|

|

|

|

|||||

|

|

Abbott Laboratories (NYSE:ABT) will release its fiscal fourth-quarter earnings report next Thursday before the opening bell, setting up an intriguing idea for bullish options traders. Ordinarily, ABT stock would rate highly as a long-term investment anchor. A healthcare juggernaut, Abbott offers financial stability and a dividend. That makes it a darling for multi-year portfolio strategies, not necessarily for bare-knuckle profit scalping.

However, while the market is off to a solid start in the new year, it's also fair to point out that momentum has noticeably decelerated relative to the heights witnessed in late October. As fears of a bubble in artificial intelligence took down tech players, many investors still remain pensive about the prospects of formerly hot names. Such context may indirectly raise the profile of ABT stock, where the underlying business is insulated from cyclical shocks.

Fundamentally, Abbott's demand is largely non-discretionary. Naturally, a weak economy impacts spending on luxury goods and travel. It doesn't meaningfully reduce demand for diagnostics equipment, medical devices, nutritional products for special patient demographics or advanced systems like implants. Further, the reimbursements for much of these product categories stem from insurance and government healthcare programs.

In short, if people stop getting sick and older, then ABT stock exposure becomes a problem. To my knowledge, that's not happening anytime soon — at least not at scale.

Another element to consider is the weak performance of the security. Abbott stock is down more than 2% to start this year and it's staring at a 7% loss in the past six months. The red ink has been conspicuous since around mid-October. While that's not necessarily a great sign, investors may treat the context as a potential contrarian framework.

For one thing, hardly anyone is short ABT stock, which makes sense given the aforementioned economic insulation. Analysts are also bullish on Abbott's forward prospects — and honestly, why wouldn't they be?

To be fair, though, these elements are already priced into ABT stock. Looking ahead, we need a second-order analysis to find out where the security is likely to congregate over the next several weeks.

While we can sit here all day and talk about Abbott's business and forward prospects, the harsh reality is that anything and everything that can materially impact ABT stock is already factored into the current share value. Therefore, the question isn't about the assumptions themselves. You can ask ChatGPT and it will provide a much better answer than I ever could. No, the question is whether the assumptions are optimally priced or not.

Consider the Black-Scholes model, which is a first-order analysis that calculates forward dispersion based on key parameters, most notably implied volatility (IV) and days to expiration. Because IV — a residual value stemming from actual order flow — is historically deflated, the market is anticipating a rather narrow dispersion for the March 20 options chain. The projected range lands between $115.36 and $129.76.

Interestingly, there has been no unusual options activity in the last 90 days, which lends credence to the narrow dispersion forecast. However, with a spot price of around $122, what Black-Scholes is telling us is that ABT stock can go up or it can go down. That's not exactly Rhodes Scholar material — and buying a long volatility trade isn't optimal if it turns out that ABT has a directional bias.

Sure enough, I'm arguing through the Markov property — which colloquially states that a system's future depends only on its present state — that we need to adjust our expectations based on the behaviorally transitional characteristics of the market. In other words, we can't just math out a forward probability of ABT stock; that probability depends on the current catalysts working on the security.

Here's the deal. In the last 10 weeks, ABT stock has printed only four up weeks, leading to an overall downward slope. This 4-6-D sequence features different market variables that are unique to it relative to other sequences, say a 6-4-U sequence.

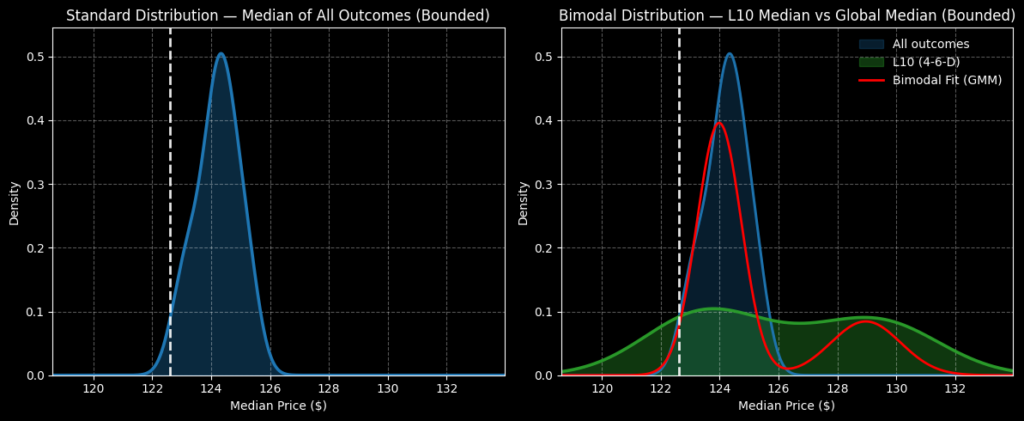

Under the current quantitative signal, past analogs going back to January 2019 reveal that we may expect ABT stock to range between $118 and $134 over the next 10 weeks. That alone doesn't tell us a whole lot. However, the second-order analysis inherent in the Markov property narrows the likely outcome (where probability density is tallest) to between $122 and $130.

The bottom line? With a starting point near $122, you're incentivized to consider a directionally bullish trade as opposed to a directionally agnostic transaction.

You can see now the advantage of conducting a second-order analysis. Under Black-Scholes, ABT stock on the March 20 expiration date could move up about 6% or it could move down about 6%. What we're saying with a second-order Markovian analysis is that, under the 4-6-D quant signal, ABT could be down about half-a-percent to up 6%.

Granted, probabilities are not guarantees. A perfect example is last year's World Series. If you played that game 99 times out of a hundred, the Blue Jays probably would have won. It's just that the Dodgers found that one game where it pulled off the impossible.

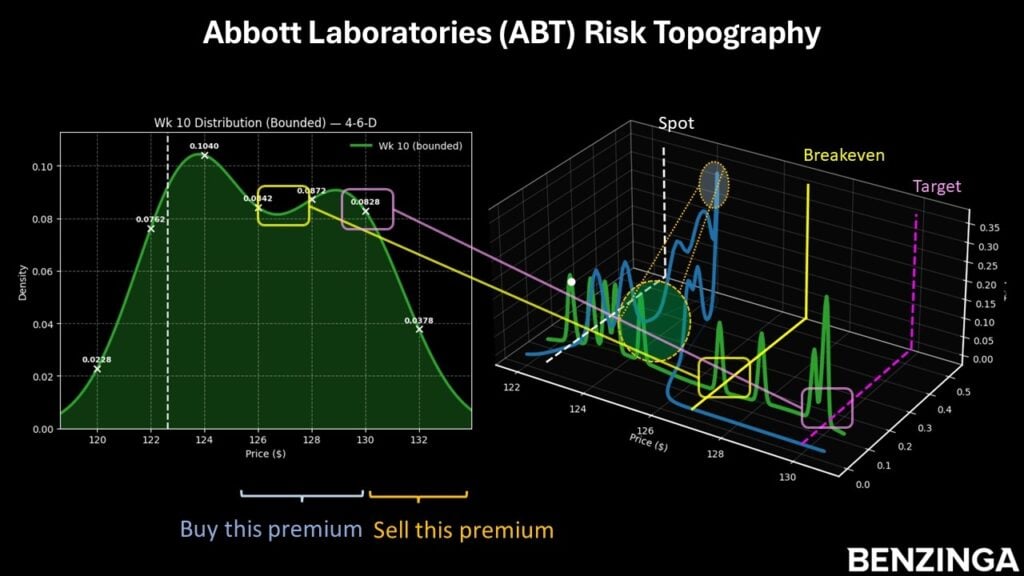

That said, unless you genuinely believe that this time could be different, you're better off playing the numbers. And what do the numbers say? Under the aforementioned quant signal, $130 represents one of the likely terminal forecasts over the next two months. Therefore, I like the 125/130 bull call spread expiring March 20.

For a net debit paid of $193 (the most that can be lost), traders will be betting that ABT stock can rise through the $130 strike at expiration. If it does, the maximum profit would be $307, a payout of 159%. Breakeven would land at $126.93, adding to the trade's probabilistic credibility.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Image: Shutterstock

| Feb-18 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite