|

|

|

|

|||||

|

|

Johnson & Johnson JNJ will begin the earnings season for the drug & biotech sector when it reports its fourth-quarter and full-year 2025 results on Jan. 21. The Zacks Consensus Estimate for fourth-quarter sales and earnings is pegged at $24.14 billion and $2.50 per share, respectively.

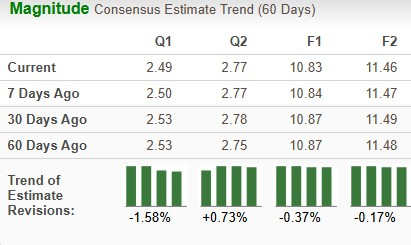

The Zacks Consensus Estimate for 2025 earnings has declined from $10.87 per share to $10.83 per share, while that for 2026 has declined from $11.48 per share to $11.46 per share over the past 60 days.

The healthcare bellwether’s performance has been pretty impressive, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 3.75%, on average. In the last reported quarter, the company delivered an earnings surprise of 1.08%.

J&J has an Earnings ESP of -1.36% and a Zacks Rank #3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 have a good chance of delivering an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sales in J&J’s Innovative Medicine segment are expected to have been driven by higher sales of key products such as Darzalex, Tremfya and Erleada due to strong market growth and share gains.

The Zacks Consensus Estimate for Darzalex, Tremfya and Erleada is pegged at $3.74 billion, $1.36 billion and $936 million, respectively.

Other products like Xarelto and Simponi/Simponi Aria are likely to continue to show growth. The rapid adoption of new drugs like Carvykti, Tecvayli, Talvey, Rybrevant, plus Lazcluze, Caplyta, and Spravato is also likely to have contributed to top-line growth.

Sales of the key drug Stelara are likely to have declined due to the impact of biosimilar competition.

Several biosimilar versions of Stelara were launched in the United States in 2025. According to patent settlements and license agreements, Amgen AMGN, Teva Pharmaceutical Industries TEVA, Samsung Bioepis/Sandoz and some other companies launched Stelara biosimilars in 2025. The Stelara LOE negatively impacted the Innovative Medicines segment’s growth by 1070 basis points in the third quarter. We expect the negative impact to be steeper in the fourth quarter as the number of biosimilar entrants is expected to have increased.

The Zacks Consensus Estimate for Stelara sales is pegged at $1.36 billion.

Imbruvica sales are likely to have declined due to rising competitive pressure in the United States due to new oral competition and the impact of Medicare Part D redesign. The Zacks Consensus Estimate for Imbruvica stands at $670.0 million.

Generic/biosimilar competition for drugs like Zytiga and Remicade is also likely to have hurt the top line.

The negative impact of the Part D redesign is expected to have weighed on sales of drugs like Stelara, Imbruvica, Erleada and pulmonary hypertension drugs.

The Zacks Consensus Estimate for J&J’s Innovative Medicine unit is pegged at $15.43 billion.

J&J’s MedTech business has improved in the past two quarters, driven by the acquired cardiovascular businesses, Abiomed and Shockwave, as well as Surgical Vision and wound closure in Surgery. Improvements in J&J’s electrophysiology business also drove the growth. The MedTech segment is expected to continue seeing strong momentum in the Cardiovascular, Surgery and Vision in the fourth quarter, backed by increased adoption of newly launched products.

J&J’s MedTech business has been facing continued headwinds in China, where sales are being hurt by the impact of the volume-based procurement (VBP) program. VBP is a government-driven cost containment effort in China. Sales in China are likely to have continued to be hurt by the impact of the VBP program in the fourth quarter.

The Zacks Consensus Estimate for J&J’s MedTech segment stands at $8.71 billion.

J&J is expected to provide a detailed and updated financial outlook for 2026. Back in October, the company said that the consensus estimates for both 2026 top and bottom lines were too low. In 2026, J&J expects top-line growth of more than 5%, while the consensus estimate, back then, was around 4.6%. EPS growth is expected to be similar to revenue growth. J&J, back in October, said that adjusted earnings per share in 2026 are expected to be around 5 cents more than the then consensus of $11.39 per share. J&J is expected to give an update on this preliminary outlook at the fourth-quarter conference call.

Nonetheless, a single quarter’s results are not so important for long-term investors. Let us delve deeper to understand whether to buy, sell or hold J&J stock ahead of earnings.

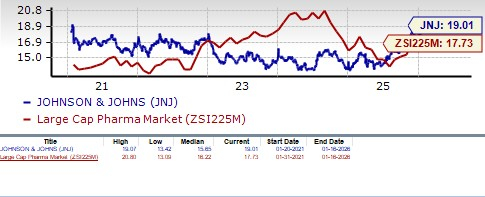

J&J shares have outperformed the industry in the past year. The stock has risen 48.7% in the past year compared with the 24.1% growth of the industry.

From a valuation standpoint, J&J is slightly expensive. Going by the price/earnings ratio, the company’s shares currently trade at 19.01 forward earnings, higher than 17.73 for the industry. The stock is also trading above its five-year mean of 15.65.

J&J’s biggest strength is its diversified business model, as it not only has pharmaceuticals but also medical devices, which help it withstand economic cycles more effectively.

J&J’s Innovative Medicine unit is showing a growth trend. The segment’s sales rose 3.4% in the first nine months of 2025 on an organic basis despite the loss of exclusivity for a blockbuster drug like Stelara and the negative impact of the Part D redesign. J&J’s MedTech business has also improved in the past two quarters. In 2026, J&J expects accelerated growth in both the Innovative Medicine and MedTech segments.

J&J has rapidly advanced its pipeline this year, attaining significant clinical and regulatory milestones that will help drive growth through the back half of the decade. J&J believes 10 of its new products/pipeline candidates in the Innovative Medicine segment have the potential to deliver peak sales of $5 billion, including Talvey, Tecvayli, Imaavy, Caplyta, Inlexzo, Rybrevant, plus Lazcluze and icotrokinra.

However, the Stelara patent cliff, the impact of Part D redesign, slowing sales in China in the MedTech segment and the pending talc lawsuits are significant headwinds. However, J&J looks quite confident that it will be able to navigate these challenges.

J&J recorded a strong operational performance in the first nine months of 2025, backed by double-digit growth in revenues from key brands and contributions from new launches. No matter how the last quarter’s results play out, one may consider staying invested in JNJ, considering its stock price appreciation this year, rising estimates and decent valuation.

It also boasts strong cash flows and has consistently increased its dividends for 63 consecutive years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN JNJ

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite