|

|

|

|

|||||

|

|

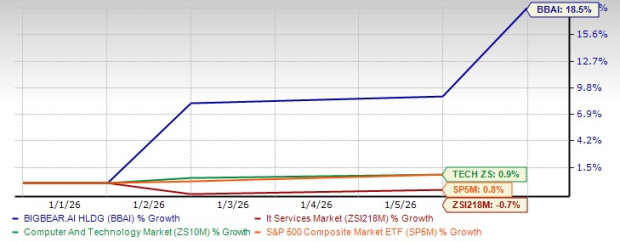

BigBear.ai Holdings, Inc. BBAI has entered 2026 with strong market momentum. The stock is up 18.5% year to date, clearly outperforming the Zacks Computers - IT Services industry, broader Zacks Computer and Technology sector and the S&P 500. Investor enthusiasm has pushed BigBear.ai to a forward 12-month price-to-sales multiple of about 16.2X, well above its three-year median and close to the upper end of its historical valuation range. The key question for investors is whether this premium reflects durable fundamentals or whether expectations are running ahead of execution.

BigBear.ai’s current valuation looks stretched when viewed purely through a historical lens. The stock’s three-year median P/S ratio sits near 2.3X, and even its industry peers trade at a slightly lower multiple. However, this comparison does not fully capture how materially the company has repositioned itself over the past year. The market is no longer valuing BigBear.ai as a project-driven government contractor alone, but increasingly as a platform-centric defense AI company with recurring software revenue potential and global reach.

That shift accelerated in the second half of 2025 with the announced acquisition of Ask Sage (now completed), a secure, model-agnostic generative AI platform already deployed across thousands of government teams. Management highlighted that Ask Sage is operating at scale in highly regulated environments and is expected to generate roughly $25 million in annual recurring revenue, growing sharply year over year. This type of recurring, platform-based revenue is precisely what investors tend to reward with higher valuation multiples.

Despite near-term revenue volatility, BigBear.ai’s operational foundation strengthened meaningfully in 2025. Third-quarter revenue declined year over year due to lower volumes on certain Army programs, but backlog remained solid at $376 million, providing multi-year visibility across defense, intelligence and homeland security customers. Management reiterated full-year revenue guidance in the $125–$140 million range, underscoring confidence in pipeline conversion as delayed programs restart.

Notably, the company exited the quarter with record cash and investments of more than $450 million, giving it unusual balance-sheet flexibility for a company of its size. That liquidity has allowed BigBear.ai to pursue both organic growth and targeted acquisitions without near-term funding pressure.

One of the most significant developments supporting the stock’s rerating is BigBear.ai’s aggressive debt reduction plan announced in early January 2026. The company expects to eliminate roughly $125 million of convertible debt through a combination of voluntary conversions and redemptions, reducing total note-related obligations to about $17 million. Management emphasized that this process should be completed with minimal cash outlay, preserving liquidity while materially simplifying the capital structure.

While the associated share issuance increases dilution, the trade-off is lower leverage, reduced interest expense and fewer valuation overhangs tied to complex derivative liabilities. For growth-focused investors, a cleaner balance sheet strengthens the case for assigning a higher multiple to future revenues.

BigBear.ai is also expanding beyond its traditional U.S.-centric footprint. The opening of a Middle East office in Abu Dhabi marks the company’s first permanent presence in the region and aligns it with governments actively investing in AI-driven security, travel and trade infrastructure. Partnerships announced in the UAE and management’s emphasis on international deployments suggest that BigBear.ai’s addressable market is widening at a time when global defense and border security spending is accelerating.

This international push complements recent strategic partnerships, including the collaboration with C Speed to integrate BigBear.ai’s AI orchestration platform with advanced radar systems for border security and counter-UAS applications. These partnerships reinforce the company’s positioning at the intersection of AI software, sensors and mission-critical decision support.

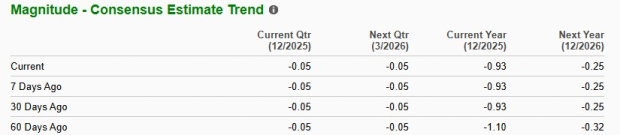

From an earnings perspective, BigBear.ai remains in investment mode, but trends are moving in the right direction. Over the past 60 days, analysts have narrowed their estimate for the company’s 2026 loss per share from 32 cents to 25 cents, reflecting confidence in revenue growth and operating leverage. The Zacks Consensus Estimate implies revenue growth of just more than 30% in 2026, a meaningful acceleration from 2025 levels.

The stock is also showing technical strength, trading well above its 50-day and 200-day moving averages, which typically signals sustained investor confidence rather than short-term speculation.

Despite these positives, the valuation premium is not without risk. BigBear.ai remains exposed to the inherent unpredictability of government spending cycles, including delays tied to appropriations and procurement processes. Revenue concentration among a limited number of large customers can also lead to quarter-to-quarter volatility, as seen in 2025.

Integration risk around Ask Sage is another factor investors must monitor. While the platform is already operational and accredited, successfully scaling cross-selling, maintaining growth rates and translating ARR into expanding margins will be critical to justifying the current multiple. Additionally, ongoing dilution from share issuance could cap upside if revenue growth does not materialize as expected.

BigBear.ai is carving out a focused role in defense AI by emphasizing mission-grade, secure and deployable systems rather than broad enterprise platforms. BigBear.ai’s acquisition of Ask Sage strengthens its positioning in classified and regulated environments, where speed, accreditation and operator trust matter most.

In contrast, Palantir Technologies PLTR dominates large-scale defense and intelligence platforms, with Palantir repeatedly expanding across U.S. government programs and embedding AI deeply into operational workflows. Palantir’s scale and production reach keep the company ahead in platform breadth.

Another notable competitor is C3.ai AI. The company is pushing standardized, commercial off-the-shelf AI across federal agencies, with C3.ai highlighting agentic AI and partner-led deployments. Still, C3.ai remains more horizontal than mission-specific.

Meanwhile, Leidos LDOS integrates AI into large defense programs, but Leidos primarily embeds AI within services rather than leading with standalone platforms. Leidos embeds AI into large, long-duration defense programs spanning cybersecurity, autonomous systems, space and digital modernization, leveraging its deep contracting relationships and scale. Unlike BigBear.ai, Leidos typically delivers AI as part of broader services-led solutions, which can limit product-level differentiation but enhance durability and funding stability. This makes Leidos a powerful incumbent enabler of defense AI adoption, even as smaller, software-centric players push faster innovation cycles.

At roughly 16X forward 12-month sales, BigBear.ai is no longer priced as a turnaround or optionality-driven defense contractor. The market is clearly pricing in the successful execution of its platform strategy, sustained growth in secure generative AI adoption and continued balance-sheet discipline. If management delivers on these fronts, the premium looks defensible. If execution falters, the multiple leaves little room for error.

For now, improving estimate trends, strong liquidity, global expansion and a cleaner balance sheet support a constructive view. With the stock carrying a Zacks Rank #2 (Buy), BigBear.ai appears positioned for continued outperformance, though investors should expect volatility as the company works to fully earn its elevated valuation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite