|

|

|

|

|||||

|

|

AngioDynamics ANGO has been gaining from its solid prospects with NanoKnife and an increased focus on cancer treatment markets. The optimism, led by a solid first-quarter fiscal 2026 performance, positive ongoing studies and a broad product line, bodes well for the stock.

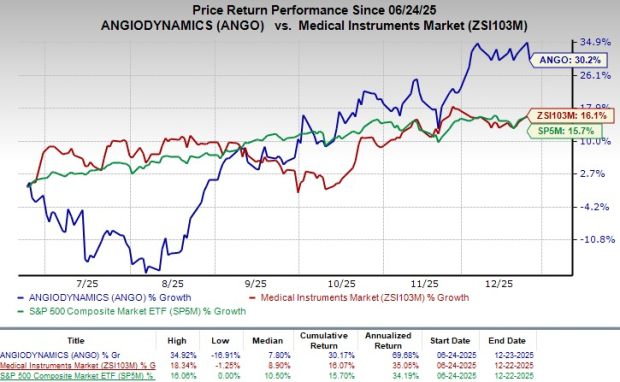

In the last six-month period, the Zacks Rank #3 (Hold) company’s shares have gained 30.2% compared with 16.1% growth of the industry. The S&P 500 has increased 15.7% during the said time frame.

The renowned designer, manufacturer and seller of an extensive range of innovative medical, surgical and diagnostic devices has a market capitalization of $490.3 million. The company projects 35.7% growth over the next year and expects to witness continued improvements in its business. AngioDynamics’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 73.1%.

NanoKnife Driving Growth: NanoKnife is emerging as a key long-term growth driver for AngioDynamics, supported by strong clinical adoption, particularly in prostate cancer, where the first quarter of fiscal 2026 saw more than 25% revenue growth and 31% probe growth. Physician uptake is accelerating ahead of the CPT Category I reimbursement rollout in January 2026, aided by an AARP awareness campaign and confidence in NanoKnife’s strong outcomes, fast procedures, and FDA-cleared next-generation platform. With prostate reimbursement arriving in 2026 and pancreatic procedures following in 2027, management expects expanding utilization, a growing installed base, and clearer payment pathways to drive a more durable, recurring revenue stream and sustained profitable growth.

Broad Product Line: AngioDynamicsis showing solid momentum across its Med Tech platforms, driven by strong performance in Auryon, thrombectomy, and its oncology portfolio. In the first quarter of fiscal 2026, Auryon posted 20.1% revenue growth, marking its 17th consecutive quarter of double-digit expansion—supported by rising adoption in hospitals and OBLs, with added contribution from the recent CE Mark.

Thrombectomy was another key outperformer, with Mechanical Thrombectomy revenue surging 41.2%, led by 37.1% growth in AngioVac and 52.3% growth in AlphaVac, while the expansion of the thrombectomy sales force to 50 territories underscores management’s focus on deeper market penetration. Alongside this, the broader Med Device portfolio delivered steady 2.3% growth, providing a stable base that complements the faster-growing Med Tech segments and reinforces the company’s strengthening competitive position across oncology, vascular access and peripheral disease markets.

Solid Q1 Results: AngioDynamics delivered a solid start to fiscal 2026, with first-quarter revenues rising 12.2% year over year, led by continued strength in its Med Tech segment, which grew 26% and now represents nearly half of total sales. The company also reported a narrower-than-expected adjusted loss, supported by gross margin expansion despite the impact of tariff headwinds.

Macroeconomic Concerns: In the first quarter of fiscal 2026, AngioDynamics emphasized that tariffs remain the biggest external drag on margins, with $1.7 million in tariff costs weighing on gross margin by about 220 basis points. These expenses were fully expected and aligned with the company’s forecast of $4–$6 million in tariff impact for the full year.

Despite this headwind, gross margin still improved year over year, driven by stronger pricing, operational efficiencies and a mix shift toward higher-margin Med Tech products. Management also pulled forward several cost-improvement initiatives, helping blunt the effect of tariffs and demonstrating solid operational discipline.

AngioDynamics has been witnessing a stable estimate revision trend for fiscal 2026. Over the past 30 days, the Zacks Consensus Estimate for loss has remained stable at 28 cents per share.

The Zacks Consensus Estimate for second-quarter fiscal 2026 revenues is pegged at $76.1 million, implying a 4.4% rise from the year-ago reported number. The consensus mark for fiscal second-quarter loss per share is pinned at 10 cents, implying a 150% decline year over year.

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, carrying a Zacks Rank #2 (Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite