|

|

|

|

|||||

|

|

ClearPoint Neuro, Inc. CLPT, a global device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine, recently received EU MDR Certification for its ClearPoint Navigation Software Version 3.0.2. This latest version of the company’s navigation software for precision-guided surgeries is among the fastest and most accurate navigation systems available, while offering the flexibility to be used in both the MRI suite and the operating room.

ClearPoint first introduced the ClearPoint Navigation Software Version 3.x in the United States last year, following the FD clearance in January 2025. The company believes that with EU MDR certification, it will be able to provide consistent training and hospital IT support by unifying its global navigation platform.

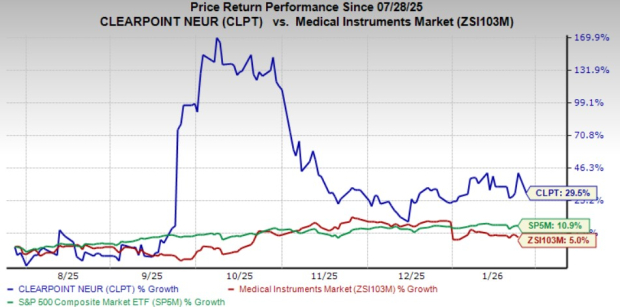

ClearPoint’s shares had gained last Friday following the announcement of EU MDR Certification. However, the company’s shares pared all gains on Monday. In the past six months, CLPT stock has risen 29.5% compared with the industry’s gain of 5%. The S&P 500 Index has risen 10.9% in the same period.

With the increasing development of cell and gene therapies, demand for precise navigation of drug delivery should rise going forward. Therefore, it is crucial for key market players like ClearPoint to help healthcare providers with simplified workflows, offering solutions to increase surgical capacity and expanding access to its hardware and software.

Moreover, unifying U.S. and EU customers on the same navigation platform will help the company to reduce operating costs and drive economies of scale. A unified global navigation system should also reduce burden from CLPT’s biopharma partners, driving a rise in demand going forward.

ClearPoint has a market capitalization of $492.4 million. The Zacks Consensus Estimate for the company’s fiscal 2025 earnings indicates a 10.6% year-over-year increase on a 23.4% revenue improvement. In the trailing four quarters, it delivered an average earnings surprise of 9.84%.

ClearPoint Navigation Software Version 3.0 introduces an intraoperative Computed Tomography (CT) workflow. While the previous versions of ClearPoint software supported MRI-guided workflows exclusively, the latest release extends ClearPoint navigation capabilities to the operating room.

ClaerPoint Navigation Version 3.0 is compatible with intraoperative CT and Conebeam CT imaging. This enhancement broadens access to precision-guided neurosurgery for facilities without intraoperative MRI capabilities. The ClearPoint Navigation Software Version 3.0, when used in conjunction with the SmartFrame XG stereotactic frame, will provide precise stereotactic guidance during neurosurgical procedures. These procedures include biopsies, catheter and electrode insertion, including deep brain stimulation (asleep or awake) lead placement.

Per a report by the Dataintelo, the intraoperative CT market is expected to register a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032. Demand for precise surgery, technological advancements and an increase in the prevalence of chronic disorders are key growth factors for the market.

Earlier this month, ClearPoint announced its preliminary results for fourth-quarter and full-year 2025. The company reported revenues of approximately $10.4 million for the fourth quarter, reflecting 20% comparable sales growth. Sales of functional neurosurgery disposables and biologics and drug delivery were up 23% and 26%, respectively. For the full year, CLPT reported revenues of approximately $37 million.

The company expects total 2026 revenues to be between $54 million and $60 million. For 2026, it expects double-digit growth in all four of its growth markets — pre-commercial biologics and drug delivery, neurosurgery navigation, laser therapy and access, and intracranial fluid management.

ClearPoint Neuro, Inc. price | ClearPoint Neuro, Inc. Quote

CLPT’s Zacks Rank & Key Picks

Currently, CLPT carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, AtriCure ATRC and Boston Scientific BSX.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT’s earnings is estimated to decline 3% in 2026 compared with the industry’s 17.7% rise. The company beat on earnings in each of the trailing four quarters, the average surprise being 45.1%.

AtriCure, currently sporting a Zacks Rank #1, reported a third-quarter 2025 adjusted loss of 1 cent per share, narrower than the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 91.7% for 2026 compared with the industry’s 17.7% rise. The company beat on earnings in each of the trailing four quarters, the average surprise being 67.1%.

Boston Scientific, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.1% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite