|

|

|

|

|||||

|

|

MercadoLibre MELI presents a concerning investment picture that should give potential investors serious pause. While the Latin American e-commerce giant reported revenue growth of 39.5% year over year to $7.41 billion in the last quarter, a deeper dive into the company's financial health reveals troubling trends that suggest investors would be wise to steer clear of this stock in 2026.

The Zacks Consensus Estimate for 2026 earnings indicates a downward revision of 1.54% over the past 30 days to $59.59 per share. The market appears to be pessimistic about MELI's growth trajectory.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

MELI's extensive exposure across Latin America presents significant macroeconomic headwinds that threaten future profitability. Argentina's inflation rate surged to 31.40% in November 2025, maintaining persistent price instability that creates chronic currency volatility and undermines consumer purchasing power. The peso's structural weakness means robust local currency revenue growth translates to disappointing dollar-denominated results, creating earnings quality concerns. In Mexico, the IMF revised GDP growth projections downward to 1.5% for 2026, signaling economic deceleration expected to pressure e-commerce transaction volumes and fintech adoption rates precisely when the company needs sustained momentum to justify aggressive expansion investments.

Regional instability undermines MELI's capital-intensive strategies. Brazil maintains elevated interest rates to combat persistent inflation, substantially increasing funding costs for the company's $11.02 billion credit portfolio and compressing net interest margins. Higher borrowing costs simultaneously reduce consumer disposable income, creating a dual headwind where credit becomes more expensive to originate and riskier to hold. This Latin American concentration represents a structural vulnerability that competitors like Nu Holdings NU, Sea Limited SE and Amazon AMZN have mitigated through geographic diversification, leaving MELI disproportionately exposed to synchronized economic deterioration across key markets.

MELI's aggressive push into fintech services presents a troubling disconnect between top-line growth and underlying profitability. The Zacks Consensus Estimate for 2025 Total Payment Volume is pegged at $275.8 billion, indicating 40.24% year-over-year growth, while the consensus mark for fintech revenues is pegged at $12.45 billion, up 44.45% annually. However, these compelling top-line figures mask an uncomfortable reality, as MELI prioritizes scale over returns in an increasingly competitive and commoditized payments environment. The strategy reflects growth-led capital deployment rather than disciplined value creation, with expanding fintech operations absorbing capital while delivering progressively weaker incremental profitability.

The pressure is most evident in MELI’s credit expansion. Net Interest Margin After Losses compressed 320 basis points to 21% in the third quarter of 2025, highlighting the structural difficulty of scaling consumer lending across volatile emerging markets. While older Brazilian credit card cohorts have approached profitability after two years, aggressive issuance in Mexico and the recent rollout in Argentina ensure that loss-making early-stage cohorts dominate the portfolio mix. This dynamic continuously dilutes overall economics. Despite rising volumes, income from operations margin fell to 9.8%, while net income margin declined to 5.7%, indicating that fintech growth is increasingly weighing on MELI’s consolidated profitability rather than enhancing it.

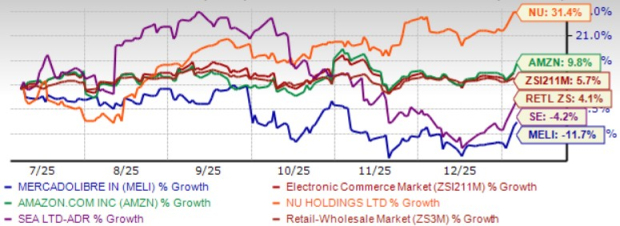

MELI shares have declined 11.7% in the past six months, underperforming the Zacks Internet-Commerce industry and the Zacks Retail-Wholesale sector's increase of 5.7% and 4.1%, respectively. This underperformance becomes more troubling when compared to peers. Nu Holdings surged 31.4%, while Amazon jumped 9.8%. Even Sea Limited, which declined 4.2%, outperformed MELI by over 750 basis points. The performance gap between MELI and Sea Limited exposes critical execution weaknesses. Despite posting revenue expansion, the stock's persistent decline reveals that aggressive top-line expansion is failing to create shareholder value, indicating that margin compression is destroying long-term enterprise value.

MELI trades at a price-to-earnings ratio of 36.35X, standing at a notable premium to the industry average of 24.26X and the broader sector average of 24.66X. Such valuation levels appear difficult to defend given persistent margin compression and deteriorating profitability metrics. Unlike Nu Holdings, which is scaling profitably across fintech operations, or Amazon, which has already achieved operating leverage in its e-commerce model, MELI's profitability trajectory remains uneven and unpredictable. Premium valuations require a clear pathway to margin expansion and sustainable profitability. MELI currently offers neither, with margins contracting across both commerce and fintech segments. Without demonstrable progress toward profitability improvement, the current valuation multiple offers minimal margin of safety for prospective investors.

MercadoLibre faces a confluence of challenges that make it an unattractive investment proposition in the current environment. Regional economic instability across Latin America creates persistent macroeconomic headwinds, while aggressive fintech expansion continues to erode profitability despite impressive top-line growth. The stock's significant underperformance relative to peers, combined with a premium valuation, leaves little room for error. With earnings estimates trending lower and no clear margin recovery in sight, MELI's Zacks Rank #4 (Sell) reflects the growing downside risk. Investors would be prudent to stay away from the stock for now until meaningful operating leverage and valuation support reappear.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 59 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite