|

|

|

|

|||||

|

|

Morgan Stanley MS is scheduled to announce fourth-quarter and full-year 2025 earnings on Jan. 15 before the opening bell. As always, the company’s performance and the subsequent management conference call are expected to grab attention from analysts and investors.

Morgan Stanley’s nine-month performance was impressive, driven by robust trading activities and gains in the capital markets business. This time, the company’s results will likely be strong on the back of solid trading and investment banking (IB) performances. The Zacks Consensus Estimate for its fourth-quarter revenues of $17.32 billion suggests 6.8% year-over-year growth.

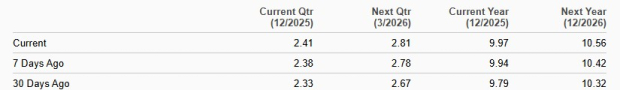

Further, in the past seven days, the consensus estimate for earnings for the to-be-reported quarter has been revised 1.3% higher to $2.41. The figure indicates an 8.6% improvement from the prior-year quarter’s actual.

Estimate Revision Trend

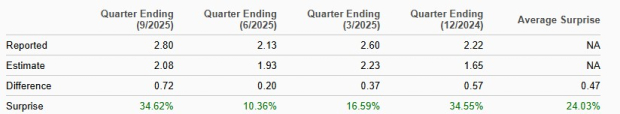

MS has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with the average beat being 24.03%.

Earnings Surprise History

IB Income: Global mergers and acquisitions (M&As) impressively surged in the fourth quarter of 2025 from the lows witnessed in April and May following President Trump’s announcement of ‘Liberation Day’ tariff plans. As corporates adapted to the rapidly evolving geopolitical and macroeconomic scenarios, larger M&A deals emerged. Also, the quarter saw a rise in M&A volume, driven by an easing of the buyer-seller valuation gap, lower capital costs and a focus on scale and AI integration.

Thus, robust deal-making activities are expected to have driven Morgan Stanley’s advisory fees in the quarter. The company’s position as one of the leading players in the space is likely to have aided advisory fees to some extent. The Zacks Consensus Estimate for advisory fees is pegged at $818.2 million, indicating a year-over-year rise of 5%.

The IPO activity in the fourth quarter was impressive. Factors, including moderating inflation, lower rates and the ongoing AI boom, drove the rise. The global bond issuance volume was also robust. Thus, Morgan Stanley’s equity and fixed income underwriting fees are expected to have improved in the quarter on a year-over-year basis.

The Zacks Consensus Estimate for equity underwriting fees of $460.9 million suggests a year-over-year rise of 1.3%. The consensus estimate for fixed-income underwriting fees is pegged at $599.4 million, indicating a jump of 47.3%. The consensus estimate for total underwriting fees of $1.06 billion implies growth of 23%.

The Zacks Consensus Estimate for IB income of $1.81 billion indicates a year-over-year increase of 10.8%.

Trading Revenues: The performance of Morgan Stanley’s trading business (constituting a significant portion of its top line) is expected to have been strong in the fourth quarter of 2025, supported by increased client activity and market volatility. Several factors that impacted trading business in the quarter included the longest U.S. government shutdown in history, a dip in consumer sentiment, easing monetary policy and a dominant AI-theme. Volatility was high in equity markets and other asset classes, including commodities, bonds and foreign exchange. So, Morgan Stanley is likely to have recorded solid growth in trading revenues.

The Zacks Consensus Estimate for the company’s equity trading revenues is pegged at $3.44 billion, suggesting a rise of 3.5% from the prior-year quarter. The consensus estimate for fixed-income trading revenues of $1.95 billion indicates a gain of almost 1%.

Net Interest Income (NII): In the to-be-reported quarter, the Federal Reserve lowered interest rates twice. This, along with the rate cut in September, is likely to have hurt Morgan Stanley’s NII. However, a solid lending scenario and stabilizing funding/deposit costs are expected to have offered much-needed support. Hence, Morgan Stanley’s NII is expected to have witnessed a modest improvement in the quarter.

The Zacks Consensus Estimate for net interest revenues is pegged at $2.53 billion, suggesting a fall of 1% on a year-over-year basis.

For the wealth management segment, management expects NII to be relatively stable sequentially.

Expenses: Cost reduction, which has long been Morgan Stanley's primary strategy for remaining profitable, is unlikely to have provided much support in the December-ended quarter. As the company has been investing in franchises, overall costs are anticipated to have been elevated.

Per our proven model, the chances of Morgan Stanley beating the Zacks Consensus Estimate for earnings this time are low. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better.

The Earnings ESP for Morgan Stanley is -0.97%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

MS currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the fourth quarter, the MS stock performance was impressive. The stock performed better than the Zacks Investment Bank industry and its close peer, Goldman Sachs GS, while lagging Citigroup C.

4Q25 Price Performance

Citigroup is set announce results on Jan. 14 and Goldman Sachs on Jan. 15. Over the past week, the Zacks Consensus Estimate for Citigroup’s fourth-quarter 2025 earnings has been revised lower to $1.65. Meanwhile, the consensus estimate for Goldman Sachs has been revised upward to $11.69 over the past week.

MS shares appear expensive relative to the industry. The stock is, at present, trading at the forward 12-month price/earnings (P/E) of 17.63X. This is above the industry’s 15.35X, reflecting a stretched valuation.

Price-to-Earnings F12M

Also, MS stock is trading at a premium compared with Citigroup and Goldman. At present, C has a forward P/E of 11.56X, while GS’ forward P/E is 16.98X.

Morgan Stanley continues to benefit from its long-standing partnership with Mitsubishi UFJ Financial Group. In 2023, the firms deepened their 15-year alliance by integrating parts of their Japanese brokerage operations, strengthening their combined equity research, sales and execution platform. These initiatives should further solidify Morgan Stanley’s position in Japan’s highly competitive market and support sustainable profitability over the long term.

At the same time, Morgan Stanley has deliberately reduced its reliance on capital markets as a primary earnings driver, prioritizing the expansion of its wealth and asset management franchises. This shift has been reinforced by a series of acquisitions, including Eaton Vance, E*Trade Financial and Shareworks. In October 2025, the company also announced an agreement to acquire EquityZen, a private shares marketplace, highlighting the growing convergence of traditional finance and private-market innovation. Collectively, these moves broaden revenue streams and improve resilience across market cycles.

Overall, Morgan Stanley’s diversified business mix provides a stronger foundation for both stability and growth, even amid volatile market conditions, and positions the firm to navigate challenges more effectively.

Looking ahead, the capital markets backdrop appears constructive, which should support steady improvement in activity levels. As a result, Morgan Stanley’s performance trajectory remains encouraging. Investors should also watch for management commentary on IB pipelines, deal momentum and broader industry trends.

Given these tailwinds, Morgan Stanley’s shares appear to offer an attractive risk-reward profile in the current environment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| 4 hours | |

| 10 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 15 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite