|

|

|

|

|||||

|

|

Financial technology (fintech) represents a transformative investment space in a hybrid sector merging finance and technology. The companies featured on the screen encompass a variety of services, like online banking, peer-to-peer payments, insurance, cryptocurrency and cybersecurity, among others.

The performance of the fintech space is inversely related to the movement of interest rates. A low-interest-rate regime will be beneficial for this space as a higher interest rate significantly affects technological improvement and product innovation of fintech companies.

Fintech's innovative nature positions it as a fascinating choice in the evolving financial landscape. With the expansion of mobile and broadband networks, fintech is poised for significant growth. The rise of artificial intelligence (AI) technologies and machine learning further revolutionizes banking, payments, and investments, offering efficient and secure financial solutions.

At this stage, we recommend investing in three financial technology bigwigs to tap digital finance revolution in 2026. These are: Robinhood Markets Inc. HOOD, SoFi Technologies Inc. SOFI and Affirm Holdings Inc. AFRM.

The chart below shows the price performance of our three picks year to date.

Robinhood Markets operates a financial services platform in the United States that allows users to invest in stocks, exchange-traded funds, options, gold and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin and other cryptocurrencies using its Robinhood Crypto platform.

Given the higher retail participation in markets, HOOD’s trading revenues are expected to improve in the near future. Buyouts and product diversification efforts to become a leader in the active trader market will likely bolster its financials.

HOOD’s third-quarter 2025 results were aided by solid trading activity and growth in net interest revenues. HOOD’s vertical integration will likely enhance its product velocity. Further, a robust liquidity position will help HOOD to sustain share repurchases.

Robinhood is accelerating growth through rapid product innovation and global expansion. Key launches include Cortex, an AI assistant for custom indicators, market analysis and real-time insights, and Legend, which adds advanced tools such as futures trading, short selling, simulated options returns and near-24/5 index options access.

Robinhood Social is introducng verified trading profiles, strategy sharing, expert portfolio tracking and soon copy trading, with users able to open up to 10 accounts for different strategies. New banking features (including expansion into mortgage loans) and a Gold credit card have broadened its personal-finance footprint. AI features and fast rollouts are increasing engagement, premium monetization and retention, while stronger tools attract both retail and advanced traders.

Internationally, Robinhood is offering tokenized U.S. stocks and ETFs across 31 EU/EEA countries with 24/5 commission-free trading and aims to tokenize private companies. Expanded crypto services, a proprietary blockchain and future global banking products, along with new offices in Toronto and plans for APAC, position Robinhood as a rising global fintech ecosystem. This will enable greater operating leverage, paving the way for sustained profitability. HOOD currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

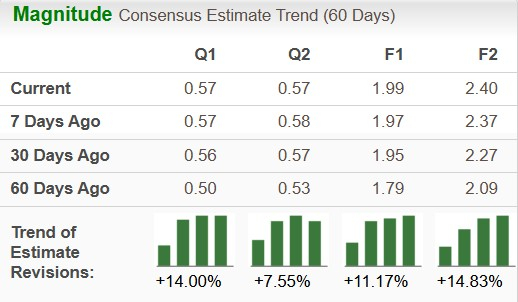

Robinhood Markets has an expected revenue and earnings growth rate of 21% and 16.2%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.3% over the last seven days. The stock has a long-term (3-5 years) EPS growth rate of 27.5%, significantly above the S&P 500 Index’s 15.9% growth rate.

SoFi Technologies positions itself as a leader, leveraging its online banking services and the Galileo platform to expand its market presence. Lower interest rates provide a favorable environment for SOFI’s lending business, encouraging customer growth through competitive loan and refinancing options.

SOFI’s focus on innovation, including new product launches and strategic partnerships, bolsters its reputation as a forward-thinking competitor to traditional banks. SOFI provides various financial services in the United States, Latin America, and Canada. SOFI operates through three segments: Lending, Technology Platform, and Financial Services. SoFi Technology currently carries a Zacks Rank #2 (Buy).

Continuous digitalization across all industries, particularly in the financial sector, presents a significant opportunity for SOFI. As a company focusing on online banking and offering a comprehensive suite of products and services, SOFI is well-positioned to benefit from this trend. The demand for online financial platforms is expected to rise and SOFI's technology platform, Galileo, which is integral to its banking business, is being adopted by other financial firms.

While conventional banks are also building their digital platforms, the acceleration in Galileo adoption positions SOFI to become a major player. Also, smaller traditional banks may very well want to license an existing platform that enables interoperability rather than building their own platform, which will be more expensive.

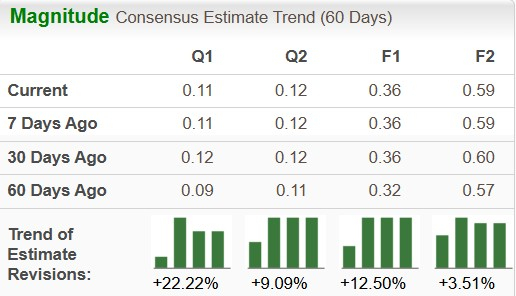

SoFi Technologies has an expected revenue and earnings growth rate of 25.3% and 62.1%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 3.5% in the last 60 days. The stock has a long-term (3-5 years) EPS growth rate of 22.2%, well above the S&P 500 Index’s 15.9% growth rate.

Affirm’s top-line momentum remains strong, supported by growing GMV, rising adoption of Affirm Cards, and entry into high-growth verticals like gaming. A robust merchant network fuels expansion, with new alliances. AFRM’s cloud-native platform uses machine learning and AI to optimize underwriting and automate customer service.

AFRM leverages a data-rich, cloud-native platform to assess fraud and credit risk using machine learning. Its proprietary infrastructure, built on millions of loan records, boosts scalability and underwriting accuracy. AFRM also uses AI to enhance internal productivity and customer support, including a chatbot that automates thousands of daily interactions. Merchant-facing AI tools are in development to help partners optimize customer acquisition and conversion.

Affirm is focused on product innovation and increasing repeat usage, a more sustainable growth driver than new customer acquisition. It’s expanding into everyday spending categories, food, fuel, travel and subscriptions, via partnerships with Costco, World Market, and others. This pivot targets high-frequency, small-ticket transactions to deepen user engagement.

Internationally, Affirm is scaling through a strategic partnership with Shopify to enter France, Germany, and the Netherlands, following its U.K. launch. AFRM is also broadening its ecosystem beyond core BNPL, investing in debit card offerings and B2B tools to further diversify its product base and customer reach. It is also broadening its relationship with blue-chip forward flow buyers while scaling its ABS program.

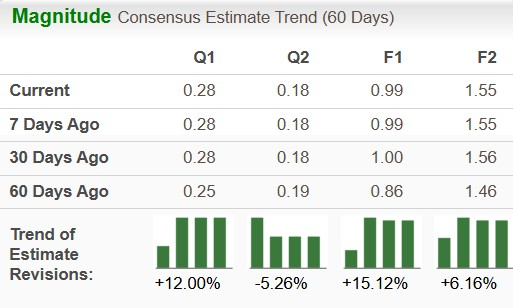

Affirm Holdings has an expected revenue and earnings growth rate of 26% and more than 100%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 15.1% in the last 60 days.

AFRM has an expected revenue and earnings growth rate of 22.8% and 56.8%, respectively, for next year (ending June 2027). The Zacks Consensus Estimate for next year’s earnings has improved 6.2% in the last 60 days. The stock has a long-term (3-5 years) EPS growth rate of 22.3%, well above the S&P 500 Index’s 15.9% growth rate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Heard on the Street: Credit Fears Are Spreading to Consumer Lending

AFRM -6.82%

The Wall Street Journal

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite