|

|

|

|

|||||

|

|

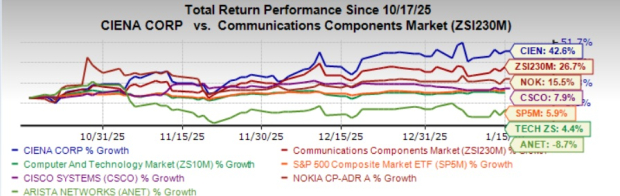

Ciena Corporation CIEN stock has gained 42.6% in the past three months, outperforming the Zacks Computer & Technology sector and the Zacks Communication - Components industry’s growth of 4.4% and 26.7%, respectively. The S&P 500 composite has also risen 5.9% over the same time frame. The company’s shares have climbed 19.6% in the past month.

CIEN has outpaced its peers, Cisco Systems, Inc. CSCO, Nokia NOK and Arista Networks, Inc. ANET, with CSCO and NOK climbing 7.9% and 15.5%, respectively, but ANET falling 8.7% during the same interval.

Cisco is gaining from an expanding security product portfolio and the completion of the Splunk acquisition. Nokia is benefiting from the increasing demand for next-generation connectivity. Arista is well-poised for growth in the data-driven cloud networking business with a leadership position in 100-gigabit Ethernet switches, industry-leading capacity, low latency, port density and power efficiency.

CIEN has a 52-week high of $261.13. Sustained demand from cloud expansion, growing data center interconnect deployments and the rapid buildout of AI infrastructure continue to drive the company’s performance.

Following a strong rally, investors may wonder whether CIEN still has upside or if expectations have outpaced fundamentals. Let’s break down to see what’s driving the rally, the bull and bear cases, and a practical approach to managing risk and position size.

Ciena’s portfolio, including WaveLogic, Reconfigurable Line System (RLS), Navigator and Interconnect Solutions, remains a recognized industry standard, with WaveLogic 6 and RLS giving it a technology lead and strong positioning to serve global AI network opportunities. The company is currently the only provider offering a 1.6 terabit WAN solution and anticipates maintaining this lead in next-generation optical technology for at least two years. It is progressing on industry-first wins with cloud providers. Additionally, Ciena is expanding its customer base for coherent routing and securing deals with international service providers and enterprise clients.

Also, the company continues to increase its capacity to support clients' metro and edge strategies and cope with increased investments made by service providers to update and boost network connectivity. The purchase of Nubis in 2025 has expanded Ciena’s portfolio with high-performance, low-power interconnects for AI workloads and brought in key talent, strengthening its ability to capture more data center opportunities.

Ciena is increasingly investing in the data and optical fiber market to cash in on the tremendous growth opportunity presented by bandwidth demand from network service providers. Network upgrades by telecom carriers to meet demand bode well for the company’s long-term growth prospects. It is one of the leading suppliers of 40G and 100G optical transport technology. Fiber Deep technology represents a big opportunity for CIEN, driven by the strong adoption of its products among all major cable operators in the global market.

Ciena Corporation price-consensus-chart | Ciena Corporation Quote

Apart from this, the company continues to benefit from higher network traffic and demand for bandwidth, which are mainly attributed to increasing AI technology use cases. Ciena’s Cloud and Service Provider customers are prioritizing network investments to support AI-driven traffic growth, highlighting long-term opportunities for its Systems and Interconnects businesses. To capitalize on this, it is focusing R&D on Coherent Optical Systems, Interconnects, Coherent Routing and solutions like DCOM, while scaling back investments in residential broadband. In 2025, the company expanded its Coherent Routing Solutions customer base to 171, driven by the combined strength of its Routing and Switching portfolio, WaveLogic Nano coherent pluggable technology and Navigator NCS.

With a $5 billion backlog, including $3.8 billion in hardware and software, Ciena has solid support for fiscal 2026 revenues and clear demand signals into fiscal 2027 and beyond. Management is taking steps to offset input cost pressures through supply rebalancing, cost reductions and pricing actions, with benefits expected to emerge in late fiscal 2026. As these measures take effect, margins are expected to improve from the first half to the second half of the year.

However, the company is encountering near-term pressure from NPI ramp challenges and escalating input costs, as tightening supply constraints struggle to keep pace with surging demand. Ciena forecasts $250-$275 million in fiscal 2026 capex, well above historical levels, pressuring near-term cash flow as the company absorbs higher investment requirements and rising 3-nanometer mask set costs.

Ciena expects fiscal 2026 revenues of $5.7-$6.1 billion, or roughly 24% growth at the midpoint, up from the 17% outlook shared in September. The company continues to expect gross margins to rise to around 43% (+/-1%) in fiscal 2026. It expects the fiscal 2026 operating margin to improve further to about 17% (+/-1 pt).

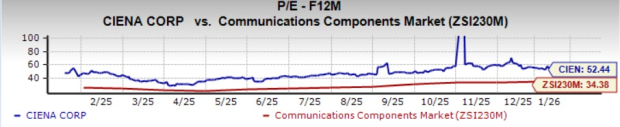

CIEN trades at a forward 12-month price-to-earnings (P/E) ratio of 52.44, above the industry’s 34.38. Ciena’s premium is supported to an extent by its strong exposure to cloud expansion, data center interconnect and AI-driven network upgrades, along with its leadership in coherent optical technology.

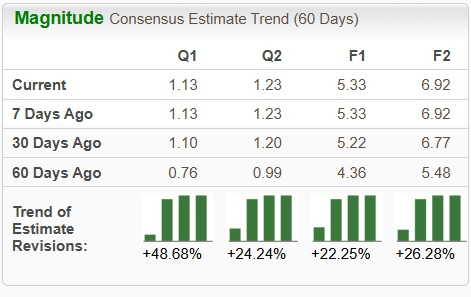

The Zacks Consensus Estimate for CIEN’s earnings for fiscal 2026 has been revised upward over the past 60 days.

Ciena continues to benefit from increased network traffic, demand for bandwidth and the adoption of cloud architecture, supported by a robust outlook and upward estimate revisions.

Sporting a Zacks Rank #1 (Strong Buy) at present and a VGM Score of B, CIEN seems to be a good bet now. Existing investors may consider holding their positions, while new investors could view the stock as an attractive buying opportunity.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 10 hours | |

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

How The AI Bubble Could Burst. Lessons From The Dot-Com Stock Market Crash.

CSCO

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 |

Broadcom Stock, Fiber Optic Star Ciena Step Up To Earnings Plate After Nvidia Carnage

CIEN

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite