|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, has been gaining from its continued product development. The optimism, led by strong third-quarter results, is expected to contribute further. However, concerns about long purchasing cycles persist.

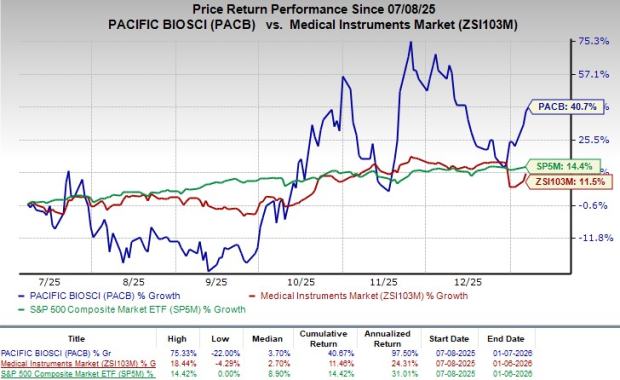

In the last six-month period, this Zacks Rank #2 (Buy) company’s shares have gained 40.7% compared with the 11.5% growth of the industry. The S&P 500 Composite has improved 14.4% in the said time frame.

The renowned global provider of sequencing systems has a market capitalization of $597.8 million. The company projects 69.8% growth for 2026 and expects to maintain its strong performance going forward. PacBio’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and met once, delivering an average surprise of 18.5%.

Sequencing Technologies Strengthen Market Leadership:PacBio differentiates itself in the genomics industry through its proprietary HiFi long-read sequencing, based on Single-Molecule Real-Time (SMRT) technology. This technology enables the high-accuracy, real-time detection of complex genomic structures, such as structural variations, haplotypes, and epigenetic modifications.

The global SMRT market, valued at $2.74 billion in 2023, is projected to reach $4.14 billion by 2031, registering a CAGR of 5.3%. Additionally, PacBio has expanded its offerings by integrating Sequencing by Binding chemistry with the launch of its Onso system in 2022, a short-read platform delivering ≥90% of bases at Q40+ accuracy, 15 times more precise than traditional sequencing methods. By providing both long-read and short-read technologies, PacBio uniquely serves diverse research and clinical applications while driving down costs and enhancing variant detection.

Robust Product Portfolio Driving Growth: PacBio’s third-quarter 2025 results highlight the growing breadth and effectiveness of its product portfolio, led by the Revio and Vega platforms. During the third quarter, the company shipped 13 Revio systems and 32 Vega systems, bringing cumulative shipments to 310 Revio and 105 Vega instruments.

Notably, approximately 75% of Revio placements and about 60% of Vega placements went to new-to-PacBio customers, underscoring the portfolio’s ability to expand the company’s installed base rather than merely upgrade existing users. While Revio’s average selling prices were temporarily lower due to strategic placements at key institutions, management emphasized that these accounts are expected to drive higher utilization and above-average consumable pull-through over time, reinforcing Revio’s role as the flagship growth engine.

Decent Q3 Results: Pacific Biosciences delivered a mixed third-quarter 2025, beating earnings expectations but missing on revenues, while showing encouraging operational progress through strong growth in Service, Consumables, and other revenues, expanded adjusted gross margins, and a reduced operating loss.

Strategically, the company strengthened its technology moat with the launch of SPRQ-Nx sequencing chemistry, which materially lowers long-read sequencing costs by enabling sub-$300 HiFi whole-genome sequencing at scale and up to 40% cost savings via multi-use SMRT Cells.

PacBio also broadened its clinical research footprint with the PureTarget portfolio, offering targeted HiFi assays for hard-to-sequence genes and supporting throughput of approximately 100,000 samples per Revio annually, reinforcing Revio’s positioning in high-volume clinical workflows.

Longer Purchasing Cycles: PacBio is facing longer sales cycles for its high-cost Revio sequencing system as customers navigate funding uncertainties and tighter capital budgets. The company has reported that academic and government-backed institutions, particularly in the United States, are delaying purchasing decisions due to National Institutes of Health budget freezes and funding constraints.

Additionally, macroeconomic pressures in the Asia-Pacific region are contributing to slower procurement timelines, further impacting instrument sales. These delays in customer decision-making could limit near-term revenue growth and create quarterly revenue volatility.

PacBio has been witnessing a stable estimate revision trend for 2025. Over the past 30 days, the Zacks Consensus Estimate for its adjusted loss per share has remained stable at $1.89.

The Zacks Consensus Estimate for 2025 revenues is pegged at $156.2 million, indicating a 1.4% increase from the year-ago reported numbers.

Some other top-ranked stocks from the broader medical space are Intuitive Surgical ISRG, Medpace Holdings MEDP and Boston Scientific BSX.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, posted a third-quarter 2025 adjusted earnings per share (EPS) of $2.40, beating the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Medpace, currently carrying a Zacks Rank #2, reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 14.28%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion topped the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite