|

|

|

|

|||||

|

|

Bio-Rad Laboratories, Inc. BIO is well-poised to grow in the upcoming quarters, given the demand for its quality control and immunology products in Clinical Diagnostics. In addition, growth across international markets boosts the stock’s appeal. Meanwhile, a dull macro scenario and unfavorable foreign exchange may restrict Bio-Rad’s full growth potential.

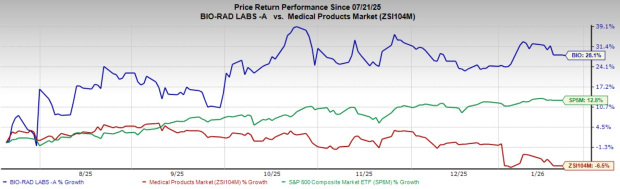

In the past six months, shares of this Zacks Rank #3 (Hold) company have risen 28.1% against the industry’s 6.5% decline. The S&P 500 composite has seen a 12.8% rise in the same time frame.

The renowned manufacturer and global supplier of clinical diagnostics and life science research products has a market capitalization of $8.44 billion. Bio-Rad’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 19.8%.

Let’s delve deeper.

Clinical Diagnostics Continues to Gain Momentum: The business has now returned to its normalized growth rate post-pandemic, maintaining strong market positions globally for its platforms. Built on its long-standing reputation as a leading blood screening systems provider, Bio-Rad’s IH-500 blood typing system is considered a gold standard in immunohematology labs, offering the highest level of automation.

The company introduced the IH-500 NEXT System in 2023, a fully automated system for ID cards to meet emerging demands and challenges in laboratory and health environments. Bio-Rad continues to invest in supporting the growth of this segment while building a position in the new molecular diagnostics segment.

In the third quarter of 2025, Clinical Diagnostics sales edged up 0.6% year over year. Performance remained stable across the product areas, with the exception of reimbursement rate headwind in China, which is expected to annualize in the fourth quarter.

Focus on International Markets: Bio-Rad conducts significant international operations, having direct distribution channels in more than 36 countries outside the United States. Year to date, the company has generated nearly 59% of its net revenues from international locations, with Europe being the largest international region. Despite the soft market conditions in APAC regions for the Life Science business, the company remains optimistic about the continued gradual improvement in the upcoming quarters.

Further, the lackluster business scenario in the key European markets, primarily due to an unfavorable funding environment in Germany and the United Kingdom, is expected to be gradually offset by a more modest improvement in funding outlooks in France and some other European countries.

Image Source: Zacks Investment Research

Macroeconomic Concerns: In the recent years, the company’s performance has been affected by challenging economic conditions, including elevated raw material costs from inflationary pressures and geopolitical turmoil. Moderating economic growth and changing government policies in China are likely to continue affecting Bio-Rad’s commercial opportunities in the country and hurt the demand for its Clinical Diagnostics products.

Exposure to Foreign Currency: Internationally, Bio-Rad’s sales are primarily denominated in local currencies. As a result, the strengthening of the U.S. dollar negatively impacts the company’s consolidated net sales expressed in U.S. dollars. Further, the volatility of other currencies may adversely impact the company’s operations outside the United States and increase its internal costs to hedge against currency fluctuations.

The Zacks Consensus Estimate for Bio-Rad’s 2025 earnings per share (EPS) has remained unchanged at $9.98 in the past 30 days.

The Zacks Consensus Estimate for 2025 revenues is pegged at $2.58 billion, which indicates a modest 0.7% rise from the year-ago reported number.

Some better-ranked stocks in the broader medical space are Phibro Animal Health PAHC, Boston Scientific BSX and Envista NVST.

Phibro Animal Health has an earnings yield of 6.9% compared with the industry’s 2.8% yield. Shares of the company have surged 90.9% in the past year against the industry’s 10.3% decline. PAHC’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 20.8%.

PAHC carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific, currently carrying a Zacks Rank #2, has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.9% growth. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 7.4%. BSX shares have lost 12.7% compared with the industry’s 10.3% decline in the past year.

Envista, currently carrying a Zacks Rank #2, has an earnings yield of 5.4% compared with the industry’s 2.8% yield. Shares of the company have jumped 22.8% against the industry’s 10.3% decline. NVST’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 12.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 12 hours | |

| 12 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite