|

|

|

|

|||||

|

|

Strategy MSTR and TeraWulf WULF are both bitcoin-focused stocks, but they offer fundamentally different ways to participate in the cryptocurrency economy.

Strategy operates primarily as a Bitcoin treasury company, aggressively accumulating BTC while maintaining its legacy enterprise analytics software business. Its stock magnifies Bitcoin price volatility, making it a preferred equity for direct BTC exposure. TeraWulf, on the other hand, is a pure-play Bitcoin miner focused on low-cost, energy-efficient operations in the United States, while strategically expanding into high-performance computing and AI infrastructure.

Amid Bitcoin’s recovery and expanding institutional interest, assessing these models is more relevant than ever. So, which stock offers greater upside, Strategy or TeraWulf? Let’s find out.

Strategy operates as the world's largest Bitcoin treasury company while retaining a profitable, subscription-led enterprise analytics software business. Holding 709,715 bitcoins as of Jan. 21, 2026, with an enterprise value near $68 billion, the company has clearly shifted toward a systematic and policy-based accumulation strategy.

MSTR’s capital-markets innovation remains central to this strategy. The company continues to benefit from rising adoption of digital credit instruments, using preferred securities such as STRF, STRK, STRD and STRC to raise low-cost capital while enhancing Bitcoin per-share accretion. Importantly, the legacy software business reinforces financial resilience, delivering 10.9% revenue growth, more than 65% subscription growth, and approximately 70% gross margins in the third quarter of 2025.

Structural tailwinds further strengthen the investment case. Improved regulatory clarity following IRS guidance on fair-value taxation has reduced uncertainty for long-term Bitcoin holders, while MSTR’s S&P B- credit rating has expanded access to global high-yield capital markets. In parallel, potential inclusion in major equity indices and the international issuance of digital credit instruments could lower funding costs and further amplify Bitcoin exposure.

Despite these positives, MSTR remains a high-risk stock. Its share price and earnings move closely with Bitcoin, leading to high volatility. Continued equity and preference issues increase the risk of liquidity, with unsold bitcoin losses totaling $17.44 billion in the fourth quarter of 2025.

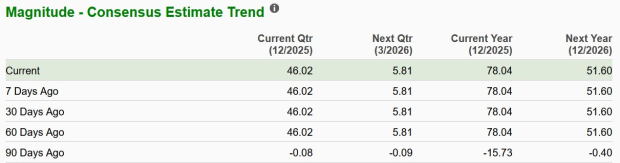

The Zacks Consensus Estimate for the first quarter of 2026 earnings is currently pegged at $5.81 per share, unchanged over the past 30 days. This represents a sharp year-over-year improvement from a loss of $16.49 per share.

TeraWulf operates low-carbon digital infrastructure, blending Bitcoin mining with a strategic shift toward HPC and AI leasing. The third quarter of 2025 marked a turning point as the company began generating recurring HPC revenues, supported by large, credit-enhanced long-term contracts.

TeraWulf benefits from low-cost, low-carbon power, vertically integrated infrastructure and partnerships with Fluidstack and Google. At Lake Mariner, the company energized 245 MW of Bitcoin mining capacity and 22.5 MW of HPC capacity while securing more than $16 billion in long-term HPC lease contracts in the second half of 2025. The company aims to add 250-500 MW of HPC capacity annually, supported by strong AI demand and expansion projects such as the Abernathy joint venture and the Cayuga site.

WULF remains exposed to Bitcoin price and halving risk, while large-scale data center builds and AI/HPC expansion have raised operating costs and capital intensity. The shift toward HPC has increased capital intensity and leverage, with the company raising more than $5 billion through convertible notes and secured debt in 2025, pushing total debt to roughly $1.5 billion. High leverage increases refinancing risk and interest expense, which contributes to sharp fluctuations in income.

The Zacks Consensus Estimate for the first quarter of 2026 loss is currently pegged at 18 cents per share, unchanged over the past 30 days, slightly worse than a loss of 16 cents reported a year ago.

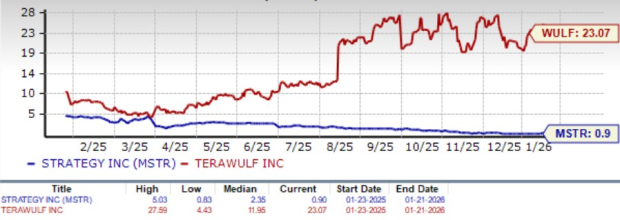

MSTR shares are down 43.1% over the past three months, while WULF has gained 1.4%. Although MSTR remains highly sensitive to Bitcoin volatility, its long-term outlook is supported by steady Bitcoin accretion and expanding digital credit instruments. WULF’s recent strength comes with a higher risk due to heavy debt, ongoing losses and the high cost of expanding its HPC business.

Both Strategy and TeraWulf shares are currently overvalued, as suggested by a Value Score of F. However, in terms of Price/Book ratio, MSTR shares are trading at 0.9X, lower than WULF’s 23.07X, indicating relatively lower valuation risk.

Strategy emerges as the stronger bet versus TeraWulf, backed by its scale, balance-sheet leverage to Bitcoin and superior capital-markets execution. Its massive BTC holdings, improving earnings outlook, and cash-generative, high-margin software business provide resilience that WULF lacks. While volatile, MSTR offers cleaner, more accretive Bitcoin exposure with lower relative valuation risk. TeraWulf has shown stronger momentum driven by its AI pivot and hybrid strategy, but heavy leverage, high capital intensity and execution risk in HPC limit its upside.

MSTR and WULF currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Riot Surges On Activist Data Center Proposal, ARK Resumes Coinbase Buys

WULF

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Riot Rises On Activist Data Center Proposal, ARK Resumes Coinbase Buys

WULF

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite