|

|

|

|

|||||

|

|

As AI adoption continues to surge, companies that provide the infrastructure powering large-scale models are increasingly in the spotlight. Two names that have captured investor interest are CoreWeave CRWV and Nebius Group N.V. NBIS, focused on supplying GPU-based AI cloud infrastructure and computing power to developers and enterprises, competing in the rapidly growing AI infrastructure space.

As highlighted by the Precedence Research, the global AI infra market is valued at $60.23 billion in 2025 and is estimated to reach $499.33 billion by 2034, at a CAGR of 26.6%. AI infrastructure demand is rising rapidly as companies adopt AI to automate operations and improve decision-making. Cloud computing, a growing AI ecosystem, expanding industry use cases and evolving regulatory requirements are driving the need for scalable and specialized AI infrastructure.

Both CoreWeave and Nebius are emerging as key beneficiaries of the AI infrastructure boom, but their strategies and risk profiles differ materially. So, which stock should you pick in terms of growth potential, fundamentals, valuation and risk tolerance? Let’s explore.

Strong demand for its AI cloud platform, rapid backlog expansion and a growing, diversified customer base are favoring CRWV’s trajectory. Despite supply chain delays prompting lower full-year revenue and CapEx guidance, management stressed operational agility, diversified growth drivers and solid access to capital. The company remains confident in its ability to scale infrastructure, meet long-term demand and strengthen its leadership in AI cloud services, supporting continued hypergrowth as new products, partnerships and federal opportunities ramp up.

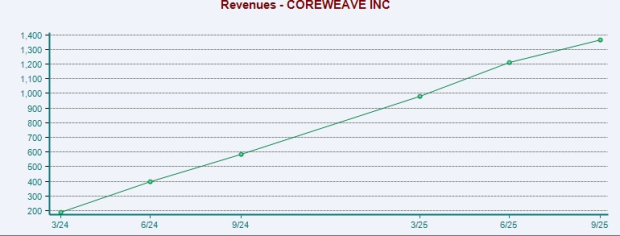

CoreWeave’s revenues have skyrocketed as customers increasingly outsource AI training and inference due to the prohibitive cost of building in-house infrastructure. Revenues jumped 134% year over year in the third quarter with massive expansions in data center power capacity. With more than 30 data centers and strong relationships with NVIDIA Corporation NVDA and major AI labs, it has built a formidable AI compute ecosystem. Its customer diversification and a robust backlog of $55.6 billion provide confidence to investors seeking scale. Third-quarter highlights include being the first to deploy NVIDIA GB300 NVL72 systems for large-scale frontier AI workloads and the first to offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances, giving CRWV an early lead in real-time AI and simulation workloads.

It is emerging as a key AI cloud infrastructure provider, with the third quarter marked by major partnerships and capacity growth. Active power rose 120 MW sequentially to roughly 590 MW, while contracted capacity expanded to 2.9 GW, leaving more than 1 GW available for future sales. New compute deals strengthened customer relationships and reduced dependence on any single client, supporting a strong growth pipeline.

CRWV signed a multi-year deal of up to $14.2 billion with Meta, expanded its OpenAI partnership by up to $6.5 billion to roughly $22.4 billion in total commitments and secured a sixth contract with a leading hyperscaler. These wins underscore its evolution from a niche GPU cloud provider into a global AI infrastructure leader built on purpose-designed HPC networking and large-scale parallel compute. Further, the company is on an acquisition spree to supplement inorganic growth. In October, it agreed to acquire Marimo Inc., maker of an AI-native Python notebook, strengthening its AI development infrastructure. This follows earlier acquisitions like OpenPipe and Weights & Biases.

However, its planned $9 billion acquisition of Core Scientific was scrapped after stakeholder pushback. Despite strong demand, supply constraints and data center delivery delays are limiting capacity and are expected to weigh on fourth-quarter results. While these issues are temporary and contracts remain intact, management lowered its 2025 outlook, now forecasting revenue of $5.05–$5.15 billion from $5.15–$5.35 billion, and adjusted operating income of $690–$720 million, below the previous $800–$830 million range. Leverage remains an added concern. Management expects 2025 interest expense of $1.21–$1.25 billion due to rising debt levels needed to fund demand-led CapEx.

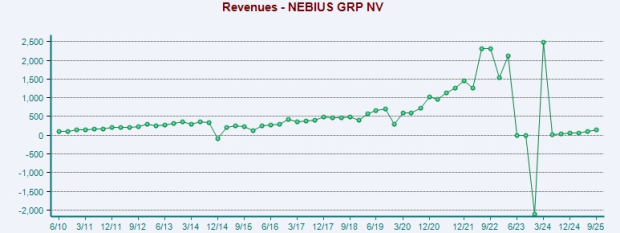

NBIS races to expand capacity as surging AI demand sells out every build, driving huge CapEx plans and reshaping revenue targets. High capital spending remains a key risk if revenue growth does not scale fast enough to offset the company’s capital-intensive model, especially as AI demand could fluctuate due to competitive pricing pressures and changing regulatory conditions. On its latest earnings call, management highlighted that capacity constraints are limiting revenue generation. To address the bottleneck, NBIS has laid out an aggressive buildout plan. By 2026, it expects contracted power to reach 2.5 GW, up from the 1 GW outlined on its August earnings call.

It also plans to have 800 MW to 1 GW of power fully connected to its data centers by year-end 2026. These structural expansions are likely to dramatically increase NBIS’s capacity to serve large-scale AI workloads. Scaling to this level requires substantial capital investments and strategic execution. Nebius has raised its 2025 CapEx guidance from approximately $2 billion to around $5 billion. However, in the near term, the main hurdles to expanding capacity are obtaining sufficient power and stabilizing the supply chain.

For 2025, NBIS narrowed and lowered its full-year revenue guidance to $500–$550 million from the earlier $450–$630 million range, reflecting slower-than-expected capacity ramp-ups. Management now expects results to land around the midpoint of this range due to delays in bringing new capacity online, raising near-term execution concerns despite its long-term growth targets. The company still projects ambitious ARR goals of $900 million–$1.1 billion by end-2025 and $7–$9 billion by end-2026. While adjusted EBITDA is expected to turn slightly positive at the group level by year-end 2025, it will remain negative for the full year.

Nonetheless, on its latest earnings call, management pointed to two significant hyperscale wins—a $3 billion, five-year agreement with Meta and a $17.4–$19.4 billion contract with Microsoft—providing strong revenue visibility. Along with scaling capacity, Nebius is enhancing its enterprise portfolio with the launch of the Aether 3.0 cloud platform and Nebius Token Factory, an inference solution built to run open-source models at scale. Looking ahead to 2026, the company plans to expand data centers in the U.K., Israel and New Jersey, while bringing new facilities online across the United States and Europe in the first half of the year.

As AI adoption scales, enterprises are struggling with GPU availability, capacity planning and predictable access to compute. Nebius recently addressed these challenges with Nebius AI Cloud 3.1, which integrates NVIDIA Blackwell Ultra infrastructure, transparent GPU capacity management, enhanced AI/ML tools and stronger security and compliance, making it well suited for enterprises running AI workloads at scale.

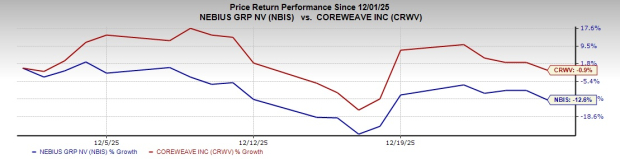

In the past month, CRWV has declined 0.9% while NBIS has plunged 12.6%.

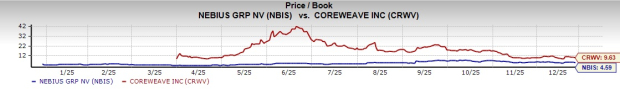

Valuation-wise, Nebius seems overvalued, as suggested by the Value Score of F, while CRWV has a score of D. In terms of Price/Book, NBIS shares are trading at 4.59X, lower than CRWV’s 9.63X.

Analysts have significantly revised their earnings estimates upward for CRWV’s bottom line for the current year.

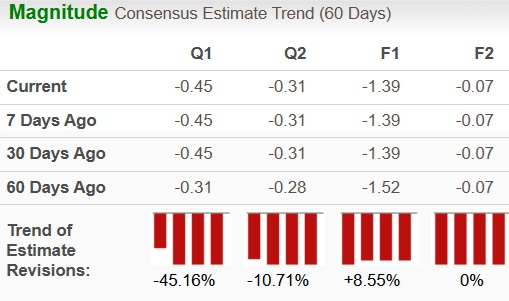

For NBIS, estimates have been drastically revised downwards over the past 60 days.

Both companies are experiencing explosive top-line growth. CoreWeave currently generates much larger absolute revenue and has a bigger customer backlog, while Nebius’s growth rates are dramatic due to being earlier in its commercial ramp. CoreWeave is ahead on scale and partnerships, while Nebius is leveraging strategic contracts and global expansion to gain market share. CoreWeave could deliver significant returns if it successfully converts its backlog into revenue and maintains dominance in AI compute services.

NBIS currently carries a Zacks Rank #4 (Sell), while CRWV has a Zacks Rank #3 (Hold). Consequently, in terms of Zacks Rank and valuation, CRWV seems to be a better option at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 min | |

| 7 min |

Stock Market Today: Dow Rises Ahead Of Fed Minutes; Nvidia Jumps On Meta Deal (Live Coverage)

NVDA

Investor's Business Daily

|

| 16 min | |

| 37 min | |

| 43 min | |

| 52 min | |

| 56 min | |

| 57 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite