|

|

|

|

|||||

|

|

Marvell Technology MRVL and Lumentum Holdings LITE are two prominent players in the AI connectivity space, offering semiconductor solutions that are crucial for networking in data centers and high performance computing infrastructure.

Marvell Technology designs products like Active Copper Cable Linear Equalizers, Digital Signal Processors (DSPs), Active Electrical Cables (AEC), interconnect, ethernet switch and co-packaged optics. Lumentum designs and sells optical and photonic components, such as lasers and optical networking products, which help move data quickly through fiber-optic networks used by cloud and AI data centers.

Both MRVL and LITE are positioned to benefit from long-term growth in data centers, but from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s understand their fundamentals to pick the stock that offers a more compelling investment case right now.

Marvell Technology’s AI connectivity portfolio includes DSPs, AEC, interconnect, ethernet switch, co-packaged optics and Active Copper Cable Linear Equalizers. To serve the growing AI market, MRVL is developing scale-up switches that connect AI accelerators within and across racks, requiring multi-terabit bandwidth and ultra-low latency.

Marvell Technology is aligning itself with industry scale-up standards like UALink and ESUN. The company expects data center switch revenues to exceed $300 million in fiscal 2026 and $500 million in fiscal 2027. Beyond its switching portfolio, MRVL has launched the Golden Cable initiative to accelerate and expand the AEC ecosystem for faster deployment of AI infrastructure by cloud and hyperscaler customers.

MRVL acquired XConn Technologies and Celestial AI to expand its connectivity portfolio. The XConn acquisition added PCIe and CXL switching solutions to MRVL’s portfolio, while the acquisition of Celestial AI will enrich MRVL’s connectivity portfolio with advanced photonic interconnect optical connectivity technology designed to improve bandwidth and latency in AI systems.

MRVL will pay 60% in upfront cash for XConn, whereas Celestial AI will involve cash expenditure of $1 billion, and this might raise investors’ concern, given MRVL has a highly leveraged balance sheet with cash and cash equivalents of $2.71 billion and long-term debt of $3.97 billion as of Nov. 1, 2025. That said, Marvell Technology’s enterprise networking segment continues to perform strongly, helping to offset balance-sheet related apprehension.

In the third quarter of fiscal 2026, enterprise networking revenues climbed 57% year over year to $237 million, while carrier infrastructure grew 98% to $168 million. This growth trend will positively contribute to future revenues and earnings. The Zacks Consensus Estimate for MRVL’s 2026 revenues and earnings imply 42% and 81% year-over-year growth. The earnings estimate has remained unchanged in the past 30 days.

Lumentum develops optical components that have their application inside data centers and high-speed networks. These networking components enable data to move quickly between servers, racks, and data centers. Demand for these optical products has increased sharply with the proliferation of new data centers and scaling of the existing ones, needing greater and better connectivity.

In the first quarter of fiscal 2026, Lumentum reported revenues of about $533.8 million, up more than 58% from last year, where more than 60% of total revenues were contributed by cloud and AI-related customers. The main reason for this growth is the strong demand for optical components, especially laser chips. Lumentum experienced traction across laser chips, laser assemblies, line subsystems, coherent components, and DCI products.

Factories are running at higher capacity, and more sales are coming from high-margin laser chips. This helped gross margin and operating margin move higher in the quarter. During the first quarter, non-GAAP gross margin increased 660 basis points year over year, while non-GAAP operating margin expanded by 1,570 basis points on a year-over-year basis. LITE’s systems business, which includes optical transceivers, is also improving.

In earlier periods, the systems business had uneven growth due to production issues. These problems are now easing. Management expects steadier growth as 800G products ramp and as the company prepares for future 1.6T products. The Zacks Consensus Estimate for Lumentum’s fiscal 2026 total revenues and earnings indicates a year-over-year increase of 56% and 175%, respectively. The Zacks Consensus Estimates for LITE’s 2026 earnings have remained unchanged for the past 30 days.

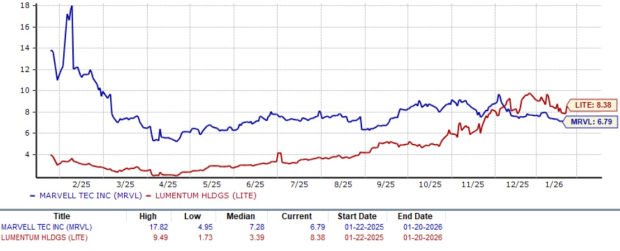

In the past year, MRVL shares have plunged 35.5% against the surge of 266.2% in LITE shares.

LITE is trading at a forward sales multiple of 8.38X, way above its median of 3.39X, over the past year. MRVL’s forward sales multiple sits at 6.79X, significantly lower than its median of 7.28X over the past year.

Both Marvell Technology and Lumentum Holdings are benefiting from growth in AI-driven connectivity. However, Marvell Technology’s ongoing acquisitions, combined with its already leveraged balance sheet, may raise investor concerns around capital allocation and financial flexibility. In contrast, Lumentum offers more direct exposure to AI connectivity with fewer balance-sheet risks, making LITE the stronger choice over MRVL in the AI connectivity space at present. MRVL has a Zacks Rank #3 (Hold), while LITE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite