|

|

|

|

|||||

|

|

Rising global demand for commercial satellites—especially for communications and climate monitoring applications—has heightened investor interest in space-focused companies. At the same time, increased government investment in advanced space-based defense capabilities has provided additional tailwinds, further accelerating growth across the broader space economy and its participants. In this context, Planet Labs PL and Redwire Corporation RDW are worth mentioning.

Planet Labs is a leading provider of Earth-imaging data and geospatial analytics, operating the largest fleet of Earth-observation satellites globally. Redwire is a global leader in mission-critical space solutions and high-reliability space infrastructure for the next-generation space economy.

Let's discuss in detail.

Planet Labs primarily generates revenues through fixed-price subscriptions and usage-based contracts, delivering imagery and analytics through its cloud-based platform to government and large commercial customers. Its ongoing revenue growth is being supported by the continued maturation of its subscription-based model, growing demand from government agencies, and a strategic shift toward higher-value satellite services and advanced analytics.

PL has increasingly prioritized securing large government and defense contracts, which provide long-term visibility and stability. At the same time, management views the commercial sector as a substantial growth opportunity as the company continues to enhance its product and solution offerings. The development of AI-enabled analytics for government customers is expected to drive broader adoption across commercial markets as well, enabling actionable insights for a wide range of use cases, including supply chain monitoring, security, operational optimization, insurance risk assessment, financial analysis, energy management and agricultural productivity.

A strong and growing backlog of $734.5 million at the end of fiscal third-quarter 2026, representing a 216% year-over-year increase, provided solid revenue visibility. EBITDA has been negative over the past many quarters. The company is still in the red, and a rebound is not expected soon.

PL shares have gained 72.6% in the past three months.

Redwire is strategically focused on optimizing its operational footprint while making targeted investments in critical locations such as Albuquerque, a hub that plays an important role in U.S. national defense infrastructure. This disciplined approach supports both operational efficiency and long-term alignment with government and defense priorities.

The company’s broad and diversified portfolio of core space infrastructure offerings, combined with its domestic and international presence, enables it to compete across national security, civil, and commercial space markets worldwide. As space becomes increasingly central to global security and economic development, demand from international spacefaring allies is expected to grow. These partners are seeking to build indigenous space capabilities, positioning Redwire as a natural supplier of advanced space technologies and services. Its highly synergistic and complementary product portfolio meaningfully expands its addressable markets, particularly in Europe and other international regions.

Redwire has pursued a dual growth strategy of organic expansion and targeted acquisitions within a fragmented space-technology landscape. Since March 2020, the company has completed 10 acquisitions, integrating businesses with innovative technologies and deep flight heritage. These acquisitions have strengthened Redwire’s core offerings and broadened its solution set, enhancing its ability to serve diverse customers across multiple space applications.

The company’s technology depth and diversified customer base provide a strategic advantage by mitigating reliance on any single market, customer, or platform. This diversification helps reduce risk and improve resilience against sector-specific disruptions.

A growing backlog remains a key indicator of Redwire’s business momentum. As of Sept. 30, 2025, backlog totaled $355.6 million, reflecting solid demand visibility. For 2025, including Edge Autonomy from the date of acquisition, Redwire expects revenues of $320-$340 million. However, the company remains unprofitable, with a near-term rebound unlikely. Additionally, the ongoing U.S. government shutdown has delayed several anticipated orders into 2026. Despite these challenges, RDW shares have risen 11.5% over the past three months, suggesting improving investor sentiment.

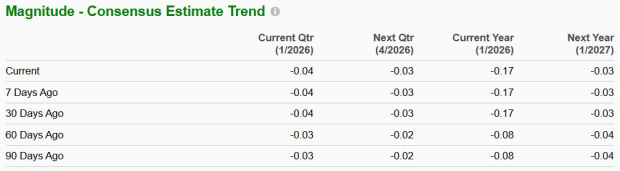

The Zacks Consensus Estimate for PL’s 2026 revenues implies a year-over-year increase of 26.2%, while that for EPS implies a year-over-year decrease of 78.4%. EPS estimates have been unchanged in the past 30 days.

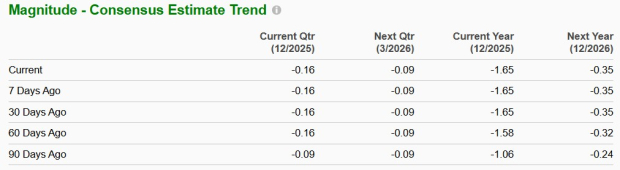

The Zacks Consensus Estimate for RDW’s 2025 revenues implies a year-over-year increase of 46.2%, and that for EPS implies a year-over-year increase of 78.3%. EPS estimates witnessed no movement in the past 30 days.

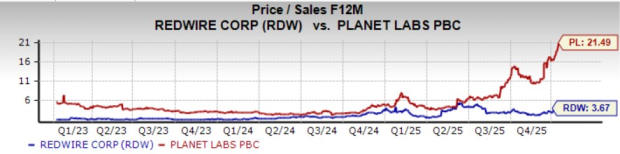

PL is trading at a forward sales multiple of 21.49, above its median of 3.61 over the last three years. RDW’s forward sales multiple sits at 3.67, higher than its median of 1.2 over the last three years.

Planet Labs is a data-driven company focused on Earth-observation imagery and analytics. Redwire, on the other hand, is a space infrastructure provider delivering mission-critical hardware, in-space manufacturing, and defense technologies across government and commercial markets. Both are poised to grow, given the rising global demand for commercial satellites.

While neither is expected to be profitable soon, RDW, with a less expensive valuation, has an edge over PL. RDW carries a Zacks Rank #3 (Hold), while PL carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 9 hours | |

| 9 hours | |

| Mar-08 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 |

Space ETF Near Buy Zone After Winners Planet Labs, AST SpaceMobile Surge

PL +9.20%

Investor's Business Daily

|

| Mar-02 | |

| Mar-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite