|

|

|

|

|||||

|

|

Dr. Reddy's Laboratories Limited RDY reported third-quarter fiscal 2026 earnings of 16 cents per American Depositary Share (ADS), which matched the Zacks Consensus Estimate. The company reported earnings of 19 cents per ADS in the year-ago quarter.

Revenues grew 4.4% year over year to $971 million, but missed the Zacks Consensus Estimate of $978 million, primarily due to lower-than-expected year-over-year growth in global generics revenues.

Dr. Reddy’s reported revenues under three segments — Global Generics, Pharmaceutical Services & Active Ingredients (PSAI) and Others.

Global Generics revenues totaled INR 79.1 billion, up 7% year over year. The increase was driven by broad-based growth across key markets, supported by favorable foreign exchange movements, partly offset by a decline in North America Generics.

Dr. Reddy’s launched six new products in North America during the reported quarter. However, revenues in the North America segment declined 12% due to lower lenalidomide sales and higher price erosion in certain key products.

As of Dec. 31, 2025, a total of 73 generic filings were pending approval from the FDA, comprising 71 abbreviated new drug applications (ANDAs) and two new drug applications. Of these 73 ANDAs, 43 are Para IVs.

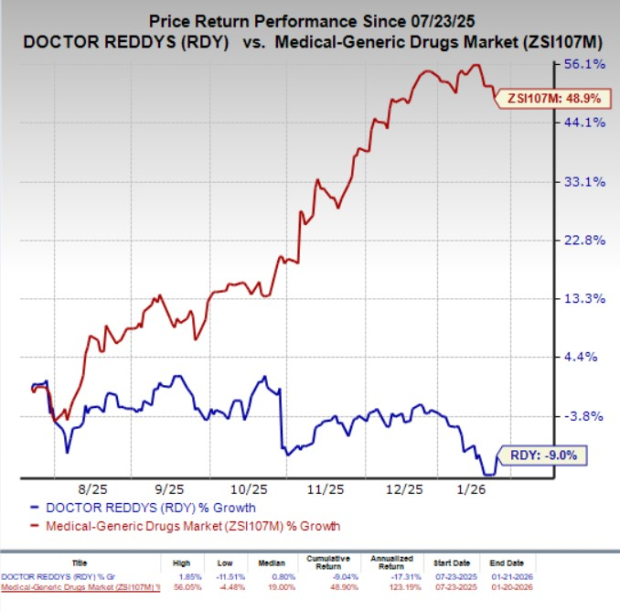

Shares of Dr. Reddy’s have lost 9% in the past six months against the industry’s 48.9% growth.

PSAI revenues totaled INR 8 billion, representing a 2% year-over-year decline, due to lower volume uptake in the active pharmaceutical ingredient (API) business.

Revenues in the Others segment totaled INR 0.1 billion, down 92% on a year-over-year basis.

Gross margin declined 505 basis points year over year to 53.6% in the third quarter of fiscal 2026. This was mainly due to lower lenalidomide sales, price erosion in the North America and Europe Generics businesses, an adverse product mix in the PSAI business, and a one-time provision arising from changes in employee benefit obligations under the new Labor Codes in India.

Research and development (R&D) expenses of $68 million were down 8% year over year due to lower development spending in biosimilars following the completion of a significant portion of the investments related to BMY’s Orencia (abatacept). R&D efforts continue to be focused on complex generics, biosimilars, peptides, and novel biologics. The quarter’s spend also included a one-time provision linked to the new Labor Codes.

Selling, general and administrative expenses totaled $300 million, up 12% year over year. The rise was primarily driven by targeted investments in Dr. Reddy’s branded franchises, including the acquired consumer healthcare business in NRT and branded generics. The rise was also influenced by adverse foreign exchange movements and a one-time provision related to the new Labor Codes mentioned earlier.

During the reported quarter, Dr. Reddy’s gained the approval of AVT03 (denosumab), a proposed biosimilar to Amgen’s AMGN Prolia and Xgeva, in the EU and the United Kingdom, under the brand names Acvybra (60 mg/mL) and Xbonzy (70 mg/mL). Following the nods, the product was launched in Germany in December 2025.

Amgen's Prolia treats osteoporosis in postmenopausal women at high risk of fractures, especially when other treatments are ineffective. AMGN’s Xgeva helps prevent fractures, spinal cord compression and the need for bone-related surgery or radiation in patients with multiple myeloma or bone metastases from solid tumors.

The development of AVT03 stems from a 2024 partnership between Dr. Reddy’s and Alvotech ALVO, under which Alvotech is responsible for development and manufacturing, while Dr. Reddy’s handles regulatory and commercialization activities in key markets. Dr. Reddy’s holds exclusive commercialization rights in the United States and semi-exclusive rights in Europe and the United Kingdom. AVT03 is a human monoclonal antibody developed by Alvotech.

RDY and ALVO were also seeking the approval of AVT03 in the United States. However, during the third quarter, Dr. Reddy’s received a complete response letter (CRL) from the FDA, referring to the observations from a pre-license inspection of Alvotech’s Reykjavik manufacturing facility.

Dr. Reddy's Laboratories Ltd price-consensus-eps-surprise-chart | Dr. Reddy's Laboratories Ltd Quote

RDY also received a CRL from the FDA for a regulatory filing seeking the approval of a biosimilar for Roche’s RHHBY Rituxan/MabThera (rituximab) to treat the same, currently approved, indications. The CRL cited the ongoing resolution of observations from the pre-approval inspection of the Bachupally biologics facility in India, conducted in September 2025, as well as certain filing-related aspects. In the EU, Dr. Reddy’s markets its proposed biosimilar candidate, DRL_RI, for Roche’s Rituxan/MabThera under the brand name Ituxredi.

During the reported quarter, Dr. Reddy’s signed a strategic collaboration with Immutep to develop and commercialize the investigational immuno-oncology therapy eftilagimod alfa (efti) in markets outside North America, Europe, Japan, and Greater China. Under the deal, Dr. Reddy’s made a $20 million upfront payment and is liable to pay potential milestone payments of up to $349.5 million, as well as double-digit royalties, while Immutep retains global manufacturing and commercialization rights in major developed markets.

Efti is being evaluated in a registrational phase III study for first-line advanced or metastatic non-small cell lung cancer, with additional studies in other solid tumors. The partnership strengthens Dr. Reddy’s oncology portfolio and supports its strategy to bring innovative cancer therapies to patients in emerging and ex-U.S. markets.

Dr. Reddy’s carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-17 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Amgen receives EC approval for Uplizna in generalised myasthenia gravis

AMGN

Pharmaceutical Business Review

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite