currently.

While BLDP carries a Zacks Rank #2 (Buy), PLUG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite