|

|

|

|

|||||

|

|

NextEra Energy NEE and Constellation Energy CEG are two of the major U.S. energy companies operating in power generation. The energy space is going through a transitional phase, with emphasis on producing clean energy and reducing emissions from the electricity generation process.

The demand for reliable clean electricity is rising in the United States, due to the development of AI-based data centers, the usage of more electric vehicles, more demand from industrial customers due to the reshoring of some industries and the usage of more electricity by residential customers.

NextEra Energy is a prominent U.S. utility recognized for its leadership in renewable energy and sustainable growth. The company invests heavily in wind, solar, battery storage, and grid modernization, positioning itself at the forefront of the clean energy transition. As the parent company of Florida Power & Light and NextEra Energy Resources, NEE manages one of the world’s largest wind and solar portfolios. Backed by strong financial performance and a track record of innovation, it offers investors stability alongside long-term growth potential in the shift toward green energy.

Constellation Energy offers a compelling investment opportunity as it is among the largest producers of carbon-free nuclear power in the United States. Its reliable, high-capacity nuclear plants provide consistent baseload electricity, minimizing exposure to commodity price fluctuations and supporting predictable cash flows. With rising demand for clean, continuous power from data centers and industrial electrification, the company is well-positioned to benefit from zero-emission energy. Continued reinvestment and favorable policy support further strengthen its long-term growth potential.

With clean energy demand accelerating, it is worth taking a closer look at the fundamentals of both companies to determine which one presents the stronger investment opportunity.

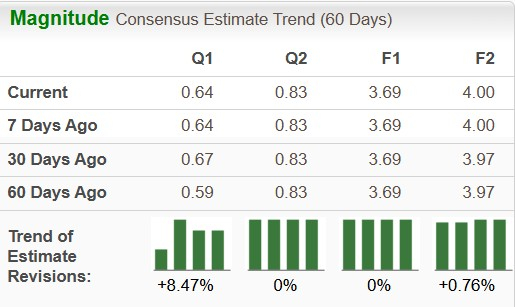

The Zacks Consensus Estimate for NextEra Energy’s earnings per share in 2026 has increased 0.76% in the past 60 days. Long-term (three to five years) earnings growth per share is pegged at 8.08%.

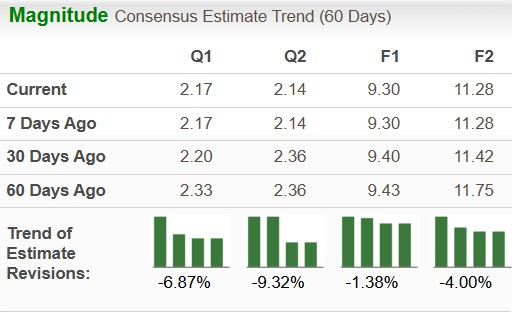

The Zacks Consensus Estimate for Constellation Energy’s 2026 earnings per share has decreased 4% in the past 60 days. Long-term earnings growth is currently pegged at 15.42%.

Companies involved in electricity generation are heavily regulated, which provides a clear picture of their forward earnings. Stable earnings allow management to approve the distribution of dividends and increase shareholders’ value. Currently, the dividend yield for NextEra Energy is 2.82% compared with the Zacks S&P 500 composite’s average of 1.52%, and the same for Dominion Energy is 0.43%.

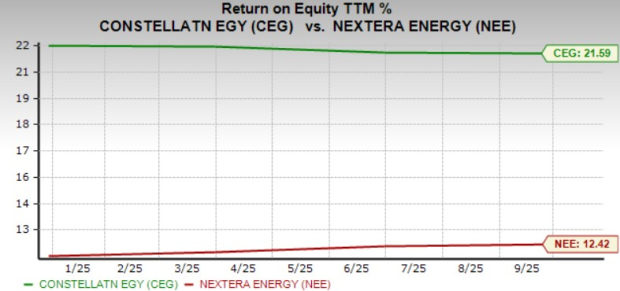

Return on equity (“ROE”) measures how efficiently the company is utilizing its shareholders’ funds to generate profits. NextEra Energy’s current ROE is 12.42% compared with Constellation Energy’s 21.59%.

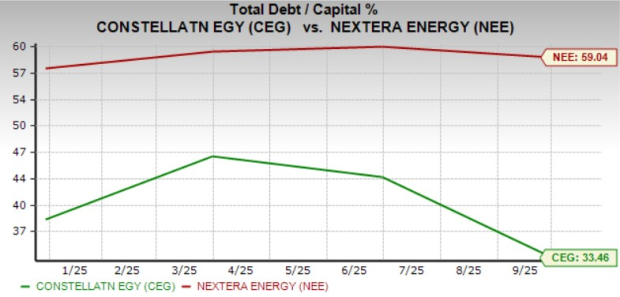

The electricity-generating business is a capital-intensive business, as a large amount of investment is required to develop power plants, and regular maintenance is required to keep the transmission and distribution lines in good working conditions.

CEG’s debt to capital is 33.46% compared with NEE’s 59.04%. It shows Constellation Energy is utilizing lower debts compared with NextEra Energy to successfully run its operation.

The Times Interest Earned (“TIE”) Ratio is a solvency ratio, which indicates how easily a company pays its debt interest using operating earnings. The TIE ratio of NextEra Energy is 2.3, and for Constellation Energy is 8.5, indicating that both companies can easily meet their debt obligations with their existing funds.

Capital expenditure is critical in the energy sector, as it drives infrastructure development, system reliability and long-term growth. Utilities must consistently invest in power generation, transmission and distribution networks to meet rising demand, integrate renewable energy sources and comply with evolving regulatory standards. The current interest rate in the range of 3.5% to 3.75% will also assist the capital-intensive utilities.

NextEra Energy plans to invest nearly $74.6 billion in the 2025-2029 period to strengthen its infrastructure and add more clean electricity generation assets. Constellation Energy expects to invest nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. Nearly 35% of projected capital expenditures are for the acquisition of nuclear fuel, which includes additional nuclear fuel to increase inventory levels.

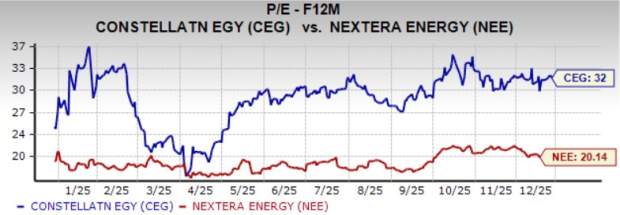

NextEra Energy currently appears to be trading at a discount compared with Constellation Energy on a Price/Earnings Forward 12-month basis. (P/E- F12M).

NEE is currently trading at 20.14X, while CEG is trading at 32X

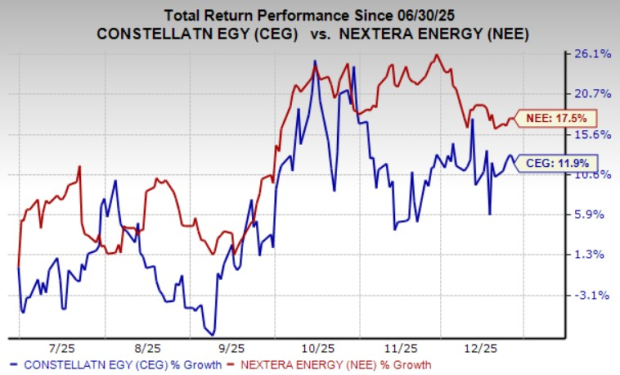

Last six months, NextEra Energy’s shares have gained 17.5% compared with Constellation Energy’s rally of 11.9%.

Constellation Energy and NextEra Energy are generating a large volume of clean energy to efficiently serve millions of customers across their service territories in the United States.

Based on the above discussion, NextEra Energy currently has a marginal edge over Constellation Energy. NEE’s price performance, stronger dividend yield, better movement in earnings estimates, elaborate capital investment and cheaper valuation make it attractive compared with Constellation Energy.

Considering the aforementioned factors, NextEra Energy is currently our choice with a Zacks Rank #2 (Buy), while Constellation Energy carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 6 hours | |

| 8 hours | |

| 14 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite