|

|

|

|

|||||

|

|

Meta Platforms META is set to report its fourth-quarter 2025 results on Jan. 28.

META expects total revenues between $56 billion and $59 billion, including 1% tailwind from favorable forex. The company expects continued strong ad revenue growth but lower Reality Labs revenues.

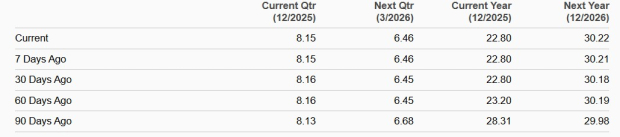

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $58.40 billion, indicating an increase of 20.7% from the year-ago quarter’s reported figure. The consensus mark for earnings stands at $8.15 per share, down by a penny over the past 30 days, suggesting growth of 1.6% from the figure reported in the year-ago quarter.

Meta Platforms’ earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 18.85%.

Meta Platforms, Inc. price-eps-surprise | Meta Platforms, Inc. Quote

Let’s see how things have shaped up for the upcoming announcement.

META’s fourth-quarter 2025 results are expected to have benefited from strong advertising revenue growth, driven by strong spending from advertisers as they leverage its growing AI prowess despite macroeconomic uncertainties. The ad business is benefiting from an improved AI ranking system. Annual run rate for META’s complete end-to-end AI-powered ad tools has passed $60 billion. The Zacks Consensus Estimate for fourth-quarter 2025 advertising revenues is currently pegged at $56.85 billion, suggesting 21.5% year-over-year growth.

Meta Platforms’ offerings — Facebook, WhatsApp, Instagram, Messenger and Threads — currently reach more than three billion people daily. Their staggering reach and increasing ad impressions (up 14% year over year in the third quarter of 2025) make META one of the most important players in the digital ad sales market, apart from Alphabet GOOGL and Amazon AMZN. Meta Platforms, along with Alphabet and Amazon, are expected to absorb more than 50% of the projected global ad spending this year and 56.2% in 2026.

META has been leveraging AI and machine learning to boost the potency of its social-media offerings. The company is using Meta AI (currently used by more than one billion people) to boost user experience. Time spent across platforms is expected to benefit from Meta Platforms’ continuous ranking optimizations. AI recommendations that deliver higher quality and more relevant content are expected to drive engagement. Vibes, META’s next-generation AI creation tools and content experience, is gaining traction. The company is using Meta AI (currently used by more than one billion people) to boost user experience. Business AI is also gaining traction with more than one billion active threads between people and businesses across its messaging platforms.

However, rising expenses related to investments in developing more advanced models and AI services are expected to keep margins under pressure. The Zacks Consensus Estimate for Family of Apps’ operating income is pegged at $29.78 billion, indicating 5.1% year-over-year growth. The Reality Labs business continues to report losses, which doesn’t bode well for META’s fourth-quarter results. The consensus mark for Reality Labs’ loss is pegged at $6.31 billion, wider than the year-ago quarter’s loss of $4.97 billion.

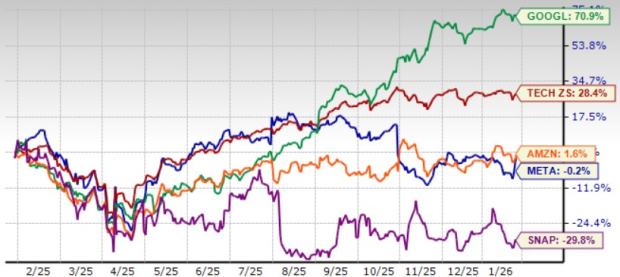

META shares have dropped 0.2% in a year, outperforming the Zacks Computer & Technology sector’s appreciation of 28.4%. Shares have underperformed Alphabet and Amazon but outperformed Snap SNAP. In the trailing 12-month period, Alphabet and Amazon shares have appreciated 70.9% and 1.6%, respectively, while Snap shares have declined 29.8%.

Meta Platforms’ current valuation is stretched, as suggested by the Value Score of C.

In terms of the forward 12-month price/sales, META is trading at 6.98X, higher than the Zacks Internet Software industry’s 4.58X, Snap’s 1.94X and Amazon’s 3.19X.

AI is heavily dependent on data, of which META has a trove, driven by its more than 3.54 billion daily users, including 3 billion monthly actives on Instagram and 150 million daily actives on Threads. The company has a strong pipeline of ad supply opportunities on both Threads and WhatsApp Status over the long term.

However, Meta Platforms is spending heavily on AI research, models and infrastructure, as well as future products from Reality Labs. The company now expects 2025 capital spending between $70 billion and $72 billion compared with the previous guidance of $66-$72 billion range. For 2026, META expects significant growth in capital expenditure in dollar terms compared with 2025. Growth in operating expenses is expected to be substantial due to higher infrastructure costs and employee compensation costs.

Although these investments are expected to boost META’s prospects over the long term, a challenging macroeconomic environment, regulatory issues (in the European Union and the United States) and stiff competition in the ad market are major headwinds for META’s prospects.

META’s use of AI across its platforms bodes well for its user engagement. This, along with an improved recommendation tool, continues to help advertisers in ad targeting, thereby driving top-line growth. Meta Platforms is spending heavily on expanding AI infrastructure, which bodes well for future prospects. However, near-term prospects are challenging due to stiff competition in the ad space and higher expenses related to AI infrastructure as well as services. These factors, along with a stretched valuation, make the stock risky ahead of fourth-quarter 2025 earnings.

Meta Platforms currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 18 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Nvidia Beats Back Bubble Fears With Record $68 Billion in Sales in Fourth Quarter

AMZN

The Wall Street Journal

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Quantum Computing Stocks: IonQ Earnings, Revenue Beat Amid Acquisitions

GOOGL

Investor's Business Daily

|

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite