|

|

|

|

|||||

|

|

CeriBell Inc. CBLL recently announced that the FDA has granted Breakthrough Device Designation for its Large Vessel Occlusion (LVO) stroke detection and monitoring solution designed for use in hospital settings. The designation highlights the potential of Ceribell’s point-of-care electroencephalography (EEG) technology, combined with an AI-based algorithm, to enable earlier and more accurate identification of severe strokes.

The breakthrough status builds on Ceribell’s recent regulatory momentum, following multiple FDA clearances for expanded neurological monitoring applications. By extending its EEG platform beyond seizure and delirium detection into stroke care, the company is positioning its system as a broader brain-monitoring solution aimed at improving outcomes in time-sensitive, high-risk clinical scenarios.

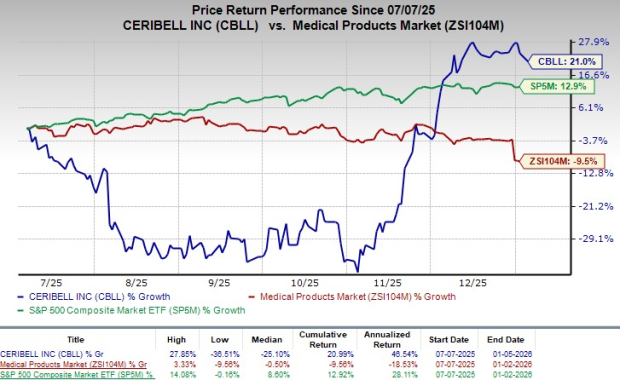

Following the announcement, shares of the company have risen 1.4% in yesterday’s after-market session. In the last six-month period, CBLL’s shares have gained 21% against the industry’s 9.5% decline. The S&P 500 increased 12.9% in the same time frame.

The FDA Breakthrough Device Designation strengthens CBLL’s long-term growth outlook by accelerating the regulatory pathway for its LVO stroke detection solution while increasing visibility and credibility with hospitals, clinicians, and strategic partners.

The designation is likely to enable faster FDA interactions, prioritized review and earlier commercialization, helping Ceribell expand its addressable market beyond seizures and delirium into high-acuity stroke care. Over time, this positions the company to deepen adoption of its EEG platform as a standard point-of-care tool, drive incremental revenue from new indications using existing hardware, and build a defensible leadership position in AI-enabled brain monitoring.

Meanwhile, CBLL currently has a market capitalization of $790.1 million.

The Breakthrough Device Designation covers Ceribell’s first-in-class solution that applies an AI-based algorithm to EEG signals to support the detection and monitoring of LVO stroke in hospitalized patients. The technology leverages Ceribell’s existing point-of-care EEG hardware, allowing the company to expand into a new, high-impact indication without requiring new capital-intensive equipment. Validation of the solution is supported by prospective, multi-center studies that combine EEG data with clinical assessments, reinforcing the robustness of the underlying approach.

LVO strokes represent one of the most severe forms of ischemic stroke, accounting for a disproportionate share of post-stroke disability and mortality. Each year, nearly 800,000 strokes occur in the United States, with LVO strokes contributing to the majority of long-term dependence and deaths despite being a subset of total cases. Importantly, up to 17% of all strokes occur in hospitalized patients, where detection and treatment are often significantly delayed compared to community-onset strokes, leading to worse outcomes and higher mortality rates.

Ceribell’s solution is designed specifically to address these in-hospital delays, where patients may be intubated, sedated, post-surgical, or otherwise difficult to assess using traditional neurological exams. Continuous EEG monitoring with automated alerts has the potential to flag neurological changes earlier, enabling faster escalation of care and access to time-sensitive interventions. Management emphasized that the designation aligns with the company’s broader vision of establishing EEG as a routine vital sign, supporting earlier diagnosis and better outcomes across multiple neurological conditions.

Per a report by MarketsandMarkets, the global stroke diagnostic and therapeutic market size is estimated at $42.07 billion in 2025 and is anticipated to reach around $89.8 billion by 2035, expanding at a CAGR of 7.88% from 2026 to 2035.

The rising prevalence of ischemic stroke among the geriatric population has boosted growth of the stroke diagnostic and therapeutic market.

In December 2025, CBLL announced that the FDA had given 510(k) clearance for its latest delirium monitoring solution, making it the one and only FDA-cleared solution for continuous tracking of delirium. This milestone confirms the Ceribell System as an AI-driven brain-monitoring platform, extending its clinical efficacy by giving doctors useful information to detect risk for both seizures and delirium in more critically ill patients.

CBLL carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks from the broader medical space are Intuitive Surgical ISRG, Medpace Holdings MEDP and Boston Scientific BSX.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, posted a third-quarter 2025 adjusted earnings per share (EPS) of $2.40, beating the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 14.28%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion topped the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 19 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite