|

|

|

|

|||||

|

|

Fintech has become one of the most closely watched areas in financial markets, with SoFi Technologies SOFI and Nu Holdings NU standing out as notable players. SoFi has expanded from student loan refinancing into a full suite of financial services, including lending, investing, and banking. Meanwhile, Nu, the Brazilian digital bank giant, is rapidly scaling across Latin America, with millions of new customers each quarter.

Both companies exemplify the shift toward digital-first banking solutions, leveraging technology to provide accessible and user-friendly financial services to a broad customer base.

SOFI continues to impress investors, delivering strong results in the third quarter of 2025. SOFI’s third-quarter 2025 results reflected operational discipline and growth trajectory. Adjusted EBITDA came in at a record $277 million, with a 29% margin, while nonlending revenues surged 57% year over year. The lending segment also performed robustly, with $481 million in revenues, up 23% from last year. Total loan originations reached a record $9.9 billion, up 57% year over year, driven by strong demand for personal and home loans.

SoFi also strengthened its balance sheet, raising $1.7 billion in new capital and increasing total deposits by $3.4 billion to $32.9 billion. This growing deposit base enhances funding stability and supports lending expansion without excessive reliance on external financing.

Scalable profitability has emerged as the central force behind SOFI’sstronger guidance for 2025, reflected in raised expectations across every major metric. SOFI now anticipates adding approximately 3.5 million members, indicating 34% growth rate compared with the earlier forecast of 30%. This upward revision demonstrates the compounding effect of SoFi’s expanding ecosystem; more members mean higher product adoption and increased operating leverage.

Revenue expectations have also increased significantly. Adjusted net revenue is now projected at $3.54 billion, indicating 36% year-over-year growth and surpassing the prior $3.375 billion estimate. Profitability projections improved even more sharply: adjusted EBITDA is now guided to $1.035 billion, while adjusted net income is expected at $455 million with adjusted EPS of $0.37. SoFi’s most striking upgrade is tangible book value growth, now forecast at $2.5 billion, significantly above the earlier $640 million target. This signals enhanced capital strength and supports future lending and fee-driven expansion.

Both SoFi and Nu Holdings are high-quality fintech platforms with strong execution and favorable long-term trends. However, SoFi emerges as the better buy right now. The company is transitioning decisively from growth to scalable profitability, supported by a diversified ecosystem that spans lending, banking, investing, and technology-driven services. Its improving operating leverage, strengthening balance sheet, and expanding fee-based revenues provide clearer visibility into sustainable earnings power. While Nu Holdings remains an exceptional long-term compounder in Latin America, SoFi’s accelerating profitability, product breadth, and strategic innovation give it a more compelling near-term and medium-term risk-reward profile.

The broad upward revision suggests a business gaining structural efficiency as it scales. Strong member growth, improved cost discipline and expanding fee-based revenue streams are helping SoFi transition into a more durable, higher-margin financial platform with clearer visibility into long-term profitability.

SOFI is entering a strategically important lane with its decision to embed blockchain rails into cross-border payments. This move matters because international remittances remain slow, fee-heavy and controlled by legacy intermediaries. By using blockchain infrastructure, SoFi positions itself to deliver near-instant transfers at a lower cost. This experience can sharply improve sentiment among digitally native users who already rely on the company for banking, lending and investing services.

Nu Holdings’ most powerful differentiator is the growing durability of its revenues. The company has demonstrated a clear ability to translate its vast customer base into recurring, multi-product income streams that are far less exposed to macroeconomic swings. In the third quarter of 2025, Nu sustained strong momentum by expanding its customer base to 127 million, adding more than 4 million new users, while maintaining an activity rate above 83%.

While Nubank’s earlier narrative was driven primarily by rapid user acquisition, the more important evolution today is the deepening monetization of those users across payments, credit, savings, insurance and other financial services. This shift toward predictable, repeatable revenue streams positions Nu Holdings for more stable performance, even during periods of tighter credit conditions or renewed foreign-exchange volatility in Latin America. Reflecting this progress, revenues grew 39% year over year on a currency-neutral basis in the third quarter, reaching $4.2 billion.

A key contributor to this resilience is the company’s disciplined focus on high-engagement products. Rather than stretching into higher-risk credit to boost short-term earnings, Nu Holdings continues to scale revenues through everyday transactions, low-cost deposits and steady cross-selling. These revenue streams naturally compound with scale and help smooth out the quarter-to-quarter volatility that often challenges traditional banks. As more customers adopt multiple products, average revenue per active user continues to rise, reinforcing long-term earnings visibility.

The model becomes even more attractive when paired with Nu Holdings’ efficient cost structure. Its technology-led platform avoids the burden of extensive physical infrastructure, allowing incremental revenue from additional products to translate more directly into operating leverage. At a time when legacy banks are grappling with rising compliance and structural costs, Nu Holdings’ revenue durability stands out as a meaningful strategic advantage, one that supports premium valuation multiples and underpins consistent shareholder returns in the next phase of growth.

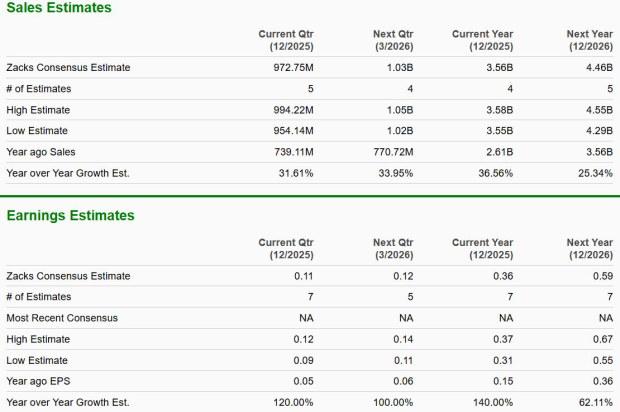

According to the Zacks Consensus Estimate, SoFi is expected to achieve 36.6% year-over-year sales growth and an impressive 140% jump in EPS in 2025, reflecting its improving profitability and operational efficiency.

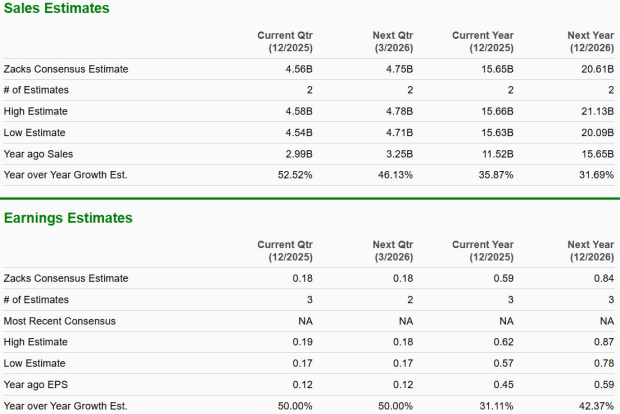

Nu Holdings is projected to post a sales growth of about 36%, driven by rapid customer acquisition and geographic expansion across Latin America. NU's EPS is forecasted to grow by 31%, trailing SoFi’s projected EPS growth.

While NU appears attractively valued with a forward 12-month P/E of 20.07X versus its median of 20X, SoFi's higher forward P/E of 46.33X, below its median of 48.67X, reflects investor confidence in its rapid earnings growth potential. SoFi’s valuation premium is justified by its accelerating profitability, diversified financial services ecosystem, and growing U.S. market share.

Both SoFi and Nu Holdings are high-quality fintech platforms with strong execution and favorable long-term trends. However, SoFi emerges as the better buy right now. The company is transitioning decisively from growth to scalable profitability, supported by a diversified ecosystem that spans lending, banking, investing, and technology-driven services. Its improving operating leverage, strengthening balance sheet, and expanding fee-based revenues provide clearer visibility into sustainable earnings power. While Nu Holdings remains an exceptional long-term compounder in Latin America, SoFi’s accelerating profitability, product breadth and strategic innovation give it a more compelling near-term and medium-term risk-reward profile.

Both SOFI and NU currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite