|

|

|

|

|||||

|

|

UnitedHealth Group Incorporated UNH and Molina Healthcare, Inc. MOH operate within the same highly regulated U.S. health insurance landscape, yet their business models, scale and exposure to policy risk differ meaningfully. With healthcare stocks facing renewed volatility amid policy uncertainty tied to President Trump’s proposed “Great Healthcare Plan,” investors are reassessing which insurers are better equipped to absorb regulatory shifts and cost pressures.

Both companies have deep exposure to government-sponsored programs, particularly Medicare and Medicaid, making them sensitive to reimbursement dynamics, medical cost trends and enrollment stability. However, their strategic positioning, diversification, and financial flexibility set them apart at a time when visibility across the sector remains limited.

Against this backdrop, investors are looking beyond near-term noise to identify insurers with the resilience and execution strength to navigate a volatile policy environment. Let’s closely compare the fundamentals of the two stocks to determine which one is better positioned to weather uncertainty.

UnitedHealth enters this period of volatility with unmatched scale and diversification across insurance and healthcare services. Through its UnitedHealthcare insurance arm and Optum platform, the company spans health benefits, pharmacy services, care delivery and data analytics, giving it multiple levers to offset margin pressure in any single segment. This integrated model provides earnings stability that few peers can replicate.

In its last reported quarter, UnitedHealth delivered steady revenue growth, supported by higher domestic commercial membership and continued expansion at Optum Rx. While margins faced pressure from higher utilization, management under CEO Stephen J. Hemsley, who returned to the role last May, reaffirmed its ability to rebalance pricing and care delivery over time. Optum’s growth, particularly in value-based care, continues to act as a stabilizing force when insurance margins fluctuate.

Profitability remains a key advantage for UNH. The company consistently generates strong operating cash flow, maintains disciplined capital deployment and benefits from scale-driven administrative efficiencies. Unlike smaller insurers, UnitedHealth can absorb short-term reimbursement changes without materially disrupting long-term earnings power, a critical edge in a shifting policy landscape.

That said, UnitedHealth is not immune to challenges. Heightened regulatory scrutiny continues to loom, with the current administration’s focus on PBMs potentially pressuring Optum Rx. At the same time, new disclosure and transparency mandates under the Great Healthcare Plan are likely to raise compliance costs and intensify competition by making cost and quality comparisons easier for consumers. While this could drive market share shifts, insurers with scale, data capabilities, operational depth and balance sheet strength — such as UnitedHealth — are better positioned to absorb the impact. Notably, UNH’s long-term debt-to-capital ratio of 43% remains below Molina’s 47.9%.

Molina Healthcare has built a strong franchise within Medicaid-focused managed care, benefiting from steady enrollment growth and deep relationships with state governments. Its narrow focus has allowed the company to operate efficiently within its niche and deliver solid profitability during favorable rate cycles. MOH’s return on invested capital of 14.6% is significantly higher than 7.6% of UNH.

The company’s latest quarterly results also reflected stable revenue growth, driven by rising premiums, rate hikes and membership gains across multiple states. However, Molina remains more exposed to margin volatility tied to medical cost trends and state-level reimbursement decisions. Unlike UnitedHealth, Molina lacks a diversified services platform to offset insurance margin compression. MOH’s trailing 12-month EBITDA margin of 3.7% is lower than UNH’s 7.3%.

While Molina has made progress in improving operational discipline and cost controls, its earnings profile remains more sensitive to utilization spikes and regulatory shifts. Any unfavorable changes tied to healthcare reform proposals could disproportionately impact Molina, given its heavier reliance on government programs. Its medical care ratio (MCR) worsened from 88.1% in 2023 to 89.1% in 2024 and further to 92.6% in the third quarter of 2025. Meanwhile, UnitedHealth’s MCR also deteriorated and reached 89.9% in the third quarter of 2025, but remained below MOH’s level.

Molina’s smaller scale also limits its ability to negotiate provider pricing or absorb near-term disruptions. In contrast to UnitedHealth’s multi-engine growth model, Molina’s performance hinges more narrowly on execution within Medicaid, increasing earnings volatility during uncertain policy cycles.

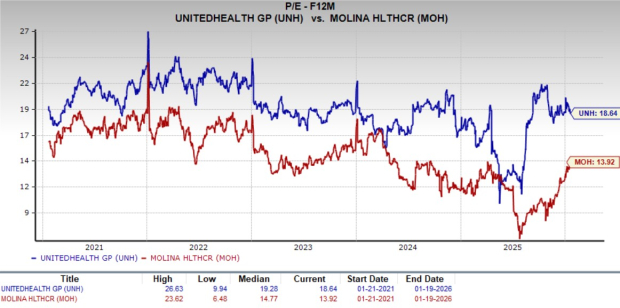

While Molina trades at a lower forward price-to-earnings multiple, UnitedHealth’s valuation better reflects earnings durability. UNH’s forward 12-month P/E of 18.64X is above MOH’s 13.92X and the industry average of 15.62X. Investors are paying for consistency, scale and visibility, which remain scarce in the current healthcare environment.

Zacks estimates reflect a turnaround for UnitedHealth, supported by diversified earnings streams and consistent cash generation. The Zacks Consensus Estimate for UNH’s 2025 EPS is pegged at $16.30, indicating a 41.1% year-over-year decline. But the same for 2026 suggests an 8% increase to $17.60 per share. It beat earnings estimates twice in the past four quarters and missed on the other two occasions, with an average surprise of negative 2.3%.

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

The consensus mark for Molina’s 2025 EPS is pegged at $13.95, a 38.4% decrease from a year ago. The same for 2026 predicts a 2.9% further decline to $13.55. It missed the earnings estimates thrice in the past four quarters and beat once, with an average surprise of negative 15.8%.

Molina Healthcare, Inc price-consensus-eps-surprise-chart | Molina Healthcare, Inc Quote

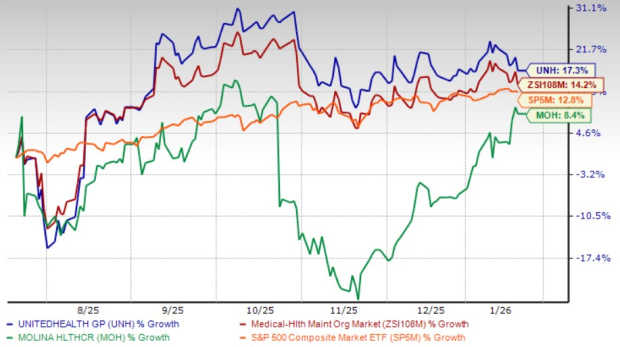

Shares of UnitedHealth have gained 17.3% in the past six months, outperforming Molina’s 8.4% growth, highlighting investor preference for stability. During this time, the industry and the S&P 500 have increased 14.2% and 12.8%, respectively.

Overall, UnitedHealth stands out as the more resilient choice in a volatile healthcare environment. Its unmatched scale, diversified Optum-driven model, stronger profitability profile and healthier balance sheet provide multiple buffers against regulatory and cost pressures. While Molina offers focused Medicaid exposure, its narrower business mix leaves earnings more vulnerable to policy shifts and utilization swings.

With better earnings visibility, improving estimates beyond 2025 and clear relative price strength, UnitedHealth appears better positioned to navigate uncertainty and deliver more durable upside for investors. It currently has a Zacks Rank #3 (Hold), while Molina has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite