|

|

|

|

|||||

|

|

Roblox Corp. (NYSE:RBLX) hasn't been the same since its third-quarter earnings report, posted in late October. Back then, RBLX stock enjoyed a triple-digit price tag, benefiting from the status as one of the most popular video game platforms. Despite the print itself being solid, exceeding estimates for bookings and producing a less-than-expected loss per share, investors rushed for the exits.

Essentially, market participants were spooked by forward profitability concerns. For example, management cited the platform's strength and safety initiatives, with the latter being an increasingly critical element due to Roblox targeting younger consumers. However, these initiatives don't come cheaply. Combined with slowing growth in key areas of opportunity, both investors and analysts downgraded RBLX stock.

Despite the ugliness — which has seen RBLX stock lose roughly 32% in the trailing six months — there are signs that a bounce back could be in the works. Perhaps most prominently, Cathie Wood-led Ark Invest made several big trades recently, including those for Roblox. Through various Ark exchange-traded funds, the investment firm acquired a total of 169,130 RBLX shares.

Further, analyst Drew Crum from B. Riley Securities highlighted the upside potential of Roblox stock, noting that the underlying company could become a leading entertainment platform. Essentially, the expert argued that Roblox has the opportunity to compound its social and content network effects.

It's also worth mentioning the structural argument that may favor a contrarian view on RBLX stock. Primarily, seller exhaustion could be taking place, as large declines typically mean that those who wanted to sell have done so. With a now reduced pool of sellers, there needs to be new information to justify sustained selling — not just lingering fear.

It's also possible that the subsequent valuation compression may create mechanical buyers. Basically, RBLX stock trades at a much lower sales multiple than it did just a few months ago. While that's not an absolute truth claim, it could inspire discount-seeking contrarian buyers.

In many ways, trading in the financial market is similar to the mechanics and strategies found in team sports. Depending on the circumstance, a team will behave in a certain way as part of its endgame. For example, in football, if the offense is behind late in the fourth quarter, it's almost certainly passing the ball. Based on analysis of prior games, the defense may look for clues about where the ball is going to be thrown to.

Similarly, we as options traders can look for clues about where the stock may head to next based on structural patterns that we have observed. In my opinion, this process can be best executed by looking at publicly traded securities in a hierarchical perspective. By observing multiple sequences across a fixed-time distribution, we can estimate the median forward pathway of the stock in question.

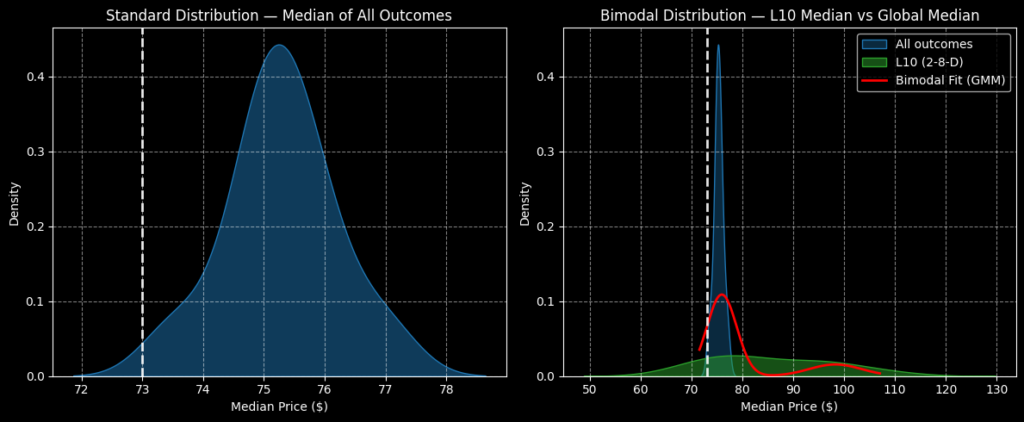

In Roblox's case, its forward 10-week outcomes would likely range between $72 and $79 (assuming a spot price of $73). Probability density would likely peak at around $75.20, indicating that on a fixed-time scale, RBLX stock enjoys an upward bias.

Still, we're not trying to bet on the security's aggregate behavior but on the statistical response to the current quantitative signal. In the trailing 10 weeks, RBLX stock printed only two up weeks, leading to an overall downward slope. Typically, this framework would be considered highly risky for investors, as it implies that the bears have control.

Interestingly, though, this 2-8-D (two up, eight down, downward trend) sequence tends to resolve higher over the next 10 weeks. Forward outcomes would likely land between $50 and $130, with probability density peaking near $80.

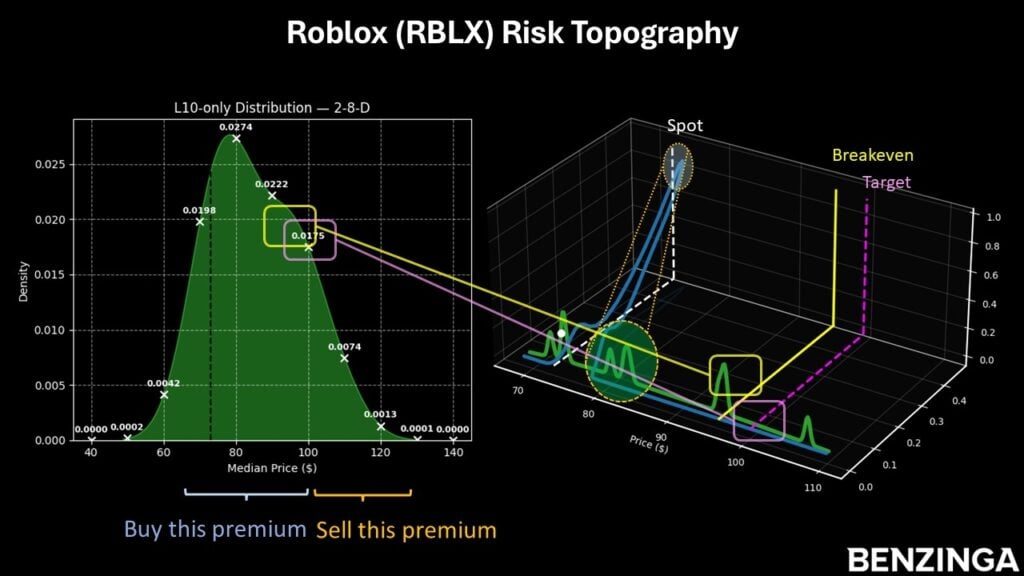

What's really fascinating is the relatively gentle acceleration of probability decay between $80 and $100. In this period, probability density drops by only 36.13%. Over the next $20 interval — between $100 and $120 — density plunges by 92.57%. There might then be a case for targeting the $100 price point.

While a lower price target would, of course, be more prudent, there's another wrinkle to consider regarding the chase for higher expected value instead of outright probability. By looking at risk topography — a three-dimensional view of demand structure — the framework reveals the possibility of heightened activity over the next several weeks.

Besides expected (terminal) price and probability density, risk topography also covers a third axis, which is population occurrence or frequency. With RBLX stock, past analogs of the 2-8-D sequence reveal the possibility of heightened travel between $80 and $110 before a settlement near $80.

My hypothesis is that, because of the extreme downturn that RBLX stock incurred since Roblox's third-quarter earnings disclosure, we could see a bigger spike than what would normally be expected. As such, I'm looking at the ultra-ambitious 95/100 bull call spread expiring March 20, 2026.

This trade will require RBLX stock to rise through the $100 strike price at expiration. If it does, the net debit required of $86 would turn into a profit of $414, a payout of over 481%. Breakeven would come in at $95.86. While incredibly aggressive, prior behaviors suggest that the trade has structural merit.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Image: Shutterstock

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite