|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Omeros Corporation OMER recently announced that the FDA approved its YARTEMLEA (narsoplimab-wuug) to treat hematopoietic stem cell transplant-associated thrombotic microangiopathy (TA-TMA), a frequent life-threatening condition that can occur after stem cell transplants. YARTEMLEA is approved for adults and pediatric patients aged two years and older and is the first and only therapy indicated for TA-TMA.

YARTEMLEA works by blocking MASP-2, the key enzyme of the lectin complement pathway, preventing pathway activation while keeping other important immune defense pathways intact. The approval was supported by a single-arm clinical study on 28 adult patients and an expanded access program that included 221 adult and pediatric patients, both enrolling high-risk TA-TMA patients.

Per management, the FDA approval of YARTEMLEA is a major achievement for the company and a significant step forward for patients and families affected by TA-TMA. After years of work with the transplant community, OMER is committed to delivering YARTEMLEA, the first FDA-approved treatment for this fatal condition, supported by strong clinical results and a favorable safety profile for both adults and children in the United States in January 2026.

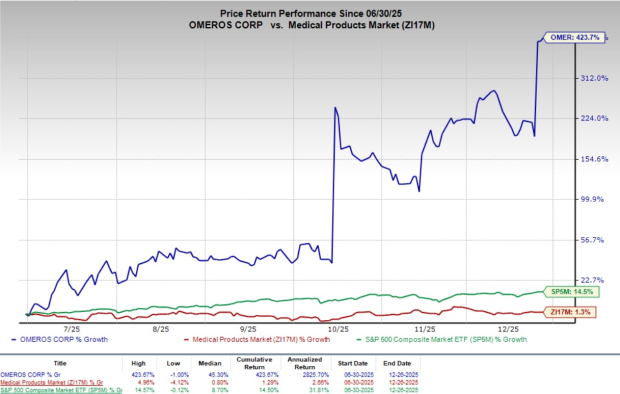

Shares of Omeros have gained 2.3% since the announcement on Wednesday. Over the past six months, shares of the company have skyrocketed 423.7% compared with the industry’s 1.3% growth and the S&P 500’s 14.5% rise.

In the long run, FDA approval of YARTEMLEA represents a transformative milestone for Omeros as its first commercial product, shifting the company from a development-stage to a revenue-generating organization. A successful launch in the United States, and potentially in Europe, combined with the reimbursement codes already in place, would provide OMER with steady revenues, a platform for potential expansion and further strengthen its position as a commercial biotechnology company.

OMER currently has a market capitalization of $1.11 billion.

In the TA-TMA study, among patients treated with YARTEMLEA, 61% showed a complete response, meaning better lab results along with improved organ function or no longer needing transfusions. In the expanded access program, the complete response reached 68%. YARTEMLEA treatment was associated with an improved survival rate in high-risk TA-TMA patients. About 73% of patients in the main study and 74% in the expanded access program were alive 100 days after diagnosis, a significant improvement in historical outcomes in high-risk TA-TMA.

As the first approved treatment for TA-TMA, YARTEMLEA represents a life-saving standard treatment for children aged two and older undergoing stem cell transplants. The clinical data show that Narsoplimab provides strong response rates and better survival, with an acceptable safety profile. The company has already secured the necessary billing and reimbursement codes. These include a specific diagnosis code for TA-TMA and procedure codes that cover how YARTEMLEA is given through either a peripheral or central vein.

The approval of YARTEMLEA strengthens OMER’s position in the biotech and rare-disease sector. It establishes the company as a leader in the treatment of TA-TMA, a life-threatening condition of stem cell transplants, giving the company a first-mover advantage in the critical orphan indications market. With a European regulatory decision expected in mid-2026, OMER aims to gain market visibility and strengthen its longer-term pipeline credibility by validating its complement-pathway expertise.

Going by data provided by Precedence Research, the stem cell therapy market is valued at $6.75 billion in 2025 and is expected to witness a CAGR of 12.6% through 2034. Factors like the rising incidence of chronic illnesses like cancer, diabetes and neurological problems, along with the poor effectiveness of current treatments, fuel the need for alternative remedies and drive the market’s growth.

Omeros announced that it has completed the sale and licensing deal with Novo Nordisk for its drug candidate zaltenibart (OMS906). Zaltenibart is a late-stage, first-in-class antibody that targets MASP-3, a key activator of the complement system and offers advantages over other similar drugs in development or on the market.

The company has formed an Oncology Clinical Steering Committee to guide its OncotoX program for acute myeloid leukemia. The program uses specially designed, small molecules that deliver toxic payloads directly into cancer cells, aiming to kill them and address a major unmet medical need.

Omeros Corporation price | Omeros Corporation Quote

Currently, OMER has a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Phibro Animal Health PAHC, AtriCure ATRC and Boston Scientific BSX.

Phibro Animal Health, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 73 cents, which surpassed the Zacks Consensus Estimate by 23.7%. Revenues of $363.9 million beat the Zacks Consensus Estimate by 2.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

PAHC has an estimated long-term earnings growth rate of 12.8% compared with the industry’s 13.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 20.77%.

AtriCure, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted loss per share of 1 cent, narrower than the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 64.2% for 2025 compared with the industry’s 11.2% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.06%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.9% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite