|

|

|

|

|||||

|

|

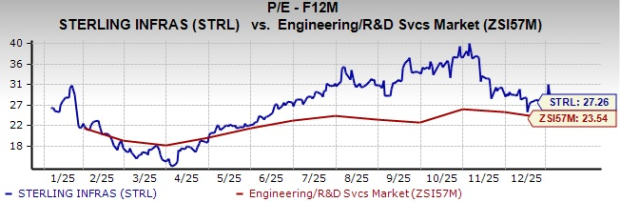

Sterling Infrastructure, Inc. STRL is currently trading at a forward 12-month Price/Earnings ratio (P/E F12M) of 27.26, a roughly 15.8% premium to the Zacks Engineering - R and D Services industry average of 23.54. The valuation also stands above the broader Construction sector multiple of 19.61X and the Zacks S&P 500 composite level of 23.11X.

The U.S. infrastructure construction environment remains supported by steady public and private investment across transportation, utilities, energy infrastructure and mission-critical development. Recent interest-rate cuts by the Federal Reserve have eased financial conditions for large projects, supporting funding visibility and capital deployment. However, inflation remains above target and labor market conditions have been volatile, creating some uncertainty around the pace and timing of infrastructure spending heading into 2026.

This Texas-based infrastructure services provider is seeing continued strength across its core operations as large-scale project activity remains elevated. Demand tied to mission-critical site development is supporting growth in E-Infrastructure, led by data center and industrial work.

Sterling stock also appears overvalued, especially when compared with other peer companies like AECOM ACM, Fluor Corporation FLR and KBR, Inc. KBR. ACM, FLR and KBR have a forward P/E of 17.17, 19.82 and 10.35, respectively.

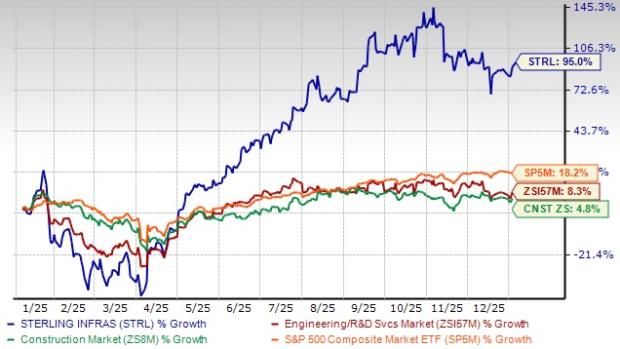

Shares of Sterling have surged 95% in the past year, outperforming the industry’s 8.3% growth. Over the same period, the broader Construction sector advanced 4.8%, while the S&P 500 rose 18.2%. The stock has also outperformed AECOM, Flour and KBR, which have declined 7.6%, 11.7% and 25%, respectively, in the past year.

Let’s examine whether the current valuation remains justified, balancing execution strength with broader uncertainty.

Sterling’s E-Infrastructure business continues to perform strongly, supported by rising demand for large and complex projects. The company’s focus on mission-critical work, including data centers, e-commerce distribution and manufacturing facilities, strengthens its position in higher-growth markets. Disciplined execution and solid project management remain key contributors to performance in this segment.

Recent operating trends highlight data centers as the primary growth driver, with revenues from this market rising more than 125% year over year in the third quarter of 2025. Looking ahead, Sterling expects data-center momentum to carry into 2026, supported by a solid pipeline of new projects and healthy customer demand.

Sterling’s signed backlog, along with unsigned awards and future phase opportunities, continues to support multi-year visibility through 2026. The company highlights a deep pool of work across E-Infrastructure, data centers, manufacturing and e-commerce, reflecting strong customer relationships and ongoing capital commitments.

Sterling’s backlog reached $2.6 billion in the third quarter, reflecting a 64% year-over-year increase. When negotiated awards and future phases tied to ongoing megaprojects are included, total potential work exceeds $4 billion, with E-Infrastructure accounting for the majority of this pipeline.

STRL is positioning itself for the next wave of infrastructure investment by expanding into new geographic markets. While Texas remains a key focus, where site-development work has begun, the company targets regions expected to see increased mission-critical activity over the next two to three years. Early market entry is viewed as important for securing long-term opportunities.

Customer pull into new locations is being driven by hyperscalers, semiconductor manufacturers and e-commerce operators planning multi-year capital deployments. The company expects geographic expansion to remain an important source of contract awards through 2026 and beyond.

STRL continues to benefit from rising demand across mission-critical markets beyond data centers, particularly in e-commerce and manufacturing. The company reported more than 150% growth in e-commerce-related backlog as customers expand fulfillment networks to support EV fleets and automation, increasing project complexity.

Manufacturing activity remains steady, with several semiconductor and industrial megaprojects moving through permitting and pre-construction phases. Looking into 2026 and 2027, STRL expects e-commerce and manufacturing to remain meaningful contributors to its mission-critical portfolio, supporting longer project durations and margin stability.

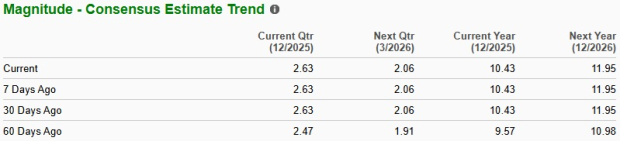

Despite its high valuation, Sterling’s upward revisions in earnings per share (EPS) estimates highlight analysts’ confidence in the stock. STRL’s earnings estimates for 2026 have trended upward in the past 60 days to $11.95 from $10.98 per share. This indicates expected earnings growth of 14.6% year over year on projected revenue growth of 19.1%.

Sterling benefits from solid execution across mission-critical markets, expanding exposure to data centers, e-commerce and manufacturing, and improving visibility through a growing backlog and pipeline. Geographic expansion and the integration of CEC further strengthen the long-term growth profile as Sterling moves toward 2026.

However, near-term challenges such as softness in the Building Solutions segment and macro uncertainties could weigh on performance. Elevated valuation levels relative to peers and the broader industry may also limit upside potential in the short term.

Given the current setup, this Zacks Rank #3 (Hold) company is likely to maintain stable performance in the near term. Existing investors can continue to hold STRL, while new investors may wait for a more attractive entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 min | |

| 23 min | |

| 2 hours | |

| 2 hours | |

| 9 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite