|

|

|

|

|||||

|

|

Both Coherent Corp. COHR and Arm Holdings plc ARM are pioneers in the high-growth tech infrastructure domain. Coherent is an optical materials and semiconductors manufacturer, and Arm Holdings is a semiconductor and software design company.

Let us delve deeper to find out which of these two stocks investors should consider adding to their portfolios.

Coherent’s robust demand is evidenced by a 17.3% year-over-year increase in its first-quarter fiscal 2026 revenues. This growth can be attributed to the company’s ability to capitalize on the AI demand. COHR registered a 1,081-basis-point year-over-year expansion in the operating margin, highlighting scalability, a much-needed trait to grow in the AI market. The company’s means of scalability can further improve with the divestiture of the Aerospace and Defense business, which will cut down debt and be accretive to EPS.

The company’s diverse product pipeline positions it to capture the surging demand for AI. On the transceivers front, the company witnessed a broad adoption of 800G with 1.6T transceivers being accepted swiftly. This lofty growth led the CEO to expect an exponential upsurge in these products in fiscal 2026. Higher yields were registered in the 6-inch Indium Phosphide product than the 3-inch ones, highlighting the expertise gained by the company over the past five years in manufacturing 2 billion VSCEL devices on its 6-inch arsenide technology. Furthermore, management noted a $2-billion addressable market opportunity for its Optical Circuit Switch.

Coherent holds a strong balance sheet position, with $875 million in cash reserves as of September 2025, while its current debt sits significantly low at $48 million. It provides a safety net and flexibility to address short-term obligations, boosting its ability to invest in products. Its strong liquidity position is further confirmed by its current ratio of 2.33, which beats the industry average of 1.58.

While we expect COHR to remain consistent in its growth trajectory, we must acknowledge the surmounting competitive pressure in the Silicon Carbide (SiC) domain. Wolfspeed and ON Semiconductor are reshaping the competitive landscape by pushing technological boundaries and strengthening their grasp in critical and high-growth applications. Coherent’s means to tackle this pressure is vested in its ability to make rapid investments, which might deteriorate its ability to balance growth and profitability.

Arm Holdings’ strength lies in its powerful dual-sided network effect that links software creators and hardware manufacturers in a self-reinforcing loop. The company manufactures energy-saving devices for Apple, Qualcomm and Samsung, strengthening its foothold in the mobile technology space. With the need of the hour shifting toward high-performance and low-power consumption, ARM chips become vital in smartphones and tablets. Arm Holdings’ core competency lies in its ability to integrate efficiency and performance.

The AI and IoT space is recognizing ARM as an eminent player. The growing focus on AI-backed innovation compels Apple, Qualcomm and Samsung to depend on ARM’s flexible and energy-efficient architecture. While Apple is leveraging ARM-based silicon to expand AI features, Qualcomm finds itself enhancing AI capabilities in mobile and automotive applications. Samsung has found its grounds in advanced IoT solutions via ARM-powered Exynos chips. Arm Holdings’ architecture is turning out to be critical for technological infrastructure, as machine learning and edge computing mold the future.

Despite ARM’s leadership position, risks prevail on the China front. With the growing inclination of Chinese companies toward RISC-V, an open-source chip, ARM’s growth in China is slowly declining. As China’s motivation to lower its reliance on foreign chip technologies grows, ARM’s market viability weakens. This threat requires investors to be cautious and monitor ARM’s momentum closely. Arm Holdings’ inclination toward producing its CPUs is a boon and a bane. While stretching arms into the hardware space expands its addressable market and boosts revenues, it attracts direct competition from well-established giants like Intel and AMD.

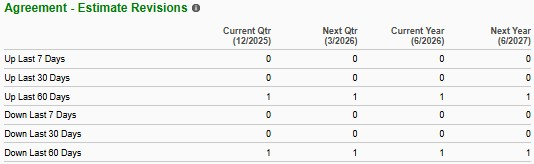

The Zacks Consensus Estimate for COHR’s fiscal 2026 sales and EPS indicates year-over-year growth of 15.1% and 44.5%, respectively. One EPS estimate moved upward over the past 60 days, with one downward revision.

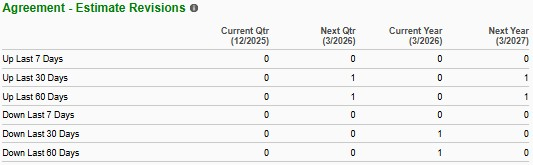

The Zacks Consensus Estimate for ARM’s fiscal 2026 sales and EPS indicates year-over-year growth of 21.5% and 5.5%, respectively. One EPS estimate moved downward over the past 60 days, with no upward revision.

Coherent is currently trading at a forward 12-month P/E ratio of 34.72 times, which is higher than the 12-month median of 26.16 times. Arm Holdings is trading at 52.89 times, substantially lower than the 12-month median of 119.14 times. While Coherent might appear pricier than its historical valuation, it is significantly cheaper than ARM.

Coherent’s higher EPS growth outlook and more attractive valuation make it a better buy for investors than ARM. Despite Arm Holdings’ dominant position in the mobile architecture domain, growth in China is dipping with lingering competitive pressure in its CPU production arm. Alternatively, COHR finds its diverse range of products scaling and meeting the surging demand for AI data centers. Coherent’s robust liquidity position, debt cut and cheaper valuation provide a better entry to investors seeking to gain from the growing AI market.

Both COHR and ARM carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 43 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite