|

|

|

|

|||||

|

|

Over the past year, the application of generative AI (genAI) in the Medical Instruments industry has moved from experimental to operational, transforming diagnostics, patient monitoring and intervention workflows. Insights from a U.S. National Science Foundation report highlight genAI’s role in generating synthetic diagnostic images, modeling disease progression and accelerating the drug development process by simulating potential drug molecules. At the same time, regulatory bodies are adapting. As of Dec. 9, 2025, 106 devices are enrolled in the FDA’s voluntary Total Product Life Cycle Advisory Program Pilot, which aims to speed up the development of safe, effective and innovative medical devices critical to public health. Further, the European Commission has proposed targeted revisions of the EU Medical Devices Regulation and IVDR to improve device availability, bolster the region’s competitiveness and simplify regulatory requirements.

Going by Fortune Business Insights data, global AI in the healthcare market is projected to witness a CAGR of 44% from 2025 to 2032. However, geopolitical headwinds continue to weigh on the sector. Sweeping tariffs, supply chain bottlenecks, rising freight and raw material costs and healthcare staffing shortages have tightened margins across MedTech. Federal research funding cuts have also slowed medical advances, led to job losses and affected researchers’ ability to publish clinical trial outcomes. Amid this scenario, industry players like Veracyte VCYT, IDEXX Laboratories IDXX and Intuitive Surgical ISRG have adapted well to changing consumer preferences and have been witnessing an uptrend in their stock prices.

Industry Description

The Zacks Medical - Instruments industry is highly fragmented, with participants engaged in research and development (R&D) in therapeutic areas. This FDA-regulated sector encompasses a vast array of products, from transcatheter valves and orthopedic devices to advanced imaging equipment and robotics. Recent trends highlight the integration of AI in diagnostics, the expansion of telemedicine, the rise of robotic-assisted surgeries and developments in 3D printing, continuous glucose monitoring systems, gene editing and nanomedicine. The emergence of generative AI is also reshaping MedTech, prompting the FDA to adopt a Total Product Life Cycle (TPLC) regulatory approach.

3 Trends Shaping the Future of the Medical Instruments Industry

GenAI Revolution: Over the past couple of years, there has been a significant increase in the adoption of genAI within the medical instruments space, with hyper-personalization being the primary feature of genAI-driven treatment options. GenAI, while analyzing vast and complex genetic and molecular data, is expected to help healthcare reach new heights in terms of predictive treatment options and smart hospital systems. According to a Precedence Research report, global genAI in the healthcare market is valued at $2.64 billion in 2025 and is expected to witness a CAGR of 35.2% through 2034. Some of the major factors fueling the market’s growth include growing collaboration among the key players, technological advancements, and increasing research and development activities. Apart from this, the application of AI in the diagnostics space is growing enormously, with the market expected to witness a CAGR of 20.4% by 2034.

M&A Trend: The medical instruments space has been benefiting from the ongoing merger and acquisition (M&A) trend. It is a known fact that smaller and mid-sized industry players attempt to compete with the big shots through consolidation. The big players attempt to enter new markets through a niche product. Going by the latest PWC report, MedTech deal value surged to $92.8 billion in 2025 — the highest level in more than a decade — driven by three mega-deals. These include Abbott’s agreement to acquire Exact Sciences for an estimated $23 billion, Hologic’s take-private deal by U.S. firms Blackstone and TPG worth up to $18.3 billion, and Waters Corporation’s $17.5 billion purchase of Becton, Dickinson and Company’s Biosciences & Diagnostic Solutions business. Despite this, overall activity remained below historical norms, with only 46 announced deals through Nov. 30. Other notable deals include Stryker’s $4.9 billion purchase of Inari Medical, Thermo Fisher’s $4.1 billion acquisition of Solventum’s Purification & Filtration business and Boston Scientific’s $664 million acquisition of Bolt Medical.

Business Trend Disruption: Per IMF’s October 2025 World Economic Outlook, global growth is expected to remain subdued over the next couple of years. At 3.2% in 2025 and 3.1% in 2026, the forecasts for growth are decisively below the pre-pandemic average of 3.7%. A few countries, especially low-income developing countries, have seen sizable downside growth revisions, often as a result of increased conflicts and recent tariff shocks. The good news is that global headline inflation is expected to decline to 4.2% in 2025 and to 3.7% in 2026, with advanced economies reaching the targets sooner than emerging market and developing economies. However, the IMF apprehends that the current policy-generated disruptions to the ongoing disinflation process could interrupt the pivot to easing monetary policy, with implications for fiscal sustainability and financial stability. Further, there are chances of higher nominal wage growth that, in some cases, reflects the catch-up of real wages, accompanied by weak productivity, which could make it difficult for firms to moderate price increases, especially when profit margins are already squeezed.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Medical Instruments industry’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. The industry, housed within the broader Zacks Medical sector, currently carries a Zacks Industry Rank #161, which places it in the bottom 33% of 243 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Underperforms S&P 500 & Sector

The industry has underperformed both the Zacks S&P 500 composite and the sector in the past year.

The industry has risen 3.1% compared with the broader sector’s growth of 6.9%. The S&P 500 has surged 19.3% in a year.

One-Year Price Performance

Industry's Current Valuation

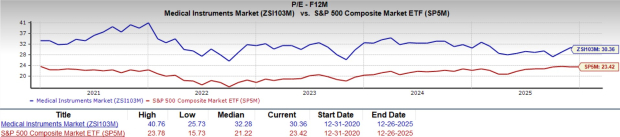

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 30.36X compared with the broader industry’s 21.29X and the S&P 500’s 23.42X.

Over the past five years, the industry has traded as high as 40.76X, as low as 25.73X and at the median of 32.28X, as the charts show below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

3 Stocks to Buy Right Now

Veracyte: California-based Veracyte is a global cancer diagnostics company. While most of its revenues presently come from Decipher Prostate and Afirma thyroid cancer tests, the company also offers Prosigna breast cancer and Decipher Bladder tests. Veracyte’s growth strategy centers on expanding into minimal residual disease, the global launch of in vitro diagnostic products and addressing new cancer challenges through tests like the Percepta Nasal Swab.

The Zacks Consensus Estimate for this Zacks Rank #1 (Strong Buy) company’s 2025 sales is pegged at $508.6 million, indicating a 14.1% rise from 2024. The consensus mark for VCYT’s 2025 EPS is pegged at $1.65, calling for an increase of 38.7% from 2024. You can see the complete list of today's Zacks #1 Rank stocks here.

Price and Consensus: VCYT

IDEXX Laboratories: Westbrook, MA-based IDEXX Laboratories develops and distributes products and services mainly for the companion animal veterinary, livestock and poultry, dairy and water testing industries. The company continues to advance its innovation-driven growth strategy with strong execution and global customer adoption. IDEXX’s cloud-based products are also seeing broad-based uptake, reflecting the strength of its vertical SaaS model, purpose-built for animal health.

The Zacks Consensus Estimate for this Zacks Rank #2 (Buy) company’s 2025 sales is pegged at $4.28 billion, indicating a 9.9% rise from 2025. The consensus mark for IDXX’s 2025 EPS is pegged at $12.93, suggesting an increase of 21.2% from 2025.

Price and Consensus: IDXX

Intuitive Surgical: Sunnyvale, CA-based Intuitive Surgical is a MedTech company focused on advancing minimally invasive care. Its da Vinci surgical system is designed to perform a wide range of surgical procedures within targeted general surgery, urologic, gynecologic, cardiothoracic, and head and neck specialties. Meanwhile, the Ion endoluminal system extends Intuitive Surgical’s commercial offerings beyond surgery into diagnostic procedures, enabling minimally invasive lung biopsies.

The consensus estimate for this Zacks Rank #2 company’s 2025 sales is pegged at $9.92 billion, indicating a 18.7% rise from 2024. The consensus mark for ISRG's 2025 EPS is pegged at $8.65, suggesting an improvement of 17.9% from the year-ago period figure.

Price and Consensus: ISRG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 10 hours | |

| 12 hours | |

| 16 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite