|

|

|

|

|||||

|

|

Revvity, Inc. RVTY recently announced a collaboration with Eli Lilly and Company to make Eli Lilly’s TuneLab predictive models available through the Revvity Signals platform. The partnership expands on RVTY’s recently launched Signals Xynthetica platform, establishing a scalable and federated framework aimed at the development of new drugs through AI-powered research and innovation.

Per management, federated learning is a very promising approach for using AI in drug discovery and can only work with the right technology. The collaboration addresses a critical blockage in AI-driven drug discovery by pairing Eli Lilly’s powerful predictive models with Signals Xynthetica’s platform and offers a secure and practical way for organizations of any size to share knowledge and gain value from working together.

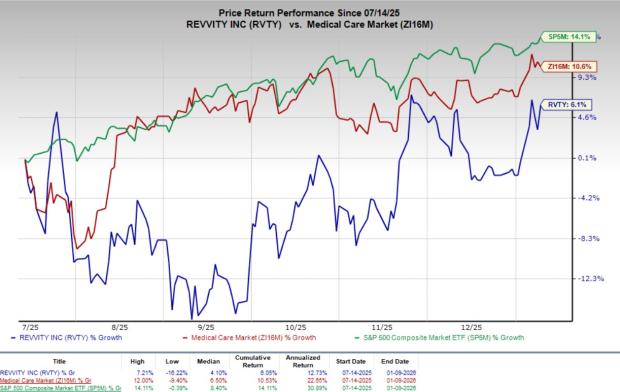

Shares of Revvity gained 2.7% since the announcement on Friday. Over the past six months, the stock has gained 6.1% compared with the industry’s 10.6% growth and the S&P 500’s 14.1% rise.

In the long run, the collaboration reinforces RVTY’s Signals Xynthetica as a core pillar of its AI-enabled drug discovery strategy and underscores the robustness of the broader Signals ecosystem. Joint funding by Eli Lilly and Revvity for selected small- and mid-sized-biotechs further lowers barriers to entry, encouraging broader adoption and showing both companies’ commitment to helping innovation grow across the biotech industry. The partnership also highlights RVTY’s ability to partner with top-tier companies and boosts potential for recurring software revenues, supporting sustained growth.

RVTY currently has a market capitalization of $11.84 billion.

Lilly TuneLab leverages advanced AI and machine learning models, built using decades of Eli Lilly research data, as well as data contributed by the wider biotech community, which helps improve the models through federated learning. The Signals Xynthetica platform enables these TuneLab models to be used directly within the Signals platform, where research teams around the world collect, manage and analyze experimental data.

RVTY’s Models-as-a-Service platform and its Signals Xynthetica solution allow researchers to leverage Eli Lilly’s predictive models within their own drug discovery workflows while maintaining data confidentiality and security. This framework increases the participation of small- and mid-sized-biotech organizations as their diverse experimental datasets can improve overall predictive accuracy and collective scientific insight without requiring data sharing.

The Signals platform delivers the core infrastructure needed for organizations to use Eli Lilly’s TuneLab models, supporting scientific data management, analytics and collaboration with both internal teams and external partners. Revvity’s Signals One enables comprehensive wet-lab data capture and experiment orchestration, while Signals Synergy facilitates secure data sharing with CROs, academic groups and collaborators for building and scaling federated learning ecosystems.

Going by data provided by Precedence Research, the artificial intelligence (AI) in the drug discovery market is valued at $7.62 billion in 2026 and is expected to witness a CAGR of 9.9% through 2035. Factors like the significant reduction in drug discovery time and cost, increased adoption during and after the COVID-19 pandemic, rising medical services spending limit and headways in medical care framework are driving market growth.

Revvity announced a definitive agreement to acquire ACD/Labs, a global developer of scientific software for analytical characterization and molecular design serving pharmaceutical and materials science markets. The deal is expected to close in late fourth-quarter 2025 and expands the capabilities of Revvity Signals by improving the connection between analytical data and actionable insights, reinforcing the company’s mission to accelerate scientific innovation. ACD/Labs brings industry-leading solutions, including Spectrus for advanced spectral analysis and Percepta for AI-based prediction of molecular properties and ADMET characteristics, as well as additional tools that support process chemistry and scientific data management.

Revvity Inc. price | Revvity Inc. Quote

Currently, RVTY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, CareDx CDNA and Charles River Laboratories International CRL.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rankstocks here.

VCYT has an estimated earnings growth rate of 38.7% for 2025 compared with the industry’s 14.7% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.12%.

CareDx, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 28 cents, which surpassed the Zacks Consensus Estimate by 115.4%. Revenues of $100.1 million beat the Zacks Consensus Estimate by 5.1%.

CDNA has an estimated earnings growth rate of 25.5% for 2025 compared with the industry’s 11.8% growth. The company beat earnings estimates in the trailing four quarters, the average surprise being 76.46%.

Charles River Laboratories International, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $2.43, which surpassed the Zacks Consensus Estimate by 4.7%. Revenues of $1.0 billion beat the Zacks Consensus Estimate by 2.1%.

CRL has an estimated long-term earnings growth rate of 3.1% compared with the industry’s 15.5% growth. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 12.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-09 | |

| Mar-07 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-02 | |

| Mar-02 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite