|

|

|

|

|||||

|

|

Exelixis, Inc. EXEL reported preliminary, unaudited financial results for fiscal year 2025, issued financial guidance for fiscal 2026, and provided a business update.

However, the stock is down in pre-market trading on Jan. 12, 2026.

These data will also be presented at J.P. Morgan 2026 Healthcare Conference.

The company reported preliminary unaudited revenues of approximately $2.32 billion for 2025, driven by continued strength of lead drug Cabometyx across the indications of renal cell carcinoma (RCC) and neuroendocrine tumors (NET).

The preliminary number missed the Zacks Consensus Estimate for 2025 revenues of $2.33 billion.

Cabometyx is approved for RCC and previously treated hepatocellular carcinoma.

In March 2025, Exelixis received FDA approval for a label expansion of Cabometyx to treat adult and pediatric patients aged 12 years and older with previously treated, unresectable, locally advanced or metastatic, well-differentiated pancreatic neuroendocrine tumors (pNET) and extra-pancreatic neuroendocrine tumors (epNET).

Net product revenues in 2025 were about $2.12 billion. EXEL ended the year with $1.65 billion in cash and marketable securities, giving the company a solid financial flexibility to fund pipeline expansion and provide shareholder returns.

For 2025, R&D expenses amounted to roughly $825 million while SG&A expenses totaled approximately $520 million.

For 2026, Exelixis guided total revenues of $2.525 -$2.625 billion. Net product revenues are projected to be in the range of $2.325 -$2.425 billion, reflecting steady cabozantinib demand and a 3% price increase, effective January 2026.

The annual guidance for 2026 excludes any contribution from a potential approval of zanzalintinib in metastatic colorectal cancer (CRC).

Operating expenses are projected to increase. The company expects R&D expenses of $875-$925 million and SG&A expenses of $575-$625 million.

EXEL expects Cabometyx to continue driving growth in 2026. The drug remains the leading tyrosine kinase inhibitor (TKI) in RCC, both as monotherapy and in combination regimens. As of the third quarter of 2025, Cabometyx held a dominant position as the number one TKI monotherapy and the most prescribed TKI in combination with immunotherapy (IO) in RCC.

The label expansion of the drug in pNET and epNET indications in 2025 is boosting sales and growth is expected to accelerate in 2026.

As of the third quarter of 2025, Cabometyx was the leading oral therapy in the second-or-later line (2L+) NET market, with broad uptake across 2L+ patient types and practice settings.

Management is expanding its gastrointestinal sales infrastructure to support further growth in NET and prepare for potential oncology indications for zanzalintinib.

Exelixis is currently looking to expand its oncology portfolio beyond lead drug Cabometyx.

Zanzalintinib represents the company’s most significant near-term catalyst. The company recently confirmed the submission of a new drug application (NDA) to the FDA seeking approval of zanzalintinib, in combination with Roche’s RHHBY Tecentriq (atezolizumab), for the treatment of patients with previously treated metastatic CRC.

The NDA is supported by positive phase III STELLAR-303 data demonstrating a statistically significant reduction in the risk of death compared with Stivarga (regorafenib).

Roche’s Tecentriq is a cancer immunotherapy that is approved around the world, either alone or in combination with targeted therapies and/or chemotherapies, for various types of cancers.

Exelixis is gearing up for the potential first commercial launch of zanzalintinib for the above-mentioned indication.

Zanzalintinib is currently being evaluated for the treatment of advanced solid tumors, including CRC, kidney cancer and neuroendocrine tumors.

A phase III study, STELLAR-304, is evaluating zanzalintinib in combination with Opdivo (nivolumab) versus Sutent (sunitinib) in previously untreated patients with advanced non-clear cell RCC. Top-line results are expected in mid-2026, based on current event rates.

Enrolment is ongoing in the phase II/III STELLAR-311 study, which is evaluating zanzalintinib versus everolimus as a first oral therapy in patients with advanced NET, regardless of site of origin, who have received up to one prior line of therapy.

Additional pivotal studies, including STELLAR-316 in the adjuvant CRC setting and Merck-partnered RCC trials combining zanzalintinib with belzutifan, further expand the drug’s long-term commercial potential.

Beyond zanzalintinib, Exelixis is advancing several phase I assets across small molecules, bispecific antibodies and ADCs.

These include ongoing phase I studies for XL309 (USP1 inhibitor), XB010 (5T4-targeting ADC), XB628 (PD-L1 + NKG2A bispecific) and XB371 (TF-targeting ADC).

EXEL also has two new investigational new drug (IND) filings planned in 2026 – XL557 and XB773. XL557 is an orally bioavailable small molecule somatostatin receptor 2 agonist for NET. XB773 is an antibody-drug conjugate (ADC) consisting of an exatecan payload conjugated to a monoclonal antibody targeting DLL3, a transmembrane protein that is expressed in neuroendocrine carcinomas, such as small cell lung cancer and neuroendocrine prostate cancer.

At the same time, the company continues to return capital, having repurchased $2.16 billion of stock since 2023, with an additional $750 million authorization in place through 2026.

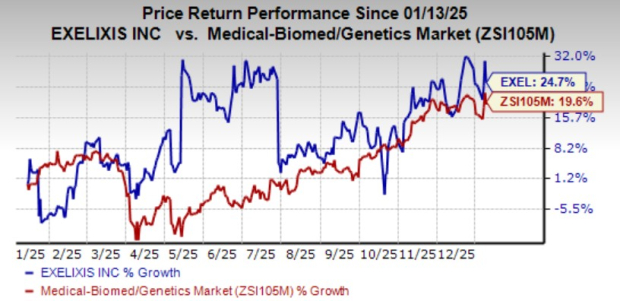

Exelixis’ shares have risen 24.7% in the past year compared with the industry’s gain of 19.6%.

The successful development of zanzalintinib should broaden EXEL’s portfolio and reduce dependence on its lead drug, Cabometyx.

EXEL’s efforts to develop its pipeline further are impressive as well.

Exelixis currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the pharma/biotech sector are CorMedix CRMD and Amicus Therapeutics FOLD, each carrying a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s 2025 EP6 have increased from $2.49 to $2.88. CorMedix’s earnings beat estimates in each of the trailing four quarters, with an average surprise of 27.04%.

In the past 60 days, estimates for Amicus Therapeutics’ 2026 EPS have decreased to 67 cents from 70 cents. Shares of FOLD have gained 54.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite