|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd. (CRDO) and Marvell Technology, Inc. (MRVL) are semiconductor companies that specialize in high-speed connectivity solutions that are essential for AI-driven data centers.

Amid rapid artificial intelligence (AI) proliferation, investors are focusing on companies that offer the infrastructure behind it. Semiconductor companies are at the core of AI workloads as these offer solutions to enable augmented processing power and efficiency. CRDO and Marvell are key players in this domain and bring to the table unique strengths. This makes it an intriguing comparison for investors.

Now the question arises: which stock makes a better investment pick at present? Let us dive into the fundamentals, valuations, growth outlook and risks for each company.

Credo’s leadership in the AEC space is one of its biggest catalysts. AEC business remains its fastest-growing segment. CRDO noted that AECs, now scaling to 100-gig per lane and transitioning to 200-gig per lane architectures, have become the “de facto” standard for inter-rack connectivity. These are now replacing optical rack-to-rack connections of up to 7 meters. The increasing adoption of zero-flap AECs is mainly due to these cables offering up to 1,000 times more reliability with 50% lower power consumption than optical solutions, added CRDO.

Beyond AECs, Credo’s IC portfolio, which includes retimers and optical DSPs, continued to show a healthy performance. Credo’s PCIe retimer program remains on track for design wins in fiscal 2026 and revenue contributions in the next fiscal year.

One of the most important recent developments for Credo is its introduction of three growth pillars, each representing a multi-billion-dollar opportunity. These include Zero-Flap (“ZF”) optics, active LED cables (ALCs) and OmniConnect gearboxes (Weaver).

ZF optics is a laser-based connectivity solution delivering AEC-level reliability through a custom optical DSP tightly integrated with Credo’s software stack. The optics are already in live data-center trials, with sampling to a second U.S. hyperscaler expected later in fiscal 2026. ALCs utilize micro-LEDs, delivering AEC-level reliability and power efficiency, and support up to 30-meter connections for row-scale data center networks. Sampling is planned for fiscal 2027, with revenues in fiscal 2028. Credo expects the ALC market to grow to more than twice the size of the AEC market. OmniConnect gearboxes are designed to optimize XDU connectivity.

Credo now has five main high-growth pillars — AECs, IC solutions (retimers and optical DSPs), Zero-Flap optics, ALCs and OmniConnect gearboxes. Collectively, these present a total market opportunity likely to surpass $10 billion, more than tripling Credo’s market reach just 18 months ago.

Marvell is a semiconductor company with a diversified product portfolio that includes custom ASICs, data center switches and 5G chips. The company’s strategic pivot to prioritize the data center market is proving to be a successful growth catalyst. The data center end market emerged as the company's largest segment, with revenue contribution of 73% in the third quarter of fiscal 2026. The company's custom XPU silicon, electro-optic interconnect products and next-generation switch offerings are the primary drivers of its strong data center performance.

Interconnect business remains impressive. The increasing demand for AECs and retimers, driven by the shift to high-speed PAM-based solutions, is likely to drive revenues from this segment moving forward. It has been working with the cable ecosystem to enable 100 and 200 gig per lane AECs and is likely to begin significant product ramps. It also noted that PCIe Gen6 retimers are also witnessing “broad traction.”

The data center switching business remains another catalyst with revenues expected to exceed $300 million in fiscal 2026 and top $500 million in fiscal 2027. Drivers include sustained demand for 12.8T platforms and accelerating ramps of next-generation 51.2T switches. Meanwhile, development is underway for 100T architectures, which are set to be introduced next year.

The company has been divesting non-core assets (like the Automotive Ethernet business) while layering in acquisitions, such as Avera, Aquantia, Inphi and Innovium, and now Celestial AI (expected to close in the first quarter of fiscal 2027). Celestial AI specializes in the Photonic Fabric technology platform. This platform is purpose-built for scale-up optical interconnect. Management highlighted that Celestial AI is “deeply engaged” with several hyperscalers and ecosystem partners. Celestial AI has already won a major contract with one of the biggest hyperscalers. This hyperscaler intends to use the photonic fabric chiplets in its next-generation scale-up architecture.

Strong cash flow and subsequent buybacks enhance Marvell’s appeal. Marvell has returned $1.35 billion through buybacks (including ASR) and dividends in the fiscal third quarter, highlighting financial flexibility even while investing.

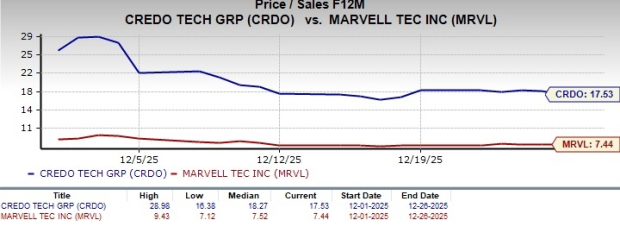

In the past month, CRDO and MRVL have declined 15.3% and 5.2%, respectively.

In terms of the forward 12-month price/sales ratio, Credo is trading at 17.53X, higher than Marvell’s 7.44X.

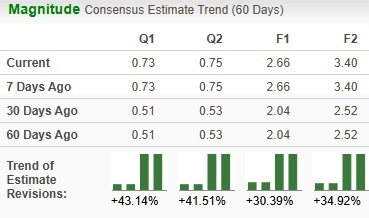

Analysts have revised earnings estimates 30% upward for CRDO for the current fiscal year in the past 60 days.

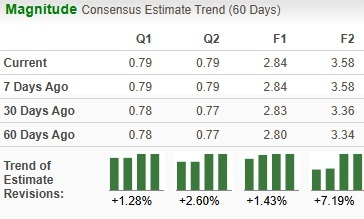

There is a marginal upward revision for MRVL’s bottom line

Credo and Marvell are well-positioned to gain from the rapidly growing AI-driven data center market.

CRDO currently flaunts a Zacks Rank #1 (Strong Buy) and Marvell carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite