|

|

|

|

|||||

|

|

Circle Internet Group CRCL and Coinbase Global Inc. COIN are crypto-financial infrastructure providers with distinct but complementary business roles. Circle is the issuer of USD Coin (USDC), focusing on blockchain-based payments, treasury services and digital dollar infrastructure, while Coinbase operates the largest U.S.-based crypto exchange offering trading, custody, staking and institutional services, serving both retail and enterprise customers.

Their shared strength lies in platform-driven beneficiaries of crypto adoption rather than token speculation. Both are deeply tied to the growth of stablecoins, with Coinbase serving as USDC’s primary distribution partner and earning a share of reserve-based interest income.

The key question for investors is which stock is more attractive. The answer lies in their underlying fundamentals.

Circle has become a key crypto-infrastructure provider, anchored by USDC, one of the largest regulated stablecoin networks globally. Its main strength is a trust-focused infrastructure that is fully reserved, regulated, audited, and spread across 28 blockchains, backed by systemically important banks and international payment systems. These features have fostered strong network effects, shown by rapidly increasing on-chain activity, rising institutional adoption, and significant operational leverage.

Circle continues to deliver solid operating performance. USDC circulation reached $73.7 billion as of Sept. 30, 2025, more than doubling year over year and increasing market share to 29%, with USDC representing close to 40% of stablecoin transactions. Revenue and reserve income increased 66%, and adjusted EBITDA rose 78%, with margins expanding to 57%. Expansion of subscription, transaction and infrastructure revenues, along with increasing use of Circle Payments Network (CPN) and Cross-Chain Transfer Protocol (CCTP), is strengthening the momentum.

Strategically, Circle is broadening its infrastructure stack through Arc, a Layer-1 blockchain positioned as an “economic OS for the Internet.” The Arc public testnet launched with over 100 major institutions, and management is exploring a native Arc token to support governance and network incentives. While this creates long-term optionality, it also introduces execution, regulatory and adoption risks. Additional challenges include dependence on interest rates for reserve income, rising distribution costs, and intensifying stablecoin competition. Nevertheless, Circle's growing ecosystem, advanced monetization mix and disciplined investment posture support an attractive long-term crypto-infrastructure valuation profile.

The Zacks Consensus Estimate for CRCL’s 2026 revenues indicates an increase of 18.6%. The consensus mark for earnings is pegged at 90 cents per share, down marginally over the past 30 days. This reflects a strong year-over-year turnaround from a loss of 87 cents per share.

Coinbase remains highly exposed to volatility across digital asset markets. Its revenues and profitability are closely tied to crypto prices and trading volumes, making performance vulnerable during market pullbacks or prolonged low-volatility periods. In addition, a meaningful share of revenues remains concentrated in Bitcoin, Ethereum, and USDC-related activity, limiting diversification and increasing sensitivity to asset-specific risks.

Rising costs are becoming a growing concern for Coinbase. In the third quarter of 2025, operating expenses increased sequentially, driven by continued headcount expansion, higher USDC reward payouts and incremental costs tied to recent acquisitions. Spending rose across technology and development, general and administrative, and sales and marketing, reflecting elevated personnel, compliance, and infrastructure investments. At the same time, amortization of acquired intangibles increased following the Deribit and Echo transactions, adding ongoing pressure to margins.

Regulatory and competitive pressures continue to weigh on the outlook. Coinbase faces ongoing uncertainty across jurisdictions, where shifts in enforcement or crypto classification could disrupt processes. At the same time, rising competition from decentralized and offshore platforms, coupled with cybersecurity risks, continues to pressure profitability and investor confidence.

Nonetheless, as part of its strategic shift, Coinbase is positioning itself as an “Everything Exchange,” covering nearly 90% of the crypto market cap. Growth in U.S. derivatives through CFTC-regulated perpetual futures, combined with the Deribit acquisition, has accelerated its push into high-margin options trading. The deal contributed meaningfully to institutional revenue growth and lifted derivatives volumes beyond $840 billion in the third quarter of 2025, deepening Coinbase’s competitive advantage.

The Zacks Consensus Estimate for COIN’s 2026 earnings is pegged at $5.82 per share, up just 3 cents over the past 30 days, but still reflects a sharp 26.7% year-over-year decline, raising concerns around earnings volatility.

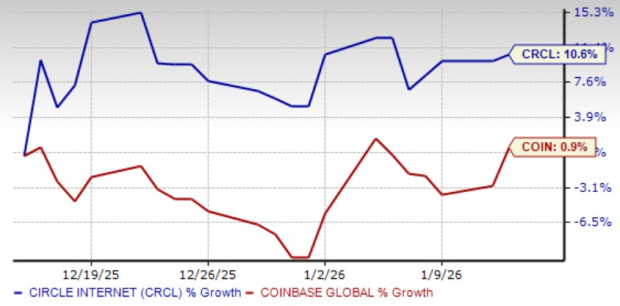

CRCL outperformed COIN over the past month, rising 10.6% compared with COIN’s 0.9% increase. Circle’s shift toward platform-driven revenues, including CPN and Arc, has reduced reliance on the reserve-only income model, creating a more balanced business model. In contrast, COIN remains more closely tied to crypto market swings. High volatility in late December 2025 and early January 2026, driven by Bitcoin ETF outflows and sharp price swings, likely constrained COIN’s share performance.

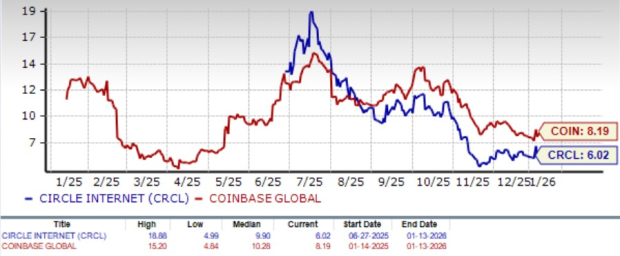

Both Circle and Coinbase shares are currently overvalued, as suggested by a Value Score of D and F, respectively. However, in terms of forward 12-month Price/Sales, CRCL shares are trading at 6.02X, lower than COIN’s 8.19X, indicating relatively lower valuation risk.

From a performance and visibility standpoint, Circle currently stands out as the stronger crypto-infrastructure play. Its revenue mix is increasingly platform-driven, less volatile than trading-led models, and supported by accelerating stablecoin adoption, expanding margins and improving operating leverage. In contrast, Coinbase is more exposed to crypto price swings, rising cost pressures, and earnings volatility. With stronger revenue visibility, improved valuation support, and lower earnings volatility, CRCL appears better positioned for consistent performance, making it the more attractive choice for investors seeking exposure to crypto infrastructure now.

Currently, CRCL carries a Zacks Rank #3 (Hold), making the stock a more stable choice compared with COIN, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 43 min | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| 16 hours | |

| 19 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite