|

|

|

|

|||||

|

|

Johnson & Johnson JNJ, like any other large drugmaker, boasts a robust R&D pipeline of drugs, with its key focus areas being immunology, oncology and neuroscience.

J&J has rapidly advanced its pipeline this year, attaining significant clinical and regulatory milestones that will help drive growth through the back half of the decade. This year, it gained approval for new products like Inlexzoh/TAR-200 for treating high-risk non-muscle invasive bladder cancer and Imaavy (nipocalimab) for treating generalized myasthenia gravis. Inlexzoh is the first-of-its-kind drug-releasing system to provide sustained local delivery of a cancer treatment directly into the bladder.

Nipocalimab, a FcRn blocker, is also being evaluated in late-stage studies for various immune-mediated conditions like warm autoimmune hemolytic anemia, hemolytic disease of the fetus and newborn, and Sjogren’s disease and is in mid-stage studies for idiopathic inflammatory myopathy, rheumatoid arthritis and systemic lupus erythematosus. J&J believes that nipocalimab has a pipeline-in-a-product potential.

Regulatory applications were recently filed for the third key candidate, icotrokinra, for moderate-to-severe plaque psoriasis in the United States and the EU. Icotrokinra, an oral targeted peptide inhibitor of the IL-23 receptor, is also being evaluated in a phase II study for treating ulcerative colitis. J&J believes that, as a once-a-day pill, icotrokinra has the potential to set a new standard of care treatment for plaque psoriasis.

Three of J&J’s new cancer drugs are Carvykti, a BCMA CAR-T therapy for relapsed or refractory multiple myeloma; Tecvayli, for relapsed or refractory multiple myeloma; and Talvey, a novel bispecific therapy for heavily pretreated multiple myeloma. These drugs have also begun to contribute to top-line growth. Combined, they generated $2.14 billion in sales in the first nine months of 2025.

J&J’s acquisition of Intra-Cellular Therapies this year added antidepressant drug, Caplyta, to its neuroscience portfolio, which is approved for the treatment of schizophrenia, depression in both bipolar 1 and 2, and major depressive disorder.

J&J believes 10 of its new products/pipeline candidates in the Innovative Medicine segment have the potential to deliver peak sales of $5 billion, including Talvey, Tecvayli, Imaavy, Caplyta, Inlexzoh and icotrokinra.

J&J is also working on expanding the labels of currently marketed products to have new indications added to their approved labels. Key recent label expansion approvals include Tremfya in inflammatory bowel disease (IBD), Rybrevant plus Lazcluze in non-small cell lung cancer and Caplyta for adjunctive major depressive disorder.

Overall, J&J’s steady pipeline execution, recent product approvals and expanding indications underscore its focus on sustaining growth beyond near-term pressures. With multiple late-stage assets, new oncology and neuroscience contributions, and meaningful sales potential across its Innovative Medicine portfolio, J&J appears well-positioned to drive long-term growth through the back half of the decade.

Other large players in the oncology space are Pfizer PFE, AstraZeneca AZN, Merck MRK and Bristol-Myers.

Pfizer boasts a strong portfolio of approved cancer medicines as well as a robust pipeline of cancer candidates. The addition of Seagen in 2023 also strengthened its position in oncology by adding four ADCs — Adcetris, Padcev, Tukysa and Tivdak. Oncology sales comprise around 28% of its total revenues. Its oncology revenues have risen 7% year to date, driven by drugs like Xtandi, Lorbrena, the Braftovi-Mektovi combination and Padcev, which made up for declining sales of drugs like Ibrance.

For AstraZeneca, oncology sales now comprise around 43% of total revenues. Sales in its oncology segment rose 16% in the first nine months of 2025. AstraZeneca’s strong oncology performance was driven by medicines such as Tagrisso, Lynparza, Imfinzi, Calquence and Enhertu (in partnership with Daiichi Sankyo).

Merck’s key oncology medicines are PD-LI inhibitor, Keytruda and PARP inhibitor, Lynparza, which it markets in partnership with AstraZeneca. Keytruda, approved for several types of cancer, alone accounts for more than 50% of Merck’s pharmaceutical sales. Keytruda recorded sales of $23.3 billion in the first nine months of 2025, up 8% year over year.

Bristol-Myers’ key cancer drug is PD-L1 inhibitor, Opdivo, which accounts for around 20% of its total revenues. Opdivo’s sales rose 8% to $7.54 billion in the first nine months of 2025.

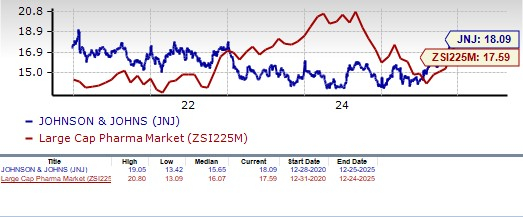

J&J’s shares have outperformed the industry in the past year. The stock has risen 42.8% in the past year compared with a 17.5% increase for the industry.

From a valuation standpoint, J&J is slightly expensive. Going by the price/earnings ratio, the company’s shares currently trade at 18.09 forward earnings, higher than 17.59 for the industry. The stock is also trading above its five-year mean of 15.65.

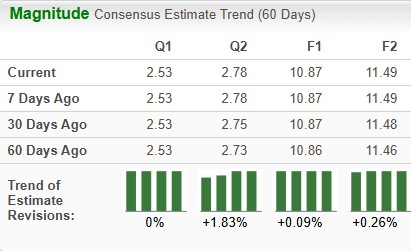

The Zacks Consensus Estimate for 2025 earnings has risen from $10.86 per share to $10.87, while that for 2026 has increased from $11.46 to $11.49 over the past 60 days.

J&J has a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 28 min | |

| 7 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite