|

|

|

|

|||||

|

|

Vicarious Surgical Inc.RBOT recently announced a software execution partnership with a global digital engineering and software development firm to transform the company’s operating model. In developing advanced robotic technology for minimally invasive surgery, the collaboration is intended to work more efficiently, making development timelines predictable and lowering operating costs while being consistent with RBOT’s cash burn guidance.

Per management, the partnership improves Vicarious Surgical’s ability to execute and enhances its operating efficiency by leveraging the external partner’s established engineering processes. This allows the company’s internal teams to concentrate on the most important tasks, such as core innovation, integrating different systems and critical works that move RBOT closer to finalizing its design and preparing the robotic system for clinical use.

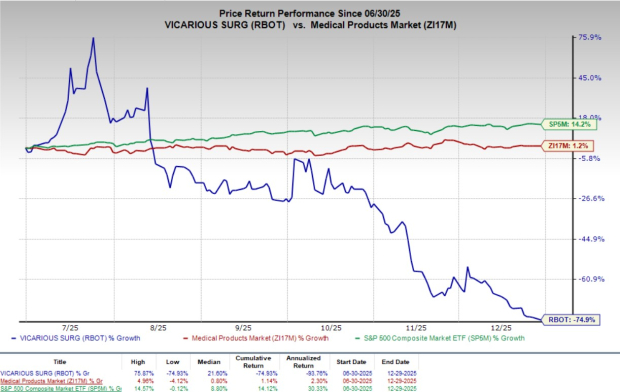

Following the announcement, shares of Vicarious Surgical declined 3.6% at yesterday’s close. Over the past six months, shares of the company have plunged 74.9% against the industry’s 1.2% growth and the S&P 500’s 14.2% rise.

In the long run, the partnership signals cost discipline, improved execution visibility and a clearer pathway toward the launch of RBOT’s Vicarious Surgical System, a revolutionary surgical robot that allows surgeons to carry out minimally invasive surgeries with 3D imaging and controlled movements. By balancing between its in-house engineering teams and external engineering support, the company expects fewer delays and better control over development timelines. The agreement addresses RBOT’s vision of advanced quality care for minimally invasive procedures at a predictably lower cost, with the best possible outcomes.

RBOT currently has a market capitalization of $12.77 million.

For Vicarious Surgical, the partnership represents a structural shift in how the company executes complex software development. The external partner will take responsibility for handling a large part of the software development for the Vicarious Surgical System. This includes robot control systems, visualization and key workflow features. By outsourcing global teams and established engineering processes for advanced robotic platforms, this partnership reduces the high costs of fully in-house execution and enables faster development timelines.

The external partner has already started work and is integrating into the company's processes through a well-planned transition to ensure development continues smoothly without disruption. This partnership supports RBOT’s strategy to reduce costs, lower cash burns and build a hybrid operating model by combining its internal leadership with external execution as the company progresses toward achieving important milestones.

Overall, this strategic software execution partnership is a significant step for Vicarious Surgical as it works to advance its next-generation surgical robotics platform. By improving development efficiency, lowering operating costs and increasing predictability, the partnership supports the company’s goal of bringing its disruptive technology closer to clinical use. The hybrid operating model allows Vicarious Surgical to focus on its core innovation and execution process while strengthening its long-term position in the evolving robotic surgery market.

Going by data provided by Precedence Research, the robotic surgery market is valued at $13.79 billion in 2025 and is expected to witness a CAGR of 16.5% through 2034. Factors like the widespread adoption of robotic surgical procedures — including gynecologic surgery, urologic surgery, cardiac surgery and orthopedic surgery — are driving market growth, as robotic systems improve surgical efficiency, lower costs, enhance patient outcomes and reduce hospital stays compared with traditional surgery.

In early 2025, Vicarious Surgical announced an agreement with UMass Memorial Medical Center to support the adoption of its robotic system. The collaboration will focus on improving perioperative practices, surgeon training and operational efficiency, including standardized procedures, inventory and sterilization processes, system testing, case observation and sharing clinical and research best practices.

Vicarious Surgical Inc. price | Vicarious Surgical Inc. Quote

Currently, RBOT carries a Zacks Rank #3 (Hold).

Some better ranked stocks from the broader medical space are Veracyte VCYT, Artivion AORT and EDAP TMS EDAP.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings growth rate of 38.7% for 2025 compared with the industry’s 13.6% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.12%.

Artivion, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 16 cents, which surpassed the Zacks Consensus Estimate by 14.3%. Revenues of $113.3 million beat the Zacks Consensus Estimate by 1.8%.

AORT has an estimated earnings growth rate of 140% for 2025 compared with the industry’s 13.6% rise. The company delivered a negative average earnings surprise of 4.38% in the trailing four quarters.

EDAP TMS, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of 15 cents, narrower than the Zacks Consensus Estimate by 42.3%. Revenues of $16.1 million topped the Zacks Consensus Estimate by 7.1%.

EDAP’s loss per share for 2025 is projected to widen 25.5%, while the industry’s earnings are expected to grow 13.6%. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 19.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Mar-04 |

Vicarious Surgical receives NYSE delisting notice

MedTech Dive

|

| Mar-04 | |

| Mar-04 |

Vicarious Surgical Receives Delisting Notice From NYSE

Business Wire

|

| Mar-03 | |

| Mar-02 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite