|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Oracle ORCL has embarked on an aggressive infrastructure expansion strategy that positions the enterprise software giant at the center of the artificial intelligence revolution, yet this bet comes with substantial capital commitments that have left investors questioning the timing of their investment decisions. The company's second-quarter fiscal 2026 results revealed both the promise and the pressure of this high-stakes gamble.

The company reported fiscal second-quarter revenues of $16.1 billion, representing 14% growth year over year, with cloud infrastructure revenues climbing 68% to reach $4.1 billion. The standout metric came from the remaining performance obligations, which surged to $523 billion, adding $68 billion in new commitments during the quarter from major customers, including Meta and NVIDIA. This backlog demonstrates robust enterprise demand for Oracle's cloud infrastructure capabilities, particularly for AI training and inference workloads.

However, these impressive bookings necessitate substantial upfront investment. Management raised fiscal 2026 capital expenditure guidance to approximately $50 billion, a $15-billion increase from prior expectations and more than double the $21.2 billion spent in fiscal 2025. The company expects to generate $4 billion in additional revenues for fiscal 2027 as this backlog converts, but the near-term cash flow implications remain significant. Free cash flow turned negative $10 billion in the fiscal second quarter, reflecting the accelerated buildout of data center capacity.

Oracle has made several important announcements in recent weeks that underscore its commitment to becoming the infrastructure backbone for next-generation AI applications. In December 2025, the company announced Oracle AI Database 26ai would become available for on-premises Linux x86-64 platforms in January 2026. This release extends the AI-native database capabilities beyond cloud-managed services to customers operating on mixed hardware environments, broadening the addressable market for Oracle's database innovations.

The company also revealed a partnership with the U.S. Department of Energy on Dec. 18, 2025, focused on advancing AI and advanced computing initiatives, including the Genesis Mission. This collaboration aims to integrate supercomputers, experimental facilities, AI systems, and datasets to accelerate scientific discovery and maintain American leadership in high-performance computing.

At the AWS re:Invent conference in December 2025, Oracle announced native integration with AWS Key Management Service for Transparent Data Encryption key management with Exadata Database Service. This enhancement strengthens the security posture of Oracle Database services running within AWS infrastructure, addressing a critical requirement for enterprise customers navigating multicloud strategies.

Oracle's strategy of embedding its infrastructure across multiple cloud providers appears to be gaining momentum. The company operates 147 live customer-facing regions with 64 additional regions planned, and is building 72 multicloud datacenters within Amazon AMZN, Alphabet GOOGL-owned Google and Microsoft MSFT cloud environments. Management highlighted that the multicloud database business grew 817% in the fiscal second quarter, representing the fastest-growing segment of Oracle's portfolio.

The company delivered nearly 400 megawatts of data center capacity during the quarter and increased GPU capacity by 50% compared to the previous quarter. The SuperCluster deployment in Abilene, TX, remains on track with more than 96,000 NVIDIA Grace Blackwell GB200 chips scheduled for installation, positioning Oracle to serve the most demanding AI training workloads.

For the fiscal third quarter, Oracle projects total revenue growth of 19% to 21% in U.S. dollars and non-GAAP earnings per share between $1.70 and $1.74. The company maintained its full-year fiscal 2026 revenue expectation of 67 billion dollars, though the expanded capital expenditure program signals management's confidence in converting the substantial backlog into realized revenues over the coming quarters.

Management emphasized commitment to maintaining an investment-grade debt rating and highlighted alternative financing options, including customer-provided chips and supplier chip leasing arrangements that could reduce borrowing requirements. These strategies aim to synchronize capital outflows with revenue generation, though execution risk remains given the scale of the infrastructure buildout.

The Zacks Consensus Estimate for ORCL's fiscal 2026 earnings is pegged at $7.38 per share, marking an upward revision of 8.4% over the past 30 days. The earnings figure suggests 22.39% growth over the figure reported in fiscal 2025.

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

From a valuation perspective, Oracle trades at a trailing 12-month Price-to-earnings ratio of 33.95 times, representing a premium to the industry average of 33.5 times, and carries a Value Score of D, indicating relatively expensive valuation metrics.

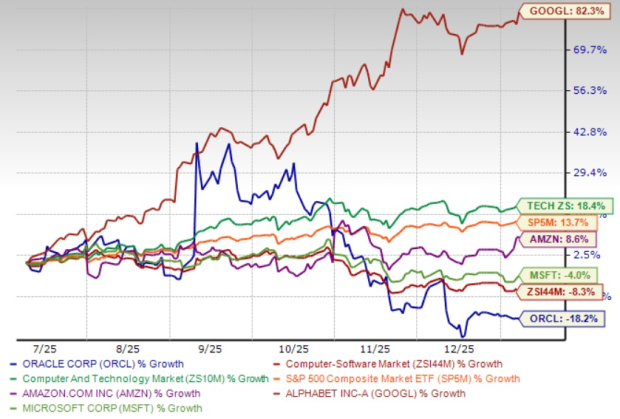

Oracle shares have lost 18.2% over the past six months, underperforming the broader Computer and Technology sector's 18.4% appreciation, the Computer-Software industry's 8.3% decline and its peers.

The competitive environment remains intense as Oracle competes directly against cloud infrastructure leaders. Microsoft continues expanding Azure's AI capabilities and maintains enterprise relationships through its Office and Windows franchises. Google pursues aggressive pricing strategies in Google Cloud Platform while leveraging proprietary AI models. Amazon Web Services maintains market leadership through its extensive service portfolio and global infrastructure footprint. While Microsoft emphasizes integrated software ecosystems, Google focuses on machine learning innovation, and Amazon prioritizes breadth of services, Oracle differentiates through database expertise and multicloud deployment flexibility.

Investors face a complex decision as Oracle navigates this transition period. The company possesses genuine competitive advantages in database technology and has secured meaningful commitments from marquee customers, yet the near-term financial profile reflects heavy investment rather than the cash generation typical of mature software businesses. With capital expenditures expected to consume significant cash flow throughout fiscal 2026, patience appears warranted for those not already positioned in the stock. Current holders might consider maintaining their positions given the long-term potential of Oracle's AI infrastructure strategy, while new entrants may benefit from waiting for greater visibility into capacity utilization rates and the conversion timeline for the substantial backlog. ORCL stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GOOGL

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite