|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Solventum SOLV announced the acquisition of Acera Surgical, which specializes in advanced synthetic treatment options for regenerative wound care, to expand its MedSurg business into the fast-growing synthetic tissue matrices market within the acute wound care market. The transaction includes $725 million in cash upfront and an additional contingent payment of $125 million in the future if Acera Surgical meets certain performance targets.

Per management, the acquisition helped reach a milestone in SOLV’s three-phased business transformation plan as Acera Surgical’s synthetic tissue matrix technology fits well with the company’s existing wound care products and improves the range of solutions available in acute care.

As regenerative wound care is a fast-growing area of healthcare, this commercial synergy aligns closely with Solventum’s leadership in advanced wound care and accelerates the adoption of Acera Surgical’s innovative Restrata product portfolio to treat complex tissue wounds.

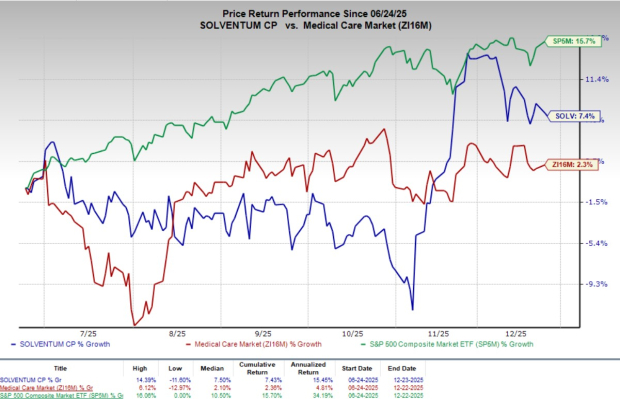

Following the announcement, shares of SOLV edged down 0.3% at yesterday’s closing. Over the past six months, shares of the company have gained 7.4% compared with the industry’s 2.3% growth and the S&P 500’s 15.7% rise.

In the long run, the acquisition strengthens SOLV’s growth profile in a $900-million U.S. synthetic tissue matrices market that is growing faster than traditional wound care categories. Solventum’s global footprint and specialized sales force are expected to enhance its ability to deliver more comprehensive wound care solutions to clinicians by combining Acera Surgical’s well-established synthetic matrices in advanced wound therapy.

SOLV’s recent announcement of a share repurchase program highlights the company’s confidence in its cash flow generation and its commitment to deliver long-term value for patients, healthcare providers and shareholders.

SOLV currently has a market capitalization of $14.01 billion.

The completion of the Acera Surgical acquisition provides SOLV with immediate scale in the synthetic tissue matrices segment, a key area within regenerative wound care.Acera Surgical’s proprietary electrospinning technology platform, Restrata, available in the United States, offers fully synthetic alternatives for soft tissue repair and improving clinical outcomes in acute care.

Acera Surgical is expected to generate $90 million in sales in 2025, adding a growth platform to Solventum’s MedSurg business and strengthening the company’s existing advanced wound care solutions, including negative pressure wound therapy.

Excluding the effects of share repurchases, the transaction will add a slight dilution to adjusted EPS in 2026. However, it is expected to start increasing earnings from 2027 onward. Solventum paid for the acquisition using cash on hand, without taking on any new debt, while preserving balance sheet flexibility.

The completion of the Acera Surgical acquisition marks an important step in Solventum’s transformation journey. By combining Acera Surgical’s innovative technology with Solventum’s strong clinical relationships and global commercial reach, the company is well-positioned to drive accelerated growth, expand margins and create value for patients, clinicians and shareholders over time.

Going by data provided by Precedence Research, the advanced wound care market is valued at $16.33 billion in 2025 and is expected to witness a CAGR of 15.70% through 2034. Factors like the rising chronic and acute wound prevalence to drive demand for dressings and devices are shaping the market’s growth.

SOLV recently announced that an international panel of wound care surgeons and experts has supported the use of closed incision negative pressure therapy with ROCF dressings to improve patient safety and surgical outcomes. The guidance highlights Solventum’s Prevena Therapy as the only ciNPT system using proprietary ROCF technology.

The company has earned the Diamond Level Resiliency Badge from the Healthcare Industry Resilience Collaborative, recognizing the company’s strong supply-chain performance. The award highlights Solventum’s ability to deliver critical MedSurg products, manage risks effectively and ensure uninterrupted patient care, even during supply disruptions.

Solventum Corporation price | Solventum Corporation Quote

Currently, SOLV carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are BrightSpring Health Services, Inc. BTSG, Pediatrix Medical Group, Inc. MD and Biodesix BDSX.

BrightSpring Health Services, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 30 cents, which surpassed the Zacks Consensus Estimate by 11.1%. Revenues of $3.33 billion beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rankstocks here.

BTSG has an estimated long-term earnings growth rate of 53.3% compared with the industry’s 15.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Pediatrix Medical Group, currently flaunting a Zacks Rank #1, reported a third-quarter 2025 adjusted EPS of 67 cents, which surpassed the Zacks Consensus Estimate by 45.7%. Revenues of $492.8 million beat the Zacks Consensus Estimate by 1.8%.

MD has an estimated earnings growth rate of 37.1% for 2025 compared with the industry’s 11.0% growth. The company beat earnings estimates in the trailing four quarters, the average surprise being 35.4%.

Biodesix, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of $1.16, which surpassed the Zacks Consensus Estimate by 27.5%. Revenues of $21.8 million beat the Zacks Consensus Estimate by 2.7%.

BDSX has an estimated earnings growth rate of 20.0% for 2025 compared with the industry’s 11.0% growth. The company’s earnings have missed estimates in the trailing four quarters, the average surprise being 6.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| Feb-20 | |

| Feb-20 |

Stock Market Leaders, Top-Performing IPOs Tend To Share This Common Trait

BTSG

Investor's Business Daily

|

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite