|

|

|

|

|||||

|

|

Geopolitical instability across the globe has been a major catalyst for the growth of defense giants, such as Boeing BA and Lockheed Martin LMT. Both companies earn a large portion of their revenues from the U.S. government, particularly the Department of Defense.

Recently, U.S. President Donald Trump proposed increasing military spending to $1.5 trillion in fiscal 2027 from $901 billion approved for fiscal 2026. The proposed increase in military spending still requires approval from the Congress, and final budget allocations may differ from initial proposals. However, the overall upward trend in defense spending often leads to more, and larger, contract opportunities for defense companies, supporting their revenue growth prospects.

Investor interest in aircraft companies with defense exposure has reached all-time highs due to rising global defense spending and consistent improvements in commercial aviation. Let's compare the two stocks' fundamentals to determine which one is better positioned at present.

The outlook for the aerospace giant’s defense and space business also remains optimistic, as it remains one of the largest defense contractors globally, as well as a prominent integrator in the International Space Station. In particular, the current U.S. government’s inclination toward strengthening the nation’s defense and space system should act as a growth catalyst for Boeing.

In the fourth quarter, Boeing’s commercial aircraft deliveries grew 180.7% year over year, reflecting continued recovery in production and delivery momentum. On the defense side, shipments increased 2.8% from the prior-year period. Increased deliveries should help the company improve overall cash flow and more effectively convert production into revenues. Additionally, a more consistent delivery pace reflects improved operational management, supporting stronger investor confidence.

Boeing forecasts a $4.7-trillion market opportunity for commercial aviation support and services in the 20-year period between 2025 and 2044. This should bode well for the Boeing Global Services unit over the long run, with a total backlog of $24.63 billion as of Sept. 30, 2025.

Lockheed Martin benefits from its dominant position as one of the largest U.S. defense contractors, with a platform-based strategy that drives recurring orders across multiple military branches. The F-35 program remains a major growth engine, contributing about 26% of total net sales in the third quarter of 2025, supported by strong deliveries, a sizable backlog, and improving aeronautics segment sales.

LMT continued to secure major Pentagon and allied contracts in third-quarter 2025, including large helicopter and missile production deals, strengthening its order pipeline. These wins lifted its backlog to $179.1 billion, with a significant portion expected to convert into revenues over the next two years, supporting long-term growth visibility.

Lockheed Martin has multiple programs across its operating segments transitioning into growth phases, driven by increased demand for missile systems, rocket artillery, radar and helicopter platforms, alongside expanding F-35 sustainment activity and ongoing modernization of the Trident II D5 ballistic missile system.

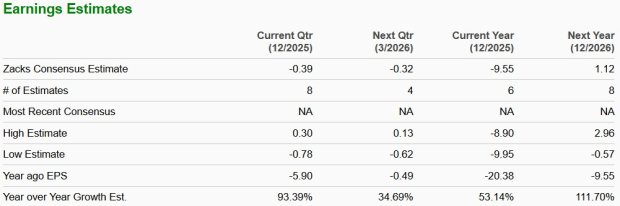

The Zacks Consensus Estimate for Boeing’s 2026 earnings per share (EPS) indicates an increase of 111.7% year over year. BA’s long-term (three to five years) earnings growth rate is 31.33%.

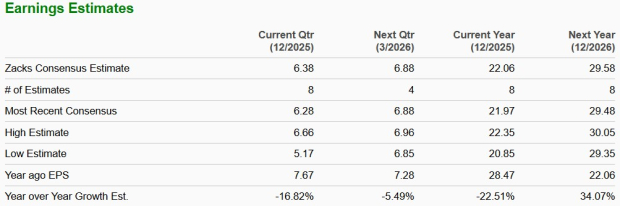

The Zacks Consensus Estimate for LMT’s 2026 EPS indicates an increase of 34.07% year over year. LMT’s long-term earnings growth rate is 11.85%.

BA shares trade at a forward 12-month Price/Sales (P/S F12M) of 1.99X compared with LMT’s P/S F12M of 1.74X.

Boeing and Lockheed Martin’s current ratio is 1.18 and 1.13, respectively. A current ratio greater than one indicates that the company has enough short-term assets to liquidate to cover all short-term liabilities, if necessary.

In the past year, shares of Boeing and RTX have increased 43% and 17.5%, respectively.

Boeing’s defense, space and commercial businesses show improving momentum, supported by rising aircraft deliveries, strong long-term services demand, and favorable U.S. government defense and space priorities, which together strengthen cash flow and growth prospects. Lockheed Martin’s leadership as a top U.S. defense contractor, anchored by the F-35 program, strong contract wins, a $179.1 billion backlog and multiple programs entering growth phases, supports solid long-term revenue visibility.

Our choice at the moment is Boeing, given its better price performance, strong earnings growth and better liquidity than Lockheed Martin. BA carries a Zacks Rank #3 (Hold) and LMT has a Zacks Rank #4 (Sell) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 |

Boeing Holds In Buy Zone, Leads 5 Stocks To Watch In Short Trading Week

BA

Investor's Business Daily

|

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite