|

|

|

|

|||||

|

|

Through major strategic deals, Oneok has built a fully integrated Permian presence that now rivals its established Bakken operations.

Major expansion projects coming online through 2027 position Oneok for solid earnings growth.

With a 5.8% yield and a reasonable valuation, Oneok offers an attractive risk/reward outlook for patient investors.

Oneok (NYSE: OKE) is one of the more underappreciated stories in energy infrastructure. The pipeline operator offers a nearly 6% dividend yield backed by more than 25 years of consistent payouts and 11 consecutive years of earnings before interest, taxes, depreciation, and amortization (EBITDA) growth. Yet the stock has fallen 30% during the past year as investors worry about declining U.S. natural gas volumes and weaker ethane recoveries. Those near-term concerns overlook a fundamental change in Oneok's investment story.

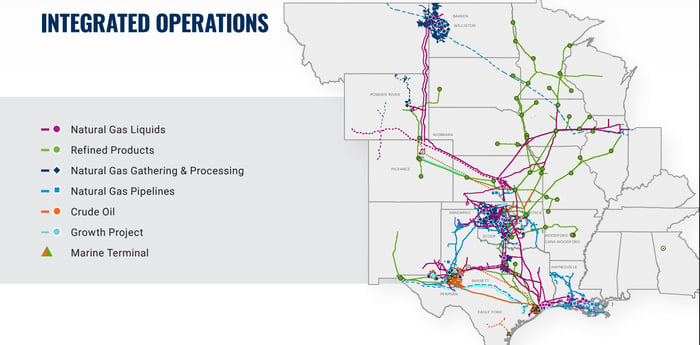

Some investors still think of Oneok as a Bakken-focused natural gas liquids (NGL) company. That was true three years ago, but the business looks completely different today. After transformative acquisitions totaling more than $25 billion, Oneok has quietly assembled one of the most integrated midstream platforms in the Permian Basin. Yet the market hasn't fully recognized the shift.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Oneok.

Since Oneok's acquisition spree, the Permian Basin has emerged as a major earnings contributor for the company, with its Gulf Coast/Permian operations now rivaling the company's established Rocky Mountain (Bakken) presence. In the third quarter, Permian NGL volumes reached nearly 570,000 barrels per day (bpd), surpassing Bakken volumes of around 490,000 bpd for the first time in company history.

Oneok spent decades building its position in the Bakken, establishing a dominant processing footprint that commands premium fee rates compared to the company's other gathering and processing operations. But the Permian is now the growth story.

Through the October 2024 acquisitions of EnLink Midstream and Medallion Midstream, plus the September 2023 Magellan Midstream deal, Oneok created a fully integrated platform stretching from wellhead to export terminal. The company can now gather natural gas in the Permian and process and transport the liquids through its pipelines to the Gulf Coast for eventual export through its Texas City, Texas, liquified petroleum gas (LPG) terminal, opening in early 2028.

The results suggest Oneok's integration is progressing ahead of schedule, with the company consistently exceeding its own projections on cost savings and operational improvements. The Magellan integration has exceeded the company's original $200 million annual target, and is on pace for nearly $500 million in total synergies by the end of 2025.

The benefits come from connecting previously isolated pipelines, using its Gulf Coast facilities more efficiently, and eliminating redundancy. More importantly, they create the foundation for organic growth in the Permian Basin.

Major projects are already under construction, fueling near-term growth. Oneok has more than 500 million cubic feet per day (MMcf/d) of new Permian processing capacity coming online through 2027, including the 300 MMcf/d Bighorn plant expected mid-2027, which is backed by long-term customer commitments. Although Oneok is positioned to capture market share in the Permian, near-term growth will also benefit from full-year contributions from projects that came online last year and continued volume growth systemwide.

Despite this, Oneok trades at just 9.5 times this year's projected EBITDA. That's a decent price for a company that's transformed into a fully integrated midstream operator with a growing presence in the Permian, backed by relatively stable, fee-based cash flows. The stock yields 5.8% and management targets 3% to 4% annual dividend growth.

With opportunity comes risk. The stock has declined 30% during the past year due to various real concerns. Commodity volatility remains a factor, particularly in refined products where spread narrowing has pressured margins. Investors also question where growth will come from beyond 2027, pointing to limited need for new NGL infrastructure once current projects are complete. Capital spending jumped 50% year over year to $2.2 billion through the first nine months of 2025, reflecting the aggressive build-out underway. Leverage currently sits at about 4 times EBITDA and is expected to decline to management's 3.5 times target by year-end 2026. In addition, execution risk remains as management completes the integration and brings new processing capacity online. But here's the important part to remember: 90% of Oneok's earnings come from fee-based contracts, insulating the business from most commodity price swings.

Oneok has grown from a single-basin NGL company into a diversified midstream powerhouse with premier positions in both the Bakken and Permian. The Bakken generates steady cash flow that helps cover the dividend. The Permian provides the growth, with volumes rising and major capacity additions locked in through 2027.

The market still prices Oneok like a mature, single-basin operator. For investors willing to look past near-term noise, this combination of a nearly 6% yield, locked-in volume growth, and successful integration execution makes Oneok one of the more compelling stories in energy infrastructure today.

Before you buy stock in Oneok, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oneok wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $489,300!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,159,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 9, 2026.

Bryan White has no position in any of the stocks mentioned. The Motley Fool recommends Oneok. The Motley Fool has a disclosure policy.

| Feb-18 | |

| Feb-18 | |

| Feb-16 | |

| Feb-11 | |

| Feb-10 | |

| Feb-07 | |

| Feb-06 | |

| Feb-05 | |

| Feb-04 | |

| Feb-02 | |

| Jan-31 | |

| Jan-31 | |

| Jan-28 | |

| Jan-26 | |

| Jan-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite