|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

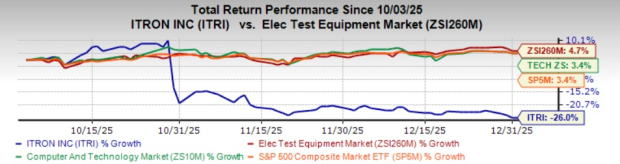

Itron, Inc. ITRI shares have plunged 26% in the past three months, underperforming the Zacks Electronics - Testing Equipment industry’s growth of 4.7%. Also, it has underperformed the Zacks Computer and Technology sector and the S&P 500 composite’s growth of 3.4% each. The stock has declined 31.6% in the past six months.

The company is facing intense competition and global macroeconomic weakness. Also, weak guidance hurt investor sentiment. However, momentum in its Grid Edge Intelligence platform, frequent product launches and strategic acquisitions are providing support.

Let us evaluate the pros and cons of ITRI and decide the best course of action for your portfolio.

Several challenges continue to weigh on ITRI’s outlook. Heightened competition across its key revenue-generating segments poses a serious risk of pricing pressure and market share erosion. Macroeconomic uncertainty is adding to these pressures. Higher interest rates and inflation have prompted consumers to delay bill payments, while delays in federal spending have increased pending bookings. Additionally, shifting trade policies and growing regulatory caution over consumer costs are slowing project approvals, creating a more challenging operating environment.

Although long-term demand drivers remain intact and there have been no project cancellations, near-term momentum is weakening. Customers are pulling back, stretching timelines and postponing commitments, resulting in weaker third-quarter bookings and softer year-end expectations. As a result, bookings are likely to fall short of the 1:1 target for 2025. Reflecting these challenges, Itron lowered its 2025 revenue guidance to $2.35–$2.36 billion, implying an about 3% decline year over year. Fourth-quarter 2025 revenue is projected at $555–$565 million, with the midpoint down 9% from the prior year, signaling continued near-term weakness. Non-GAAP EPS is anticipated to be in the range of $2.15-$2.25.

Adding to the concerns is Itron’s elevated debt burden. Total debt was $1.265 billion at the end of the third quarter of 2025, with a debt-to-capital ratio of 42.1%, well above the industry average of 25.8%. High leverage may constrain cash flow flexibility, limit the company’s ability to meet future obligations comfortably and reduce access to favorable refinancing options.

Despite near-term challenges, Itron’s momentum in its Grid Edge Intelligence platform remains a key positive. Growth is being driven by data center demand, electrification, grid modernization and digitalization across utilities, supported by a solid $4.3 billion backlog. Adoption of distributed intelligence continues to accelerate, with millions of endpoints deployed and licensed DI applications rising sharply year over year.

Frequent product launches also bode well. In October, Itron launched its Gen6 network platform and the latest UtilityIQ suite, advancing its Intelligent Connectivity portfolio. The update adds public and private cellular connectivity to endpoints and supports cross-device, cross-vendor distributed intelligence. In May, Itron unveiled its Solar Battery Access Point, a solar-powered, battery-operated device that enhances connectivity in areas lacking mesh networks. In March 2025, Itron unveiled IntelliFLEX, a smart grid-edge energy management system that gives utilities real-time control of behind-the-meter DERs. Using Grid-Edge Intelligence, it helps optimize the grid, unlocking up to 20% more capacity and delaying costly upgrades.

Itron, Inc. price-consensus-chart | Itron, Inc. Quote

Moreover, the company is gaining from strategic collaborations, acquisitions and deal wins. In November, Itron agreed to acquire privately held Locusview, a utility construction management software provider, for $525 million in cash, with the deal expected to close in January 2026. In October, Itron partnered with Gordian Technologies to add AI and machine learning to its Grid Edge Intelligence portfolio. Through this collaboration and the Distributed Intelligence Developer Program, Itron will help utilities boost grid resilience, improve disaster management, enhance efficiency and provide affordable energy. In a move to bolster its AI and safety analytics capabilities, Itron announced the planned acquisition of Urbint, Inc., a Miami-based software company specializing in predictive risk and safety intelligence for critical infrastructure. The $325 million all-cash deal is expected to close in the fourth quarter.

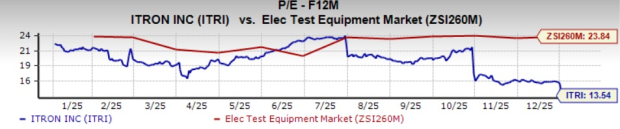

ITRI’s stock is trading at a discount, with a forward 12-month Price/Earnings of 13.54X compared with the industry’s 23.84X.

With a Zacks Rank #3 (Hold), ITRI appears to be treading in the middle of the road. Strength in its Grid Edge Intelligence platform and product launches bode well for ITRI. However, macroeconomic headwinds and shifting trade policies, along with stiff competition, are concerns.

Hence, existing investors may hold the stock, while new investors should remain on the sidelines and wait for a better entry point.

Some better-ranked stocks from the broader technology space are Palantir Technologies Inc. PLTR, BlackBerry Limited BB and Five9, Inc. FIVN. PLTR presently sports a Zacks Rank #1 (Strong Buy), whereas BB & FIVN carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Palantir Technologies’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 16.27%. In the last reported quarter, PLTR delivered an earnings surprise of 23.53%. Its shares have surged 122.5% in the past year.

BlackBerry’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, with the average surprise being 125%. In the last reported quarter, BB delivered an earnings surprise of 25%. Its shares have increased 3% in the past year.

FIVN’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 16.09%. In the last reported quarter, Five9 delivered an earnings surprise of 6.85%. Its shares have decreased 27.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 18 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite