|

|

|

|

|||||

|

|

The global drone industry has reached a pivotal growth phase driven by increasing uptake across commercial, government and military sectors. According to a report from Grand View Research, the global drone tech market is expected to witness a CAGR of 14.3% from 2025 to 2030. The convergence of drones with artificial intelligence (“AI”), cloud computing and edge processing is further driving adoption across verticals.

Both Ondas Holdings (ONDS) and AeroVironment (AVAV) are players in this domain, but operate from very different positions of scale and maturity. Ondas is an emerging player, while AeroVironment is a long-established leader with deep ties to the U.S. military and allied governments.

These companies bring to the table unique strengths, which make this an intriguing comparison for investors.

So, now the question arises: which stock makes a better investment pick at present? Let us dive into the fundamentals, valuations, growth outlook and risks for each company.

ONDS’ Ondas Autonomous Systems (“OAS”) business is transitioning into a high-visibility growth engine. OAS is gaining primarily from the deliveries for both its Optimus System and Iron Drone Radar counter-UAS platforms, as well as contributions from Apeiro ground robots. The segment delivered $10 million of revenues in the third quarter of 2025, up from just $1 million in the year-ago quarter. OAS had a backlog of $22.2 million, while the consolidated backlog stood at $23.3 million, and it reached $40 million, including acquisitions.

ONDS is focusing on M&A to strengthen portfolio offerings and broaden reach across multiple domains like unmanned ground systems, robotics and fiber optic communications, subsurface intelligence and demining robotics. In the past few months, it has acquired Sentrycs, Apeiro Motion, Zickel, among others and recently announced an agreement to buy Roboteam, which specializes in multi-mission tactical ground robotics.

A robust balance sheet enables strategic M&A activity. As of Sept. 30, 2025, Ondas had $433.4 million in cash, cash equivalents and restricted cash, and has raised $855 million since June to support its aggressive expansion plans.

However, challenges now emerge for ONDS. Heavy dependence on the OAS division for revenue growth in the increasingly crowded drone space is a concern. For ONDS, if a single large customer delays, reduces or cancels, revenues would decline materially.

Ondas Holdings Inc. price-consensus-eps-surprise-chart | Ondas Holdings Inc. Quote

Further, so many acquisitions in such a short period of time can create integration overload risk. Although these buyouts provide undeniable technological depth, investors must watch closely for an increase in expenses and execution risks.

ONDS is in the middle of a massive transition and already incurring sizable expenses. Management described a period of heavy infrastructure building and team expansion. These moves strengthen long-term competitive moat, but amplify short-term financial pressure.

For its Ondas Networks, the company expects “meaningful adoption” by the railroads in 2026 for dot16, but at present has “modest revenue expectations from Ondas Networks relative to the OAS business”.

AeroVironment is one of the key pure-play beneficiaries of rising global demand for military drones and its biggest competitive moat is the strategic ties with the U.S. and allied governments. AVAV develops uncrewed aircraft and ground robot systems, loitering munition systems, counter-UAS technologies and related services for the U.S. Department of Defense, other federal agencies and international allied governments. AVAV continues to strengthen its competitive position by seamlessly integrating AI and cutting-edge computer vision into agile, effective next-gen drone solutions.

In the second quarter of fiscal 2026, the total ceiling value of contract awards reached $3.5 billion, driving bookings to $1.4 billion. AVAV’s steady investment in R&D and manufacturing capacity is the key catalyst in driving business momentum. In the fiscal second quarter, the company unveiled the next generation of Switchblade loading munitions (Switchblade 600 Block 2, Switchblade 400 and Switchblade 300 Block 20), as well as upgraded JUMP 20 and JUMP20-X (its Group 3 uncrewed aircraft system).

AVAV’s expanding software ecosystem, anchored by the AV_Halo open-architecture platform, is emerging as a powerful long-term growth driver. It recently launched two products, namely AV_Halo Cortex (an advanced intelligence fusion and analysis environment) and AV_Halo Mentor (a war fighter readiness suite that uses AR/VR weapons training and mission rehearsal).

AeroVironment, Inc. price-consensus-eps-surprise-chart | AeroVironment, Inc. Quote

AVAV is scaling its manufacturing footprint, including a planned high-capacity Switchblade facility, while leveraging synergies from the BlueHalo acquisition to deepen capabilities across counter-UAS, cyber, space and electronic warfare. For fiscal 2026, it expects revenues between $1.95 billion and $2 billion.

Nonetheless, AVAV's extensive exposure to the government vertical makes it prone to customer concentration risk. Any untoward shifts in defense budgets, procurement delays or political decisions can extensively impact AVAV’s top line. The recent government shutdown negatively impacted performance in the fiscal third quarter, mainly due to delays in FMS shipments and revenue loss (particularly Space, Cyber and Directed Energy segments).

Increasing costs, integration risks from acquisitions and capital-intensive manufacturing expansion are additional risks to monitor.

Over the past six months, ONDS has registered gains of 357.7% while AVAV stock has lost 3.2%.

In terms of the forward 12-month price/earnings ratio, ONDS is trading at 23.1X, higher than AVAV’s 5.47X.

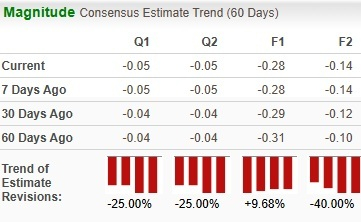

Analysts have revised earnings estimates by 9.7% for ONDS for the current fiscal year in the past 60 days.

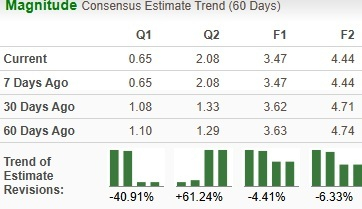

There is a downward revision of 4.4% for AVAV’s bottom line over the same time frame.

ONDS currently carries a Zacks Rank #4 (Sell), while AVAV carries a Zacks Rank #3 (Hold). In terms of Zacks Rank, AVAV appears to be a better pick at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite