|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

AngloGold Ashanti PLC AU and Alamos Gold Inc. AGI are two prominent gold producers, each with a diversified portfolio of mines. Both AU and AGI are gaining from record-high gold prices.

Gold prices are benefiting from safe-haven demand, heightened geopolitical risks and trade tensions. The prices of gold are currently trading at a fresh high of nearly $4,900 per ounce, backed by escalating tensions over Greenland. The yellow metal has advanced 76.4% in a year.

For investors seeking to ride this momentum, the question is: which stock offers better value? Let us examine the fundamentals, growth prospects and challenges for AngloGold Ashanti and Alamos Gold.

AngloGold Ashanti, headquartered in Greenwood Village, CO, has operations in Argentina, Australia, Brazil, the Democratic Republic of the Congo, Egypt, Ghana, Guinea and Tanzania. In October 2025, it bolstered its asset base with the acquisition of Augusta Gold Corp. This addition expands AU’s footprint in the Beatty District of Nevada through the acquisition of the Reward and Bullfrog properties.

AngloGold Ashanti also expanded its portfolio in November 2024 with the acquisition of Egyptian gold producer Centamin, adding the large-scale, long-life, world-class Tier 1 Sukari mine, which has the potential to produce 500,000 ounces annually. The Sukari mine contributed 135,000 ounces of gold in the third quarter of 2025, cementing its position as one of the company’s top producers.

The company reported a 17% year-over-year increase in gold production to 768,000 ounces in the third quarter. The upside was also fueled by solid performances from key assets like Obuasi, Kibali, Geita and Cuiabá. The increased production volumes, along with higher metal prices, led to a 109% year-over-year jump in its adjusted EBITDA to $1.56 billion in the quarter. Gold revenues surged 61.9% to $2.37 billion.

AU expects gold production of 2.9-3.225 million ounces for 2025. This suggests year-over-year growth of 9-21%.

However, AU has been facing headwinds from higher operating costs for the last few quarters. Total cash costs per ounce for the group rose 5% to $1,225 in the third quarter. All-in-sustaining costs (AISC) per ounce increased 6% to $1,720. For managed operations, total cash costs rose 5% year over year to $1,244 per ounce, while AISC increased 6% to $1,766 per ounce. The upside was due to inflationary cost pressures from increased labor and mining contractor costs. However, the impacts on its earnings were offset by higher sales volumes and prices.

AngloGold Ashanti generated a record $920 million in free cash flow in the third quarter, a 141% year-over-year whopping rise. The company ended the quarter with $3.9 billion in liquidity, including cash and cash equivalents of $2.5 billion. The adjusted net debt to adjusted EBITDA ratio improved to 0.09X in the third quarter from 0.37X in the year-ago quarter.

AU remains focused on its Full Asset Potential program to offset the inflationary impacts. The company is executing a clear strategy of organic and inorganic growth. It is also intensifying its efforts to streamline operations and sharpen its focus on core assets, particularly in the United States. In June 2025, AU inked a deal to sell its interest in the Mineração Serra Grande mine in Brazil (one of its higher-cost assets) following the sale of its interests in two gold projects in Côte d’Ivoire.

Obuasi remains a significant pillar of its long-term strategy. The mine aided AU's production upside in the quarter, driven by growing contribution from underhand drift-and-fill mining and improvement in recovered grade. This important orebody is expected to deliver 400,000 ounces of annual production at competitive costs by 2028.

Alamos Gold is a Canada-based gold producer with diversified production from operating mines in North America. In July 2024, AGI acquired its rival Argonaut Gold. This move granted AGI access to Argonaut's Magino mine, which is adjacent to Alamos' Island Gold mine in Ontario, Canada.

AGI remains focused on high-return growth projects. The company’s Island Gold Phase 3+ Expansion in Canada is currently in progress, with completion expected in the second half of 2026. The project aims to double the mill throughput to 2,400 tons per day.

Alamos Gold is also advancing with its planned expansion at the Magino mill, with the aim of increasing throughput to 12,400 tons per day. The completion of the study is expected by the first quarter of 2026. The company is also conducting detailed engineering for a larger potential capacity.

AGI reported a year-over-year production drop of 3.8% in 2025 and came below the company’s guidance. The downside was led by lower production from the Island Gold District and Young-Davidson.

The company’s cash position was $623 million in 2025, a 91% year-over-year jump. The company repaid $50 million of the debt in the fourth quarter that was inherited from Argonaut Gold. At the end of 2025, AGI currently has $200 million drawn on its credit facility.

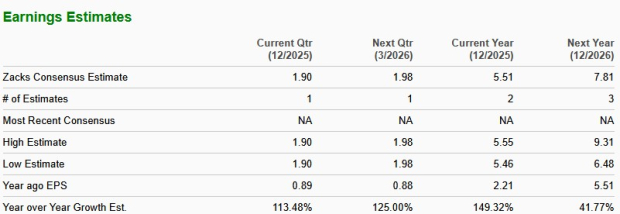

The Zacks Consensus Estimate for AngloGold Ashanti’s 2025 earnings is pegged at $5.51 per share, indicating a year-over-year upsurge of 149.3%. The earnings estimate of $7.81 for 2026 implies a 41.8% rise. The estimates for 2025 have been trending south, while those for 2026 have been trending north over the past 60 days.

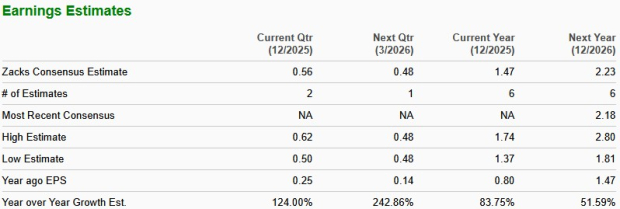

The Zacks Consensus Estimate for Alamos Gold’s earnings for 2025 is pegged at $1.47 per share, indicating a year-over-year jump of 83.7%. The 2026 estimate of $2.23 implies growth of 51.6%. The estimates for both years have been trending north over the past 60 days.

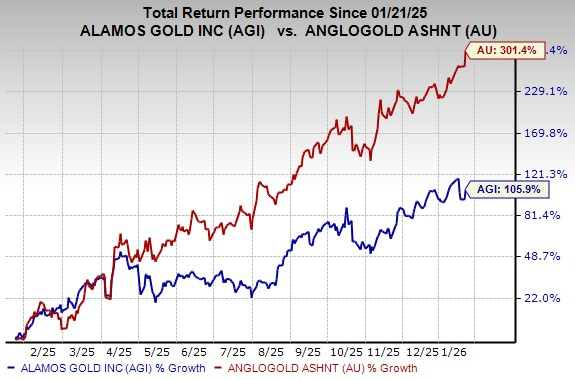

In the past year, the AU stock has skyrocketed 301.4%, whereas AGI has climbed 105.9%.

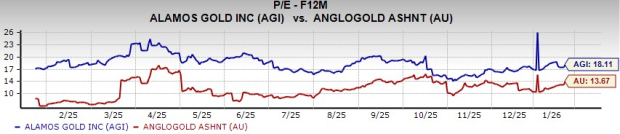

AGI is currently trading at a forward 12-month earnings multiple of 18.11X, higher than its five-year median. AU is currently trading at a forward 12-month earnings multiple of 13.67X, higher than its five-year median.

Both AngloGold Ashanti and Alamos Gold are well-positioned to benefit from the ongoing rally in gold prices, along with their efforts to grow their production capabilities. Both companies have a Zacks Rank #3 (Hold) at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AngloGold Ashanti has delivered a stronger one-year price performance than AGI. In addition, AU’s cheaper valuation is attractive. Given these factors, AU appears to be a more compelling investment choice right now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite