|

|

|

|

|||||

|

|

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at reinsurance stocks, starting with Reinsurance Group of America (NYSE:RGA).

This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. The primary headwind remains the immense and concentrated exposure to large-scale catastrophe losses, as the growing impact of climate change challenges traditional risk models and creates significant earnings volatility. Additionally, they face the risk of adverse prior-year reserve development, where claims prove more costly than anticipated, while the eventual influx of new capital from alternative sources threatens to soften the market and compress future returns.

The 6 reinsurance stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Luckily, reinsurance stocks have performed well with share prices up 12.2% on average since the latest earnings results.

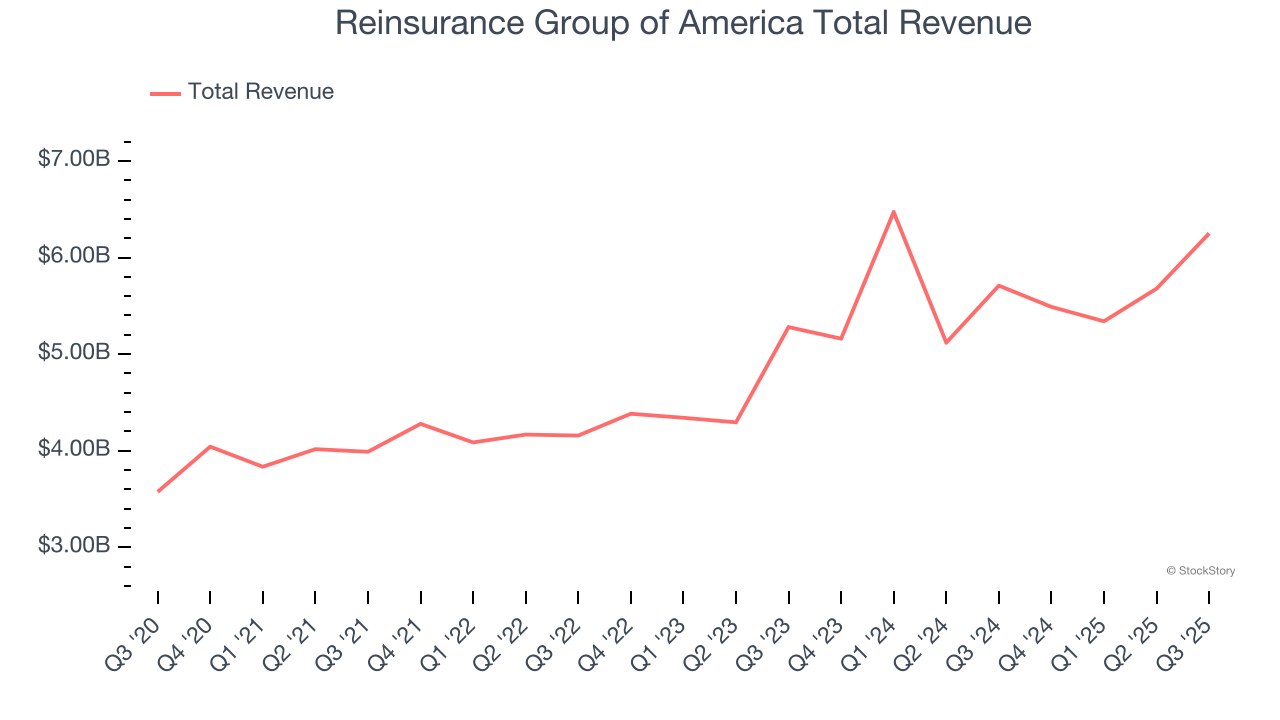

Operating behind the scenes of the insurance industry since 1973, Reinsurance Group of America (NYSE:RGA) provides life and health reinsurance services to insurance companies, helping them manage risk and meet regulatory requirements.

Reinsurance Group of America reported revenues of $6.25 billion, up 9.5% year on year. This print exceeded analysts’ expectations by 3.2%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ book value per share estimates but a significant miss of analysts’ net premiums earned estimates.

Tony Cheng, President and Chief Executive Officer, commented, “The record third quarter operating results were strong, and above expectations. A number of our businesses performed very well, particularly Asia Traditional and EMEA and U.S. Financial Solutions. Also, as a reminder, the Equitable transaction closed in the quarter, and our results reflected the expected earnings contribution from that block. We continued to have very good momentum overall and benefited from the earnings diversity that comes from our global platform. New business in the quarter remained strong, and our success with exclusive client arrangements is a good indicator of our competitive strength and unique position in the market.

Interestingly, the stock is up 9.1% since reporting and currently trades at $206.22.

Read our full report on Reinsurance Group of America here, it’s free for active Edge members.

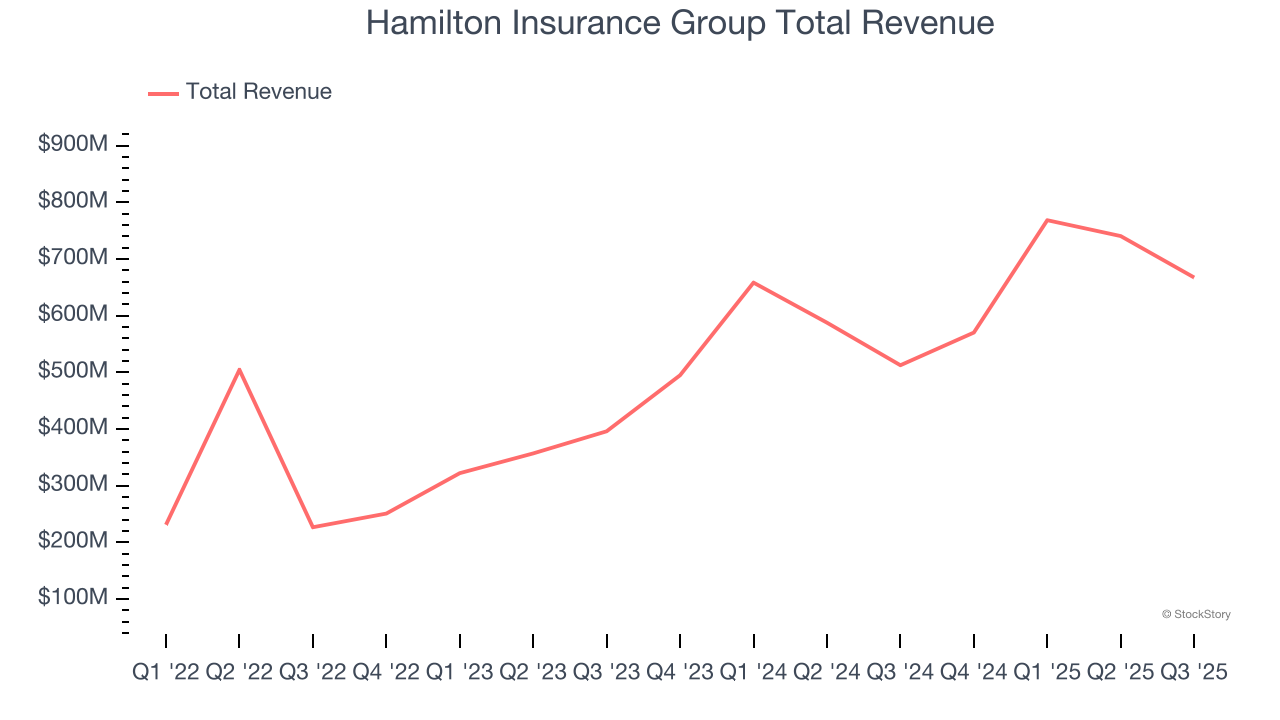

Founded in 2013 and operating through three distinct underwriting platforms across four countries, Hamilton Insurance Group (NYSE:HG) operates global specialty insurance and reinsurance platforms across Lloyd's, Ireland, Bermuda, and the United States.

Hamilton Insurance Group reported revenues of $667.7 million, up 30.2% year on year, outperforming analysts’ expectations by 10.3%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

Hamilton Insurance Group achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 20.1% since reporting. It currently trades at $28.33.

Is now the time to buy Hamilton Insurance Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Rebranded from Everest Re in 2023 to reflect its evolution beyond just reinsurance, Everest Group (NYSE:EG) underwrites property and casualty reinsurance and insurance worldwide, serving insurance companies, corporations, and other clients across six continents.

Everest Group reported revenues of $4.32 billion, flat year on year, falling short of analysts’ expectations by 2.5%. It was a disappointing quarter as it posted a significant miss of analysts’ net premiums earned estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2.2% since the results and currently trades at $336.32.

Read our full analysis of Everest Group’s results here.

Founded in the aftermath of the 9/11 attacks when insurance capacity was scarce, AXIS Capital Holdings Limited (NYSE:AXS) is a global specialty insurer and reinsurer that provides coverage for complex risks across property, liability, professional lines, cyber, and other specialty markets.

AXIS Capital reported revenues of $1.64 billion, up 4.1% year on year. This number met analysts’ expectations. It was a strong quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ book value per share estimates.

The stock is up 23.6% since reporting and currently trades at $109.04.

Read our full, actionable report on AXIS Capital here, it’s free for active Edge members.

Founded in Bermuda in 2014 and designed to adapt nimbly to evolving market conditions, Fidelis Insurance (NYSE:FIHL) is a global specialty insurer and reinsurer that provides customized coverage across property, specialty, and bespoke risk solutions.

Fidelis Insurance reported revenues of $651.9 million, down 5% year on year. This print lagged analysts' expectations by 11.1%. It was a softer quarter as it also logged a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net premiums earned estimates.

Fidelis Insurance had the weakest performance against analyst estimates among its peers. The stock is up 2.5% since reporting and currently trades at $19.62.

Read our full, actionable report on Fidelis Insurance here, it’s free for active Edge members.

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite