|

|

|

|

|||||

|

|

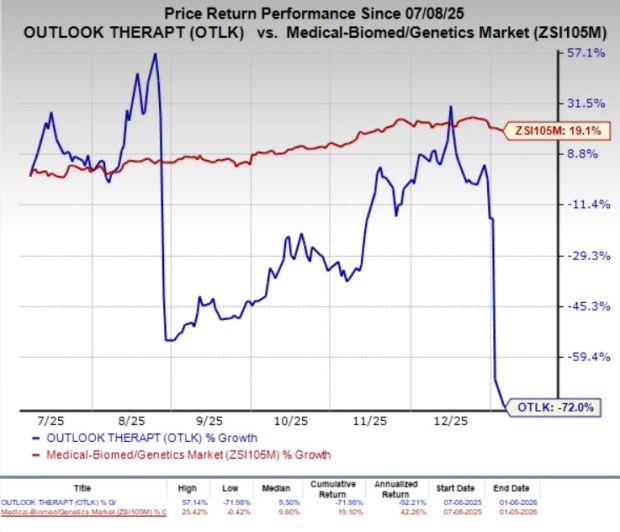

Shares of Outlook Therapeutics OTLK have tumbled 66.5% in a week. The massive crash was observed after the FDA issued a third complete response letter (CRL) in late December, rejecting OTLK’s biologics license application (BLA) resubmission for ONS-5010 in wet age-related macular degeneration (wet AMD). ONS-5010 is an ophthalmic formulation of bevacizumab, which is being developed to treat wet AMD and other retinal diseases in the United States.

Outlook Therapeutics first received a CRL from the FDA in 2023 for the ONS-5010 BLA, which was based on a phase III NORSE TWO study evaluating the safety and efficiency of ONS-5010 compared with Lucentis (ranibizumab) for treating wet AMD. The FDA had stated concerns related to chemistry, manufacturing, and controls, as well as open observations of the manufacturing process, which were made during pre-approval inspections and later successfully remediated by the company. Additionally, the regulatory body had cited that there was “a lack of substantial evidence” and asked for a second adequate and well-controlled study to be conducted, the NORSE EIGHT study.

Subsequently, the regulatory agency again issued a CRL for the ONS-5010 BLA resubmission in August 2025, citing a single deficiency — insufficient evidence of efficacy — highlighting that ONS-5010 failed to meet the primary efficacy endpoint in the confirmatory NORSE EIGHT study, and recommending additional confirmatory data to support approval.

In the latest CRL issue, the FDA stated that the additional mechanistic and natural history data included in the November 2025 BLA resubmission did not alter its prior assessment. While the agency acknowledged that the NORSE TWO study demonstrated efficacy, it again requested confirmatory evidence to support approval. Notably, the FDA did not specify what form of confirmatory data would be acceptable.

In the past six months, shares of Outlook Therapeutics have plummeted 72% against the industry’s 19.1% growth.

Following the third regulatory setback, Outlook Therapeutics is currently exploring all available pathways for potential approval of ONS-5010 for wet AMD in the United States.

OTLK also reaffirmed its commitment to offering patients an alternative to compounded Avastin. Alongside U.S. regulatory discussions, the company also intends to advance its efforts to secure approvals and expand into additional European markets.

ONS-5010 received regulatory approval in the EU and the United Kingdom in 2024 for the use of ONS-5010 to treat wet AMD. The drug is marketed under the brand name Lytenava (bevacizumab gamma).

Outlook Therapeutics launched Lytenava in the United Kingdom and Germany in June 2025. Lytenava is the first and only authorized ophthalmic formulation of bevacizumab for use in treating wet AMD in adults in the EU and the United Kingdom. OTLK is confident that ONS-5010/Lytenava is a critical therapy for wet AMD, offering a regulated alternative to off-label repackaged Avastin (bevacizumab), which is not approved for ophthalmic use.

Beyond its plans to expand its commercial footprint in select EU markets, Outlook Therapeutics is actively evaluating strategic collaborations with potential commercial and distribution partners across additional EU countries and in markets outside the EU.

Per OTLK, AMD is a leading cause of vision loss in people aged 50 years and older. Wet AMD, the advanced form of the disease, is characterized by abnormal blood vessel growth beneath the retina, leading to fluid leakage, macular damage, and progressive vision loss. Elevated levels of VEGF play a central role in this process, making anti-VEGF injections the established standard of care for wet AMD and other retinal diseases, including diabetic macular edema and retinal vein occlusion.

Outlook Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Amicus Therapeutics FOLD, CorMedix CRMD, and Indivior INDV, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, estimates for Amicus Therapeutics’ 2026 EPS have decreased from 67 cents to 65 cents. Shares of FOLD have surged 129.6% over the past six months.

Amicus Therapeutics’ earnings beat estimates in one of the trailing four quarters, missing the mark on the other three occasions, delivering an average negative surprise of 20.21%.

Over the past 60 days, 2026 EPS estimates for CorMedix have risen from $2.49 to $2.88. Shares of CRMD have lost 0.2% over the past six months.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 27.04%.

Over the past 60 days, estimates for Indivior’s earnings per share for 2026 have risen to $2.85 from $2.60. Indivior stock has rallied 138.6% over the past six months.

Indivior’s earnings beat estimates in three of the trailing four quarters and were in line in the remaining quarter, with the average surprise being 68%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite