|

|

|

|

|||||

|

|

Beam Therapeutics BEAM is engaged in developing investigational gene therapy candidates that are currently in early-to-mid-stage development for treating certain hematology and genetic diseases.

The company’s proprietary base-editing technology potentially enables the development of a differentiated class of precision genetic medicines that target a single base in the genome without making a double-stranded break in the DNA, thereby minimizing errors.

One of the company’s assets developed using the above technology is risto-cel (formerly BEAM-101), an ex vivo therapy being evaluated in the phase I/II BEACON study for treating sickle cell disease (“SCD”). In December 2025, BEAM reported updated data from this study at the 2025 ASH annual meeting. Updated data from 31 adult and adolescent SCD patients treated with risto-cel demonstrated mean HbF induction of more than 60%, HbS reduced to below 40% and sustained resolution of anemia for up to 20 months.

Initial safety and efficacy data from this study (announced last year) showed that treatment with risto-cel led to a robust and durable increase in fetal hemoglobin and a reduction in sickle hemoglobin. The FDA granted an orphan drug designation and Regenerative Medicine Advanced Therapy (“RMAT”) Designation to risto-cel for treating SCD in June and August 2025, respectively.

Beam Therapeutics recently initiated dosing in a phase I healthy volunteer study evaluating BEAM-103, an experimental anti-CD117 monoclonal antibody for the treatment of SCD.

Apart from hemoglobinopathy candidates, Beam Therapeutics is also expanding its genetic disease pipeline by developing BEAM-301 and BEAM-302 — for treating glycogen storage disease type 1a (GSD1a) and alpha-1 antitrypsin deficiency (“AATD”), respectively, in separate phase I/II studies. While dosing is currently underway in the BEAM-301 study, an update on the BEAM-302 study is expected in early 2026.

Though Beam Therapeutics is making steady progress with the pipeline development, its biggest challenge lies in the lack of an approved product in the portfolio. Also, the growing competition in the target market remains a threat to the company’s pipeline assets. Given that Beam Therapeutics is a clinical-stage company, the successful development of the pipeline candidates remains in key focus for it heading into 2026.

While Beam Therapeutics’ pipeline of innovative CRISPR-based therapies looks promising, the development of these remains a complex affair. Upon successful development and potential approval, the candidates are likely to face stiff competition from companies that are also using the CRISPR/Cas9 gene editing technology to address various diseases in specific areas.

CRISPR Therapeutics CRSP is the first and only company in the world to market a CRISPR/Cas9-based therapy. CRSP’s one-shot gene therapy, Casgevy, was approved in late 2023 and early 2024 across the United States and Europe for two blood disorder indications —SCD and transfusion-dependent beta-thalassemia.

CRSP has developed Casgevy in partnership with large biotech, Vertex Pharmaceuticals, which is responsible for the therapy’s global development and commercialization.

Meanwhile, Intellia Therapeutics NTLA is currently advancing two in vivo candidates — lonvo-z (or, NTLA-2002) for hereditary angioedema (“HAE”) and nex-z (or, NTLA-2001) for transthyretin (“ATTR”) amyloidosis.

Intellia recently completed enrolment in the pivotal phase III HAELO study evaluating lonvo-z to treat HAE. Top-line data from this study are expected by mid-2026.

Intellia is developing nex-z, in collaboration with Regeneron, in two late-stage studies, MAGNITUDE and MAGNITUDE-2, for ATTR amyloidosis with cardiomyopathy (ATTR-CM) and ATTR amyloidosis with polyneuropathy (ATTRv-PN), respectively.

In the past six months, shares of Beam Therapeutics have rallied 58.7% compared with the industry’s rise of 25.1%. The stock has also outperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

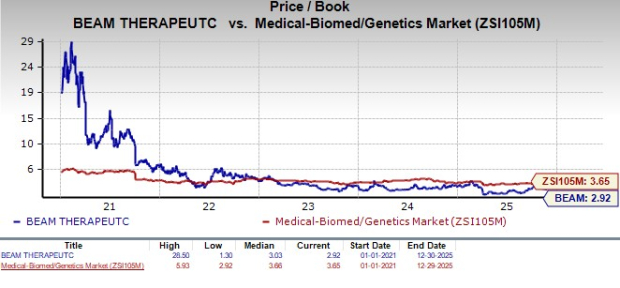

From a valuation standpoint, Beam Therapeutics is trading at a discount to the industry. Going by the price/book ratio, the company’s shares currently trade at 2.92, lower than 3.65 for the industry. The stock is trading below its five-year mean of 3.03.

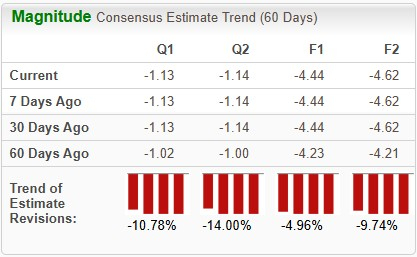

The Zacks Consensus Estimate for BEAM’s 2025 loss per share has widened from $4.23 to $4.44 over the past 60 days. Loss per share estimates for 2026 have also widened from $4.21 to $4.60 during the same time frame.

Beam Therapeutics currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-08 | |

| Mar-07 | |

| Mar-06 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite