|

|

|

|

|||||

|

|

Hologic HOLX is set to release first-quarter fiscal 2026 results on Jan. 29, after the closing bell.

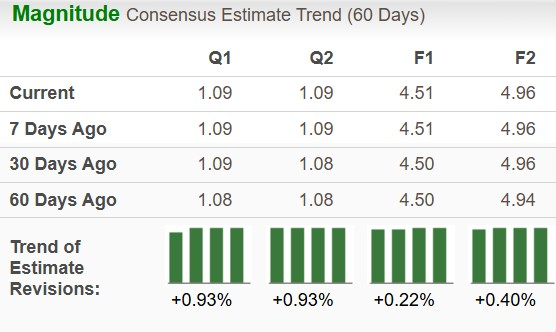

The Zacks Consensus Estimate for fiscal first-quarter earnings per share (EPS) suggests a 5.8% increase year over year to $1.09. The estimate has moved up 1 cent in the past 60 days. The Zacks Consensus Estimate for first-quarter revenues currently stands at $1.07 billion, suggesting a 5% jump year over year.

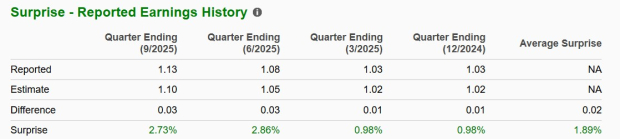

The company has an impressive earnings surprise track record, having topped estimates in each of the trailing four quarters, with an average beat of 1.89%.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has a higher chance of beating estimates, which is exactly the case here.

Earnings ESP: Hologic has an Earnings ESP of +1.97%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks Rank #1 stocks here.

Consistent with recent quarters, Diagnostics’ performance in the fiscal first quarter is expected to have been led by stronger U.S. molecular diagnostics sales. Growth is likely to have been driven by the continued strong uptake of the BV, CV/ TV assay, supported by Hologic’s ongoing efforts to expand in the underpenetrated U.S. vaginitis market. Sales momentum of Panther Fusion respiratory assays may have also persisted. Hologic secured the FDA’s 510(k) clearance and CE IVDR nod for the new Panther Fusion Gastrointestinal Bacterial and Expanded Bacterial Assays, which are designed to deliver tailored, actionable diagnostic results.

In the Biotheranostics oncology business, the Breast Cancer Index test is likely to have favored growth. Meanwhile, expanding adoption of the Genius digital diagnostics system is expected to have aided cytology and perinatal business revenues. That said, the full extent of Diagnostics’ growth may have been restrained by macroeconomic headwinds, such as the funding cuts to USAID and the difficult operating environment in China. The Zacks Consensus Estimate projects first-quarter Diagnostics revenues to grow 2% year over year.

Hologic’s Breast Health segment is likely to have delivered improved performance under the new commercial leadership. Growth is expected to have been driven by the Interventional breast health unit, supported by the Endomagnetics acquisition. In fiscal 2025, Endomagnetics added an incremental $54.9 million of product revenues. Going by the Zacks Consensus Estimate, Breast Health revenues are expected to grow 6.3% improvement year over year.

GYN Surgical is likely to have been a major contributor to Hologic’s fiscal first-quarter top line, backed by robust International performance. Results are likely to reflect strong demand in newly reimbursed markets for MyoSure and NovaSure, alongside gains from expansion into new regions. The fiscal 2025 Gynesonics addition is also expected to have contributed to the division’s revenues. The Zacks Consensus Estimate projects an 8.8% growth in Surgical revenues in the first quarter.

Lastly, the Skeletal Health division is also expected to have favorably contributed following the resumed shipment of the Horizon DXA systems late last year. The Zacks Consensus Estimate projects revenues to grow 27.4% year over year.

Further, tariff-related costs are also expected to have factored into Hologic’s margin performance in the fiscal first quarter. Management earlier hinted about a quarterly impact of roughly $10 million to $14 million, considering the mitigation efforts already in place and those planned.

Hologic has solidified its status as a MedTech innovator focused on improving women’s health through early detection and treatment. The company is currently in the middle of a takeover transaction by Blackstone and TPG in a deal valued at up to $18.3 billion. The agreement includes a fixed cash price of $76 per share and a non-tradable contingent value right (CVR) tied to achieving certain global revenue metrics in Breast Health in fiscal 2026 and 2027.

The aggregate purchase price represents a roughly 46% premium to Hologic’s May 23 closing price, the last trading session before media reports of a potential deal surfaced. With the stock closing yesterday’s session at $75.14, the transaction implies a modest upside potential of 1.1% to the $76 offer, subject to the stockholder approval and other customary closing conditions ahead of the expected first-half 2026 completion.

In the past six months, Hologic shares have risen 15%, outperforming the industry as well as peers QIAGEN QGEN and Abbott ABT.

In terms of valuation, Hologic is trading at a forward five-year Price/Sales (P/S) of 3.85X, lower than its median and industry average. Meanwhile, QGEN and ABT have a five-year P/S of 5.30X and 4.35X, respectively.

Over the years, Hologic has continued to benefit from evolving key drivers across all its core segments, such as Biotheranostics, BV, CV/TV and Endomagnetics. We expect the same pattern to reflect in the upcoming quarterly release. The company’s solid earnings surprise history raises expectations for another beat this time, too. The recent price performance and impressive valuation relative to the industry and peers further add to the stock’s appeal. Considering all, Hologic presents a compelling investment case while it continues its publicly traded phase.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-12 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite