|

|

|

|

|||||

|

|

Pembina Pipeline Corporation PBA is a leading energy infrastructure company based in Canada, known for its diverse portfolio of pipeline systems, storage and transportation services. With a strong focus on long-term sustainability, Pembina aims to capitalize on evolving market conditions and strong customer demand. Its growth strategy for 2026 includes significant capital investments, the expansion of pipeline infrastructure and the development of strategic agreements in the growing LNG sector. These efforts position Pembina to continue its leadership in the North American energy market while driving operational excellence and profitability.

Recently, Pembina revised its 2026 financial guidance, projecting a 4% increase in fee-based adjusted EBITDA compared with 2025, aiming for a range from C$4.1 billion to C$4.4 billion. This growth will be driven by higher volumes across Pembina’s diversified assets, particularly in its fee-based business, which is expected to grow at a compound annual growth rate of about 5% from 2023 to 2026.

However, the company anticipates a more moderate contribution from its marketing business, which will be impacted by fluctuating commodity prices. Despite this, Pembina’s overall financial outlook remains robust, with significant capital investments planned to expand its pipeline and facilities divisions.

As the stock continues to underperform, investors are becoming increasingly cautious, seeking to understand the reasons behind the company's struggles and whether it’s wise to invest at this point. Let’s take a closer look at the factors contributing to the stock's decline and evaluate its core strengths.

Cedar LNG Remains a Multi-Year Capital Project With In-Service Risk: Despite successful remarketing, the Cedar LNG facility is not expected to be operational until late 2028, representing several more years of substantial capital outflows (C$380 million from Pembina in 2026 alone) before any EBITDA contribution begins. This, like all major construction projects, remains subject to execution, cost and timing risks over this extended period.

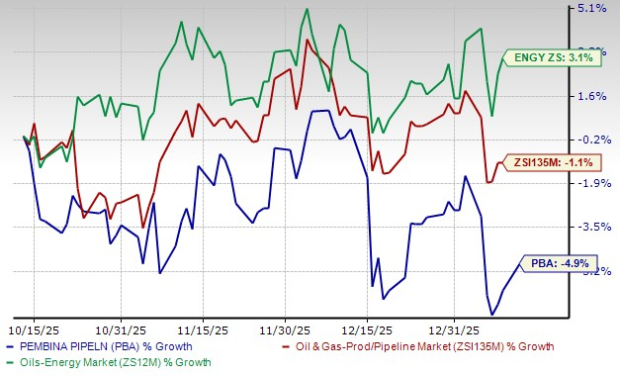

PBA Underperforms Compared With Industry and Sector: Over the past three months, PBA underperformed both the Oil & Gas Production and Pipelines sub-industry (ZSI135M) and the broader oil and energy sector (ZS12M). PBA recorded a decline of 4.9%, while the Oil & Gas Production and Pipelines sub-industry showed a slight decrease of 1.1%. In contrast, the broader oil and energy sector posted growth of 3.1%, highlighting PBA’s relative underperformance during this period.

Greenlight Project Final Investment Decision Still Pending: While progress is being made, the Greenlight Electricity Center has not yet reached a final investment decision, expected in the first half of 2026. The project's ultimate approval, scale, timing and economics are not yet finalized, representing a future uncertainty rather than a secured growth driver at this stage.

Dependence on Continued Producer Activity and WCSB Growth: Pembina's growth thesis is heavily reliant on continued volume growth from oil and gas producers in the Western Canadian Sedimentary Basin (“WCSB”). A significant or prolonged downturn in commodity prices could lead producers to curtail drilling plans, reducing the demand for transportation and processing services and impacting Pembina's volumes and future expansion justification.

Marketing Business Hedging Provides Downside Protection: For the volatile marketing segment, Pembina has proactively hedged approximately 30% of its frac spread exposure for the first half of 2026. This strategy locks in a portion of earnings at known prices, providing cash flow stability and downside protection against potential weakness in natural gas liquids prices, which are currently expected to pressure marketing contributions in 2026.

Unique Integrated Value Chain Across Multiple Commodities: Pembina differentiates itself as the only Canadian midstream company with a fully integrated service offering across natural gas, natural gas liquids, condensate and crude oil. This scope and scale, combined with access to premium global markets via assets like Cedar LNG, provide a competitive moat, unlock cross-selling opportunities and position the company to capture a disproportionate share of volume growth in the basin.

Strong Commercial Success in Core Pipeline Business: Throughout 2025, Pembina renewed existing contracts and secured new ones totaling more than 200,000 barrels per day of conventional pipeline capacity. Notably, it recontracted substantially all volumes from contracts expiring in 2025 and 2026 on the Peace Pipeline system, often maintaining current tolls despite competitive alternatives. This demonstrates the high value customers place on Pembina's reliable, integrated service offering.

Industry-Leading Project Execution Track Record: Pembina consistently highlights its ability to deliver major capital projects on time and on or under budget. Key projects like the RFS IV fractionator, Wapiti Expansion and K3 Cogeneration Facility are all tracking well for service in the first half of 2026. This disciplined execution mitigates cost overrun risks, protects project returns and enhances the company's credibility with customers and investors for future developments.

Pembina's strengths lie in the proactive hedging strategy, which provides downside protection in volatile markets and its unique, fully integrated service offering across natural gas, natural gas liquids and crude oil. The company also boasts strong commercial success in its core pipeline business and a track record of executing major projects efficiently.

However, risks persist, including the delayed Cedar LNG project, which is not expected to contribute EBITDA until 2028, and the underperformance of the stock compared with its peers. Additionally, the Greenlight project has not yet reached a final investment decision and Pembina's growth relies heavily on continued activity in the Western Canadian Sedimentary Basin. Given this mix of strengths and potential challenges, investors should wait for a more opportune entry point instead of adding this Zacks Rank #3 (Hold) stock to their portfolios.

Investors interested in the energy sector might look at some better-ranked stocks like Cenovus Energy CVE, sporting a Zacks Rank #1 (Strong Buy), TechnipFMC FTI and Oceaneering International OII, carrying a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cenovus Energy is valued at $30.92 billion. It is a Canadian integrated oil and natural gas company, focused on the exploration, production and transportation of crude oil and natural gas. Cenovus Energy operates primarily in Alberta and is known for its innovative oil sands projects and strong commitment to sustainability and environmental responsibility.

TechnipFMC is valued at $20.25 billion. FTI is a global leader in energy projects, technologies and services, specializing in subsea, onshore, offshore and surface solutions for the oil and gas industry. TechnipFMC is known for its integrated engineering, procurement, construction and installation model, which helps clients reduce project costs and accelerate delivery.

Oceaneering International is valued at $2.67 billion. The company is a global provider of engineered services and products to the offshore energy, aerospace and defense industries. Oceaneering International specializes in underwater robotics, remotely operated vehicles and subsea engineering solutions for offshore oil and gas exploration and production.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite