|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

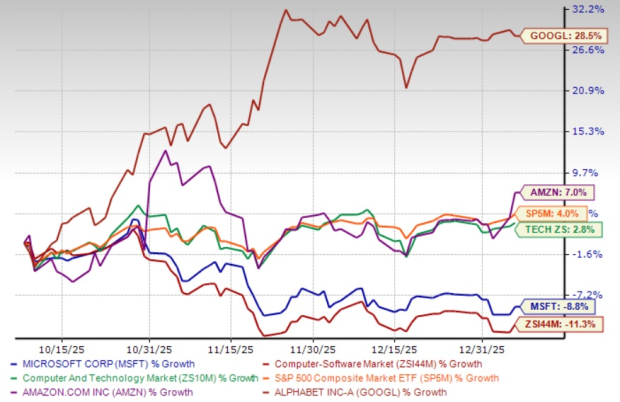

Microsoft MSFT shares have lost approximately 9% over the past three months, underperforming the broader Zacks Computer and Technology sector. Yet this pullback in one of technology's most formidable companies presents a compelling entry point for long-term investors. Despite near-term headwinds from elevated capital expenditure concerns and AI monetization questions, Microsoft's structural advantages in cloud computing, artificial intelligence, and enterprise software position the stock for meaningful upside in 2026.

The decline began immediately after Microsoft reported stellar first-quarter fiscal 2026 results on Oct. 29, 2025. Revenues reached $77.7 billion, up 18% year over year, while operating income surged 24% to $38 billion. Azure cloud services grew an impressive 40% in constant currency, outpacing expectations. However, investors focused on the company's record $34.9 billion quarterly capital expenditure — a 74% year-over-year increase — raising concerns about the gap between AI spending today and monetization tomorrow. The stock shed nearly 3% the following day and has drifted lower since, weighed down by broader market rotation away from mega-cap technology.

The first reason Microsoft remains a buy is Azure's market share momentum. While Amazon’s AMZN Amazon Web Services (“AWS”) maintains overall cloud leadership at roughly 30%, Azure is growing at twice AWS' rate. Microsoft's 40% Azure growth in the first quarter significantly outpaced AWS' approximate 20% expansion, narrowing the competitive gap. Management guided for 37% constant currency growth in the second quarter, acknowledging that demand significantly exceeds available capacity — a constraint expected to persist through June 2026.

This capacity limitation, counterintuitively, signals robust demand rather than weakness. Microsoft's Intelligent Cloud segment generated $30.9 billion in quarterly revenues, up 28%, with commercial remaining performance obligations reaching $392 billion — a 51% year-over-year increase reflecting contracted future revenues. The company's multi-model approach through Azure AI Foundry, offering not just OpenAI but also Anthropic's Claude and other models, positions it to capture AI workloads regardless of which foundation model ultimately dominates.

Microsoft's second compelling investment case centers on its expanding Copilot ecosystem, which has reached 150 million monthly active users across Microsoft 365 Copilot, GitHub Copilot, and Security Copilot. This represents 50% sequential growth, demonstrating accelerating enterprise adoption.

Recent announcements reinforce this momentum. In December 2025, Microsoft launched Microsoft 365 Copilot Business at $21 per user monthly, targeting the underserved small and medium business segment with fewer than 300 employees. More than 90% of Fortune 500 companies now use Microsoft 365 Copilot, with major deployments, including PwC's 200,000-plus seats and Lloyds Banking Group's 30,000 licenses — the latter reporting 46 minutes saved per employee daily.

The January 2026 acquisition of Osmos, an agentic AI data engineering platform, signals Microsoft's push toward autonomous AI agents that transform raw enterprise data into analytics-ready assets. Combined with the December launch of the comprehensive Microsoft Defender Experts Suite, integrating managed extended detection and response, Microsoft is monetizing AI across security, productivity, and developer tools simultaneously.

The third reason favoring Microsoft shares is the company's exceptional financial position, enabling continued aggressive investment without compromising shareholder returns. Microsoft generated $45.1 billion in operating cash flow during the first quarter, up 32%, while returning $10.7 billion through dividends and repurchases.

With $102 billion in cash and operating margins approaching 50%, Microsoft can fund its ambitious $80 billion AI infrastructure buildout while maintaining its 19-year dividend growth streak. The company's December 2025 announcement of a $17.5 billion investment in India — its largest in Asia — and plans to increase AI capacity by 80% in fiscal 2026 demonstrate management's conviction in the AI opportunity.

The Zacks Consensus Estimate for MSFT’s fiscal 2026 earnings is projected at $15.61 per share, up 0.6% over the past 30 days. The estimate indicates 14.44% year-over-year growth.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Microsoft currently trades at a forward price-to-sales ratio of 10.17 times, representing a significant premium to the Zacks Computer-Software industry average of 9.11 times, which is justified. The premium reflects Microsoft's superior positioning against major cloud rivals.

Amazon Web Services leads in market share but faces margin pressure as enterprises increasingly favor Azure's seamless integration with existing Microsoft infrastructure. Alphabet GOOGL-owned Google Cloud continues growing rapidly, yet remains third in market position behind both Amazon and Microsoft. Oracle ORCL has carved out database and enterprise application niches but lacks the comprehensive cloud platform breadth of Amazon, Google, and Microsoft. Azure's 40% growth rate substantially exceeds Amazon's AWS expansion, while Microsoft's AI Copilot ecosystem creates differentiation versus Google's Workspace and Oracle's enterprise solutions. The valuation premium acknowledges Microsoft's entrenched enterprise relationships, multi-cloud AI strategy, and sustained momentum capturing workloads from Google, Oracle, and Amazon competitors.

Microsoft's second-quarter fiscal 2026 guidance for $79.5 to $80.6 billion in revenues suggests continued double-digit growth, positioning the company for earnings growth acceleration. The 9% pullback creates an opportunity to acquire shares in a company with expanding margins, accelerating AI adoption, and a cloud business growing at twice its primary competitor's rate. For investors with a 12-to-24-month horizon, Microsoft's combination of defensive characteristics and offensive growth potential makes the current price an attractive entry point into one of technology's highest-quality franchises. Microsoft currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 19 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite